The Best Part About Monday's Market Selloff? It Was Awful.

Yikes. On Monday the S&P 500 closed 1.7% below Friday's close, although at one point it was down as much as 2.86%; it reclaimed some of its loss during the session. Still, it was a punishing day, snapping key technical floors for most of the major indices. That makes it easier for the bears to sustain the selling effort, now that investors have nothing to lean on (so to speak).

And yet, it's possible Monday's rout may have also been at least a near-term bottom.

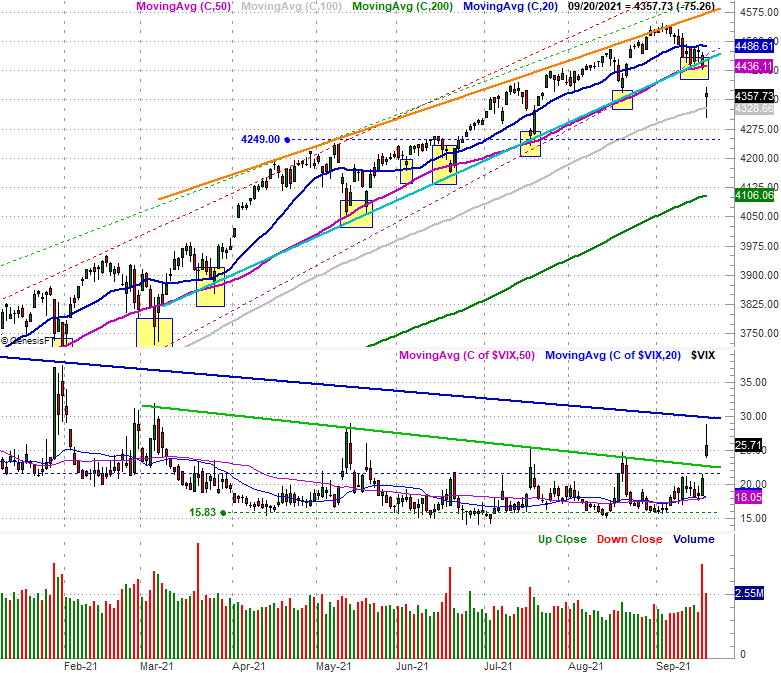

Take a look at the daily chart of the S&P 500 below. It was already testing the 50-day moving average line (purple) as of the end of last week, after pulling under straight-line support by Friday's close. Both of those floors are now in the distant rearview mirror, with a big bearish gap being left behind by Monday's awful open.

It may ultimately be a good thing, however.

Ever heard the term "dead cat bounce?" Just as you might surmise, it's in reference to anything including a dead cat -- if dropped from high enough heights -- will bounce. Now down a little more than 4% from its early September high thanks to today's drubbing, the S&P 500 may have fallen enough to bounce no matter what. The fact that the 100-day moving average line (gray) appeared to act as some sort of technical floor underscores this argument. Ditto for the shape of the chart. The open and close are near one another, in-between a long-tail (or deep intraday low). This often indicate a transition from a net selling to a net buying environment. The bearish gaps is also begging to be closed.

It all points to a reversal, and soon. Indeed, odds are good we'll see a bullish rebound effort on Tuesday, and it could go somewhere. It may even be a strong enough reversal effort to continue prodding the market back above the technical floors it just fell under. If so, investors may decide once again they can't afford to miss out on any upside, fueling a more prolonged rally. That's the good news in Monday's meltdown.

The bad news is, Monday's selloff inflicted some serious technical damage on a market that's already ripe for a lot of profit-taking.

The key here is what happens if-and-when the S&P 500 revisits the convergence of all those support lines around 4440. It could test them without actually clearing them, and then readily roll over again. It's a process that could take a few days to complete no matter what's in the cards.

Whatever's in those cards around 4440, now, the 100-day moving average line at 4329 is the line to watch. The bulls have clearly established that level as a line in the sand. Now let's see if those bulls can stand up to another bearish effort. If they can't, that should pretty much push the broad market into full-blown correction mode. Then the 200-day moving average line (green) at 4106 becomes the next potential floor to put on your radar.

Again, the odds of a dead cat bounce from Tuesday on are pretty good just due to the sheer severity of Monday's selloff. Don't read too much into such a move, however. It could just be a simple dead cat bounce.