How to Trade Boston Beer After Its Steep Earnings Plunge

-- After a magnificent run, Boston Beer stock is getting slammed on earnings and is now down almost 50% from the April highs. Here's how to trade it. --

By Bret Kenwell, TheStreet.com

Wow. That's all I can say about Boston Beer (SAM) after Friday's reaction to earnings.

The company whiffed on its most recent earnings report, missing both top- and bottom-line expectations.

The miss comes at a time when shares were already under quite a bit of pressure. A downgrade from Goldman Sachs doesn't help, either.

While many beverage companies struggled during 2020 due to COVID-19, Boston Beer was one of the few that was able to rally.

And by "rally," what I really mean is explode to the upside. Shares rallied over 365% from the March 2020 low to the April 2021 high.

However, the stock sold off hard from the company's prior earnings report and was trending lower into this quarter's report. Obviously, the market doesn't like this one either.

For what it's worth, TheStreet's Jim Cramer was a seller of Boston Beer last month.

It's also worth mentioning that Constellation Brands (STZ) Anheuser-Busch (BUD) and others have been struggling lately as well, although not to the same tune as Boston Beer.

What do the charts hold?

Trading Boston Beer Stock

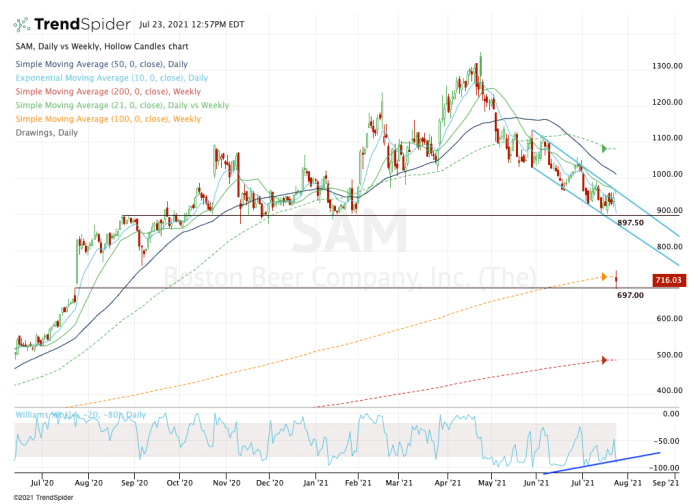

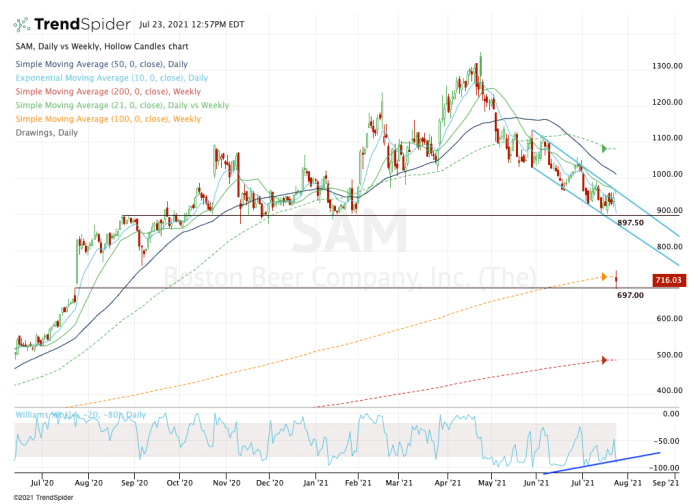

Daily chart of Boston Beer stock

Chart courtesy of TrendSpider.com

I'm not sure if Boston Beer stock could have given us a better gap-down scenario.

While the 100-week moving average is a seldom followed measure, the gap-fill mark at $697 was no secret to anyone.

Shares opened at $725, dropped to a low of $693.21 and are now bouncing. That's not to say it's been a robust bounce, but Boston Beer is certainly off the lows.

Even if investors waited for the stock to reclaim the $697 area, they could have gone long with less than $4 per share in risk (measuring against this morning's low).

On a push through Friday's high, I'm looking to see if the stock can get back into the $760 to $775 zone, which was an area of support in the third and fourth quarters of 2020.

Specifically, I want to see if this area rejects or accepts Boston Beer stock. Above this area and perhaps the stock can make a push above $800 and back to its prior downtrend channel.

Further, I can't help but notice there's a bit of divergence on the Williams %R reading at the bottom of the chart, despite Friday's putrid price action. This comes as shares are down almost 50% from the highs, so perhaps some sort of capitulation is developing.

Should the stock fail to bounce or eventually end up closing below the current post-earnings low, perhaps shares will have a date with the 200-week moving average.

From TheStreet.com