Midweek Update: Wednesday Was Good, But Not Great

It's been a back-and-forth affair, but the bulls are turning the tide. Thanks to Wednesday's gain, most of the indices are mostly above key technical ceilings.

Not everything is quite as bullish as we wish it was though.

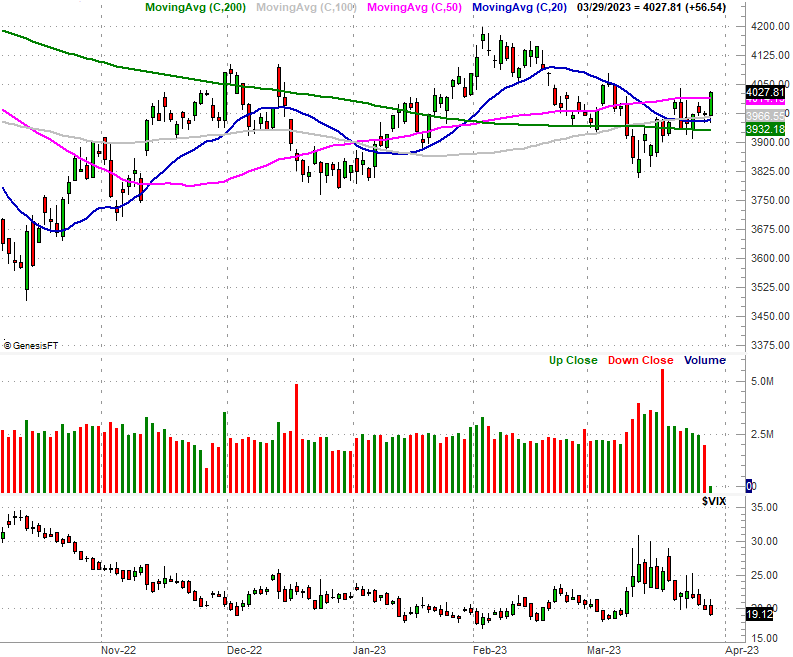

But, first things first. Take a look at the daily chart of the S&P 500. While it's been back and forth since its early March low, as of today the index is back above its 50-day moving average line (purple) at 4016. More notable is the fact that the index seemed to push up and off of its now-converged 20-day (blue) and 100-day (gray) moving average lines to make it happen. With that move, the S&P 500 is now above all of its key moving averages, and inching upward.

It's not a perfect effort though. While the volume data for Wednesday's session doesn't show on this chart, know that today's volume was pretty thin, suggesting the rally effort isn't necessarily a bullish opinion. Indeed, volume has been declining all the way up, indicating that the higher the index climbs, the less faith traders have that it will be able to continue doing so.

One also has to wonder if the S&P 500's Volatility Index (VIX) is also nearing a "too low" level.

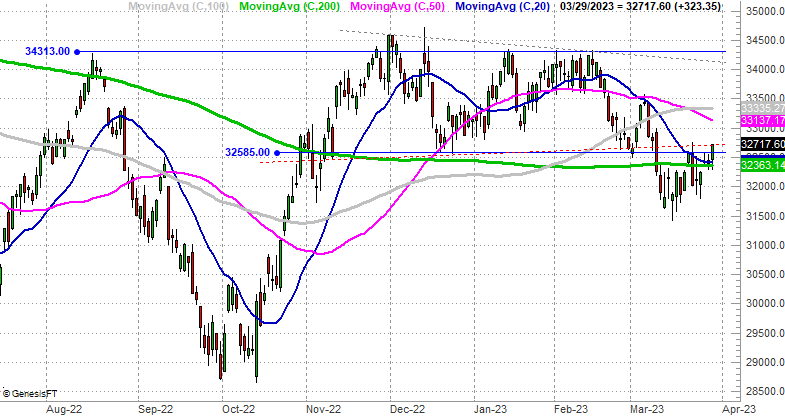

The Dow Jones Industrial Average is also doing better than it was just a few days ago, fighting its way back above the 200-day moving average line (green) as well as its 20-day line (blue) today. But, where the blue chip index stopped its rally is suspicious. Wednesday's peak of 32,728 is right on line with a floor established beginning late last year (red, dashed), which first showed itself as a technical ceiling a week ago. Even if only for psychological reasons, there's something about this line in the sand that's too big too ignore.

Of course, the Dow's still got a ton of resistance to push through above this technical ceiling, all the way up to the 34,300 area.

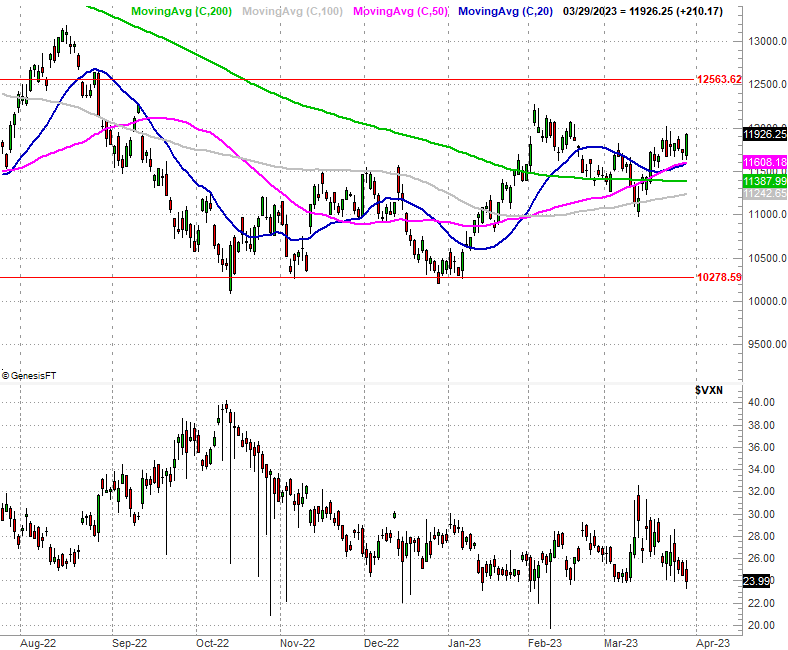

As for the NASDAQ Composite, it's doing as well as it ever was, managing to log its best close in over a month today. It's also holding above all of its key moving average line, which means it's not likely to bump into serious resistance anytime soon.

The point is, while the action is encouraging, stocks aren't fully over the hump just yet. They're close though. Let's assume the current uptrend will remain in motion until we clearly can't afford to maintain that assumption any longer. That of course will require a tumble back under all of the aforementioned moving average lines.

Let's also keep an eye on volume, or lack thereof. If this advance is going to continue chugging, it's going to have to draw in some more buyers sooner than later.