Using Option Put Call Ratios to Follow the 'Smart Money'

Following the Big Players Using Dollar Weighted VIX Put Call Ratio

Let's start by defining what does Put/Call Ratio mean, what kind of information we get from it, and how to use that information. We will look at the difference between a simple put/call ratio and the dollar weighted put/call ratio.

* Simple Put/Call Ratio (PCR): The ratio of the put options to the call options. The number of puts contracts traded against the number calls contracts traded. A high PCR is considered bearish and a low is considered bullish.

* Dollar Weighted Put/Call Ratio ($wPCR): The ratio between the total dollars in premiums paid for puts to the total dollars in premium paid for calls. A high $wPCR (>2.0) is considered bullish and a low (<0.50) is considered bearish.

Now that we know the meaning of the terms we can talk about the type of information they give us. When lots of calls are traded it is perceived as bullish since investors believe there is upside to the underlying. The opposite is true when lots of puts are traded.

The simple PCR which looks at volume as the key factor does not give us the complete picture, as you know options have different prices and one call traded at $1 is not the same as one put traded at $15. The bigger the dollar value a trader commits to his trade can show the conviction of the move. With the $wPCR we are able to get a reading that lets us take the money factor into consideration and clears the problem that simple PCR has.

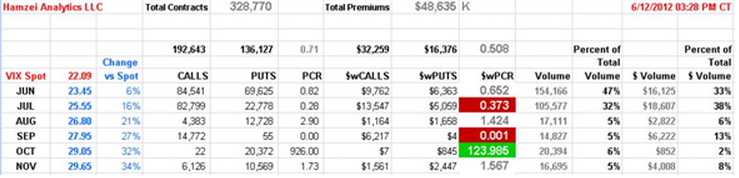

(See the next table:)

Using $wPCR to follow the smart money

By looking at the $wPCR on the CBOE Volatility Index (VIX) (VXX) (also know as "the fear indicator" which lets us know the 30 days implied volatility for the at the money S&P 500 (SPX) (SPY) options), we can get an intraday as well as short term gauge of the market sentiment. Since most of the VIX volume is pit-traded it reflects the big institutions' sentiment, while they are hedging their current holdings. This creates the perfect indicator to follow how big players are positioning themselves in the market.

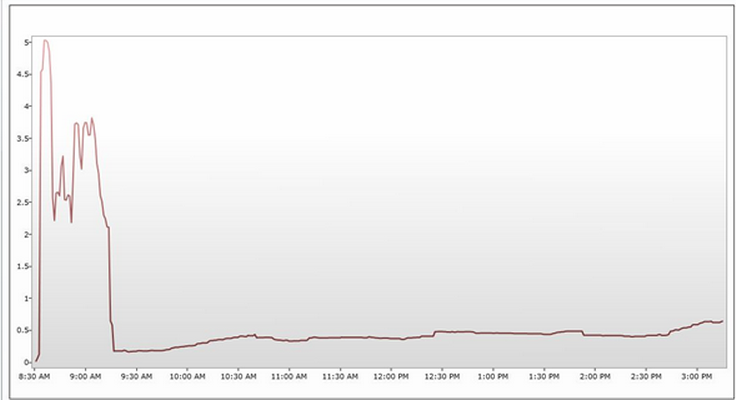

To interpret the information we get from the VIX $wPCR we must take into account the negative correlation that S&P 500 and the VIX have. This means that a low $wPCR is bearish and a high $wPCR is bullish. Based on our current trading experience we have noticed the intraday rise and fall in the front month $wPCR have a high positive correlation with changes with S&P 500 index futures. (See following graph:)

As one can see the important point to take is that the key is looking at the marginal change in $wPCR. Although the actual value is important the critical measure is how this number changes throughout the day. By using this indicator we eliminate the problem that simple PCR has and create a powerful intraday as well as short-term sentiment tool.

Courtesy of Fari Hamzei, hamzeianalytics.com