5 Stocks That Are 25-year Dividend Champions

5 Stocks That Are 25-year Dividend Champions

by Michael Fowlkes

It is always good to be a champion, and in the world of investing, dividend champions are stocks that have increased their dividends for at least 25 consecutive years.

Why is it important to seek out companies that have solid track records of dividend increases? Because by doing so, and coupling the approach with a dividend reinvestment plan, or DRIP, you can build a portfolio that is constantly growing its income power. When you combine dividend reinvestment with increased dividends, you are left with positions that increase in size each quarter, and once a year your dividend gets a nice boost, as will the number of shares your DRIP plan will purchase. [BigTrends.com note: a DRIP plan is not a guarantee of profits, and also keep in mind that dividends are normally a taxable event for stocks in a non-retirement account, even if they are re-invested.]

But a higher dividend payment is not the only reason to seek out dividend champions. A second, and just as important aspect to these stocks is that a long track record of dividend increases indicates strength in a company's underlying business. An ability to maintain a steady dividend program, let alone one that is consistently raising its dividend payment, illustrates that management is confident not only in the company's current standing, but also its ability to maintain the program moving forward.

Let's take a closer look at my favorite dividend champions, and why they may be strong buy candidates for any portfolio.

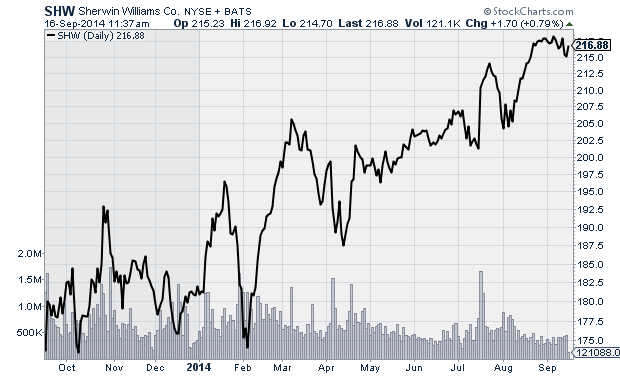

Sherwin Williams (SHW):

Sherwin Williams (SHW) manufactures paints. As the housing market has improved, the stock has flourished. Not only has the stock been strong, but the company has managed to boost its dividend for an impressive 35 consecutive years. The stock's yield is just 1.0%, but with a very low payout ratio of 25.5%, the company can easily afford to increase its dividend moving forward. Sherwin Williams is a favorite choice among builders and professional painters, and as the housing market continues to improve, the company's paints will be in demand for both new construction and remodeling projects undertaken by homeowners. Analysts forecast earnings growth of 22% next year, which will keep the stock moving in the right direction, and along with the expected dividend increase, the stock is an attractive choice at the current time.

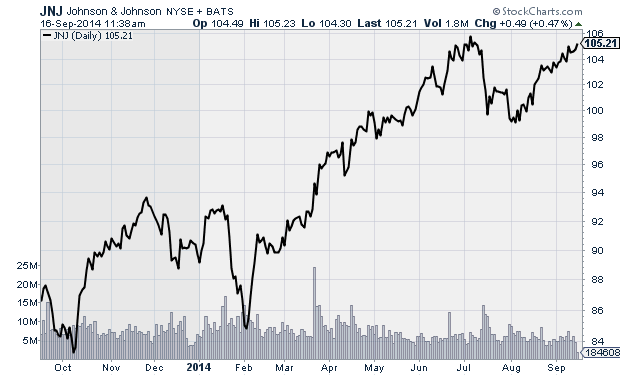

Johnson & Johnson (JNJ)

Not only is Johnson & Johnson (JNJ) a dividend champion, it is also a dividend aristocrat, meaning it has increased its dividend for more than 50 years in a row. In JNJ's case, the streak is actually 51 years. At 2.7%, the yield is attractive, and the company has a relatively low payout ratio of 47%, so it can easily afford to extend its streak of increases. An aging population, in conjunction with a higher number of insured Americans after the Affordable Care Act, paints a positive picture for companies in the healthcare sector moving forward. Those are two of the reasons why I am bullish on JNJ as a long-term holding. The company is expected to grow earnings by 7% next year, which should keep the stock trading near its record highs.

