Why Ford Motor (F) SHOULD Fear the Worst Following a Banner 2016

By all superficial accounts, carmaker Ford Motor (F) should be celebrating. Last year was a record-breaking year for auto sales, domestic and abroad, and the iconic company maintained its market share relative to 2015's levels... an impressive feat in light of the fact that rival General Motors (GM) seems to be - no pun intended - firing on all cylinders. The industry's U.S. were surging as the year came to a close, likely inspired by a pro-business President Trump.

Yet, Ford shares fell 3.3% on Thursday following a disappointing fourth quarter report and a similarly disappointing 2017 outlook. As CEO Mark Fields opined of the year currently underway, 2017's top line would be 'generally lower' than 2016's.

Contrary to popular belief, however, it's not a lack of demand. While the 'there are absolute limits' argument actually holds water, we're not actually at that limit yet.... for Ford Motor or its competitors. The impasse lies in other factors that are not readily evident within Ford's accounting reports. These factors may well be bigger than Ford, and largely out of the company's control, but also have nothing to do with economic strength (good or bad).

Fourth Quarter Numbers, 2017 Outlook

For the quarter ending in December, the automaker earned an adjusted 30 cents per share. Analysts were collectively looking a profit of 31 cents per share of F. Revenue for the quarter hit $38.7 billion, above the $35.0 billion FactSet consensus.

For all of 2016, Ford's total adjusted pre-tax results rolled in at $10.4 billion, down roughly $400 million from 2015. Full-year adjusted earnings per share were $1.76, down $0.17 from 2015's unusually strong profit.

2017's automotive revenues are expected to be same as 2016's. Ford also expects its Automotive segment's operating cash flow to decline this year from 2016's levels. Adjusted earnings per share and automotive operating margin are also expected to come in lower than 2016's margins.

The lull and subsequent 2017 guidance might not quite jibe with investors that keep close tabs on the automobile industry. According the to the Conference Board, in December, the number of consumers who intend to buy a car within six months surged to a multi-year high of 14.3%, suggesting 2017 could be even better than 2016 in terms of automobile sales.

The catch? Those consumers may or may not actually buy a new car, and if they do choose to purchase a new vehicle, Ford -- or any other automaker -- are going to have to give them a honey of a deal.

Incentives Up, Used Car Prices Down

In many regards Ford and its peers are victims of their own success. They've built such great quality vehicles, even when they're used they're still almost as good as new. That's great during the early stages of an economic recovery, when used cars are a little too used and expectations from investors are low. In the latter stages of what's now become an eight-year recovery, all of those new cars leased between 2009 and 2014 are coming off leased (usually three years)... in spades. A record 3.1 million leased vehicles were turned back into dealers last year, and a whopping 3.35 million are expected to get turned back in this year. Those dealers have to do something with them.

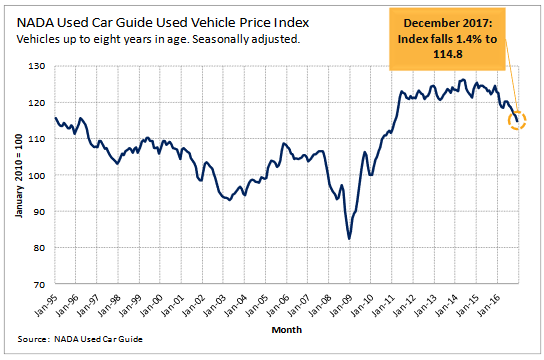

They're selling them, and for cheap. As the NADA automobile sales report for January illustrates, used car prices -- as measured by the NADA Car Guide Used Vehicle Price Index -- plunged to a multi-year low of 114.8 last month, accelerating a downtrend. Some of those deals are too good for would-be new car buyers to pass up.

On the flipside, some of the deals new car buyers are being offered are also too good to pass up. December's incentives per car reached a multi-year record high of $3700, also jumping the most (year-over-year) they has in years to extend what's also become an alarming trend. Inventive crimp margins, and nearing $4000 per vehicle, there's little to no room left to make a profit.

The rising incentives indicate that while demand has remain brisk, it's somewhat artificial.

Between gaming a car's actual price and a flood of used vehicles that are reaching prices too good to ignore, Ford Motor's worry that 2017's performance could be generally lower isn't just a lowballing effort.

Bottom Line

While Ford is poised to disappoint for the foreseeable future as it struggles to show much (if any) year-over-year growth -- which may keep the stock suppressed -- bear in mind that the worst-case scenario is already priced in, and the company will still be able to pay its dividend even if things get unexpectedly hairy.

Following Thursday's post-earnings announcement setback, F shares are valued at a trailing P/E of 5.8, and they're yielding 4.76%. It's also only been dishing out about a third of its recent profits as dividends, so the payout is protected.

Still, to the extent headlines create headwinds for a stock, owning Ford in 2017 could be a real test of patience.

Do you want to capitalize on a company's short-term response to earnings rather than sit back and wait for time to pass and put some money in your pocket? Our BigTrends Earnings Explosion Advisory Service and our BigTrends Earnings Extravaganza Advisory Service are designed to do exactly that. Sign up for either (or both) today, and don't miss out on all the opportunities that earnings-driven volatility creates.