Trading Implied Volatility and News Events through Option Spreads

Volatility Arbitrage

Trading Implied Volatility and News Events through Option Spreads

For option traders it is vital to know how implied volatility (IV) affects the price of an option. Many times traders get frustrated about losing in a position when they were directionally correct about the expected move. The price of an option is derived from several inputs into a robust pricing model such as Black-Scholes (the most commonly used one).

These are current price of the underlying, the contract strike price, time to expiration, volatility, interest rates, and dividends paid. If price moves as one expected but volatility falls the price of an option might not move. The reason is because price components (Delta and Vega) are acting against each other.

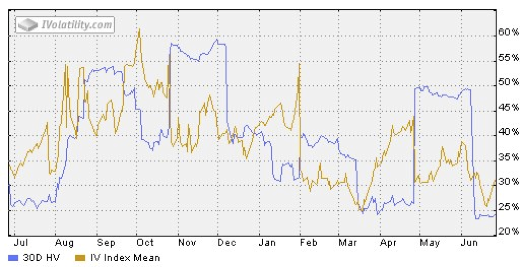

As you can see in the chart below volatility will often be crushed after a news event. Therefore for you to profit from a trade the movement in the price must be big enough to offset the fall in volatility. IV for event driven trades could be the single and most important element for a trader to consider.

Creating a spread in which one sells Vega (the amount an option's price changes by a 1% move in volatility of the underlying) creates a great potential 'arbitrage' opportunity that captures the premium built into the front-expiry (weekly or monthly) options based on the anticipation of a movement.

For event driven strategies such as earnings volatility plays a key role. IV moves up or down based on the expected future movement in the underlying asset. The increase in implied volatility leading to the event can affect the outcome of the trade. If you look at the chart below taken from Amazon (AMZN) you can easily spot the rise in implied volatility and then followed by a huge IV fall after the unknown becomes known (first chart below).

AMZN Historical Volatility (Blue) & Implied Volatility (Brown) Chart

Source: www.ivolatility.com

All this occurs because there is an expectation of a big moment in the underlying asset. Since market makers and traders do not know which way the stock will move, the options will price the potential move before it occurs.

By selling Vega, a spread trader can capitalize on the contraction in volatility when IV falls after uncertainty is removed (no longer a factor). A trader must first look at different options and decide which will suffer the biggest decline in IV and sell those while at the same time look for the ones that will suffer the least and buy those.

Usually front month options have the biggest IV crush but not always. Therefore one must be extra careful and look beyond the option contract IV, and instead, look and compare the option contracts' Vega and its time-to-expiration, as close as possible to initiation of the spread trade.

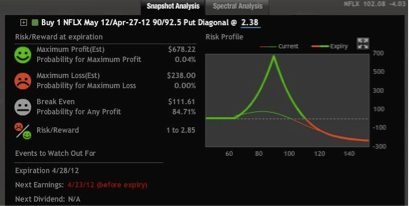

To see an example of a volatility arbitrage trade in action, let's go over a real-life sample trade on NetFlix (NFLX);

Choice 1:

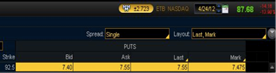

. Sell 1 NFLX April 27th 90 Put at 2.85

. Buy 1 NFLX May 92.5 Put at 5.23

Source: www.trademonster.com

This data is from April 23, 2012, with a bearish outlook for a total cost of 2.38. One could ask why not go with long puts instead of this spread. The main reason is trying to get a lower cost basis for the position that will yield the same or better return with lower risk.

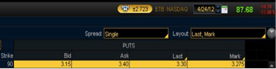

If we had decided to go with just long puts the result of the trade would be the following, on the next day April 24 this was the price of those options:

Source: ThinkorSwim

Choice 2:

. if LONG 1 NFLX April-27 90 Put traded at $3.40 (17% profit)

Choice 3:

. if LONG 1 NFLX May 92.5 Put traded at $7.55 (42% profit)

But if one had done a volatility arbitrage spread the net result for the next day would be:

. Spread trading at 4.15 (74% profit)

One can see the huge difference in terms of profits. What is also worth taking into consideration is that getting a bigger profit is great, but lowering the risk of the trade is critical in your money management decisions. From the 3 choices mentioned above the cheapest one was the spread, which also yielded the best returns.

In conclusion a trader must fully understand the changes in IV and how to use them to gain advantage of trading opportunities that otherwise will result in losses. The way to do this is by creating a volatility arbitrage and have long and short Vega exposure during an event-driven trade.

Courtesy of Fari Hamzei, http://www.hamzeianalytics.com