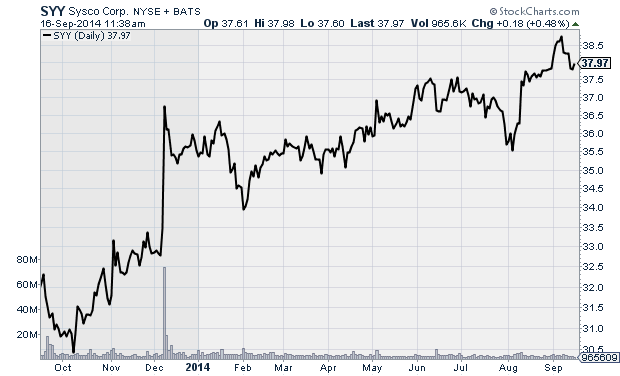

Sysco Corp. (SYY)

Food wholesaler Sysco Corp. (SYY) is a true dividend champion, with a streak of 43 consecutive years of dividend increases. While the company's payout ratio is slightly high at 62.0%, I do not see any risk of the increases coming to an end. Sysco is an industry leader, and the company is looking to extend its market share with the announcement last December that it would acquire US Foods, which will result in a company with significant market share. The two companies estimate 25% market share following the proposed merger, but analysts have estimated the combined market share could be closer to 54%. The merger will need FTC approval before it goes through, but regardless of whether the merger is approved or not, SYY remains attractive. Populations continue to grow, and as an industry leader, Sysco's business is secure. Analyst forecast earnings growth of 8% next year.

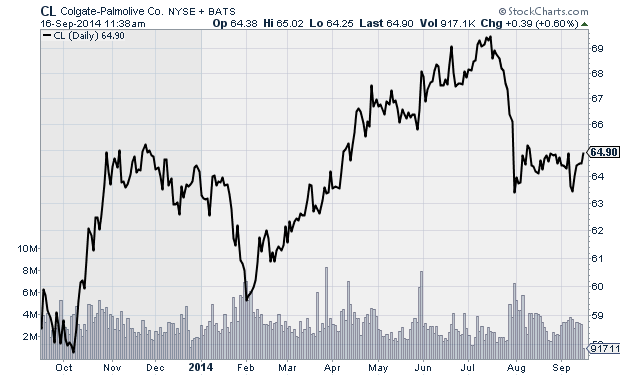

Colgate-Palmolive (CL)

Consumer goods manufacturer Colgate-Palmolive (CL) currently has a dividend yield of 2.2%, and it has raised its dividend each of the last 50 years. The company currently has a dividend payout ratio of 48.6%, leaving it plenty of room to continue lifting its dividend for years to come as long as earnings continue moving in the right direction. Improved consumer confidence should lead to higher spending, which will benefit the company, but the beauty of Colgate-Palmolive is that a large percentage of its products are consumer staples, so they will remain in demand regardless of economic conditions. However, when the economy does run into problems, Colgate can suffer because consumers may shift to more inexpensive generic goods, but demand will always be there. In addition to its personal hygiene product lineup, the company also sells things such as Science Diet dog food and Murphy oil soap. It is a well-diversified company, and is a good long-term holding with a nice dividend program. The stock has sold off a bit as of late, but I see the dip as a good buying opportunity, and with analysts predicting 10% earnings growth next year I see a lot of upside to the stock at the current level.

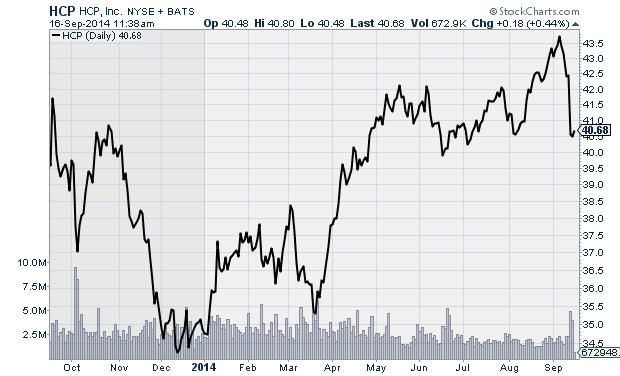

HCP Inc. (HCP)

HCP Inc. (HCP) is a healthcare REIT, and in order to keep the tax advantages afforded to a REIT, the company is required to pay out at least 90% of its income to shareholders. As a result, the company has a high dividend yield of 5.4%, and has increased its dividend for the last 28 years. HCP invests in properties such as senior living facilities, medical offices, and hospitals. The population in the U.S. is aging, and with the baby-boomer generation entering retirement, there is going to be higher demand for senior living facilities as well as need for ongoing healthcare services at hospitals and clinics. This, combined with an increase in the number of insured people under The Affordable Care Act creates a favorable environment for HCP moving forward. Earnings are expected to rise 10% next year, which should push shares higher, and along with the 5.4% dividend this REIT is a solid long-term holding.

Courtesy of MarketIntelligenceCenter