Stocks just broke below a key level and what's next could decide fate of bull market

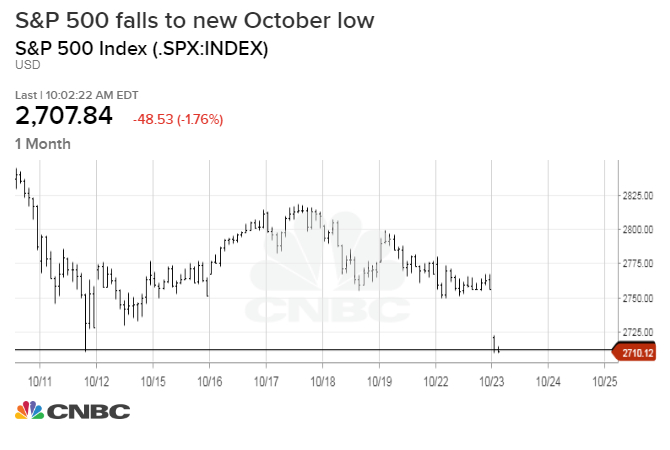

- The S&P 500 fell below 2,710, its recent October low and now a major test zone as the market looks for a bottom.

- A close below that level would be bearish, but if the market bounces and closes above that level, it would be seen as a positive.

- However, if the market stays weak and goes lower, investors will watch for new zones it could retest.

The stock market sell-off sent the S&P 500 below a key level Tuesday, and how it trades next could determine whether the market is close to finding a bottom or more selling is ahead.

The S&P 500 dropped as low as 2,691, below the 2,710 Oct. 11 low. It was last at 2,707, just below the key level.

"It could be bullish if it breaks below and then reclaims it and has a strong finish," said Scott Redler, partner with T3live.com. "But if it gets below 2,710 and things are weak, banks are weak and tech can't rally, and Apple breaks $216, $215, chances are that would start the next leg lower."

Apple was trading just below $217 in early trading. The Financial Select Sector SPDR Fund ETF was off 1.3 percent, and the Technology Select Sector SPDR ETF was off 1.9 percent.

When the S&P fell to 2,710 earlier this month, it was 7.8 percent off its September all-time high. Redler said if the decline continues, the next level it would test could be 2,650, the level of its prior breakout in May. Below that is 2,550, the 2018 low.

From CNBC