Stock-market bulls are ‘playing with fire,’ says financial blogger

The Nasdaq Composite is just 1.4% shy of its record close

Are Wall Street optimists pyromaniacs? At least one financial blogger thinks the bulls are engaged in a dangerous game that could get them scorched, as U.S. stock markets continue to flirt with all-time highs.

Sven Henrich, a financial blogger at Northman Trader, says investors are chasing U.S. equities, like the Dow Jones Industrial Average (DJIA), S&P 500 (SPX), and Nasdaq Composite Index (COMP), which have been streaking, in fits and starts, to fresh heights.

Henrich, in a blog post titled “Playing With Fire,” cautions that a peak may be at hand and that the subsequent unraveling, when and if it comes, could leave yield-hungry investors swirling in a world of hurt. Why is Henrich so unnerved, with a plodding race to the top for markets presumably lining investors’ pockets? He cites, in part, distortions created by central banks, which arguably have buoyed the market’s enthusiasm on the way up, but may slowly be unwinding accommodative policies, at least in the U.S., to the peril of some.

As I’ve said earlier this year tops are processes and they take time and this here is no exception. But so far the only surprises have been the unprecedented levels of central bank intervention and the resulting low levels of volatility. But people chasing into overpriced stocks in the hopes of even grander returns? That’s standard fare in any topping process. And invariably when you play with fire you risk getting burned.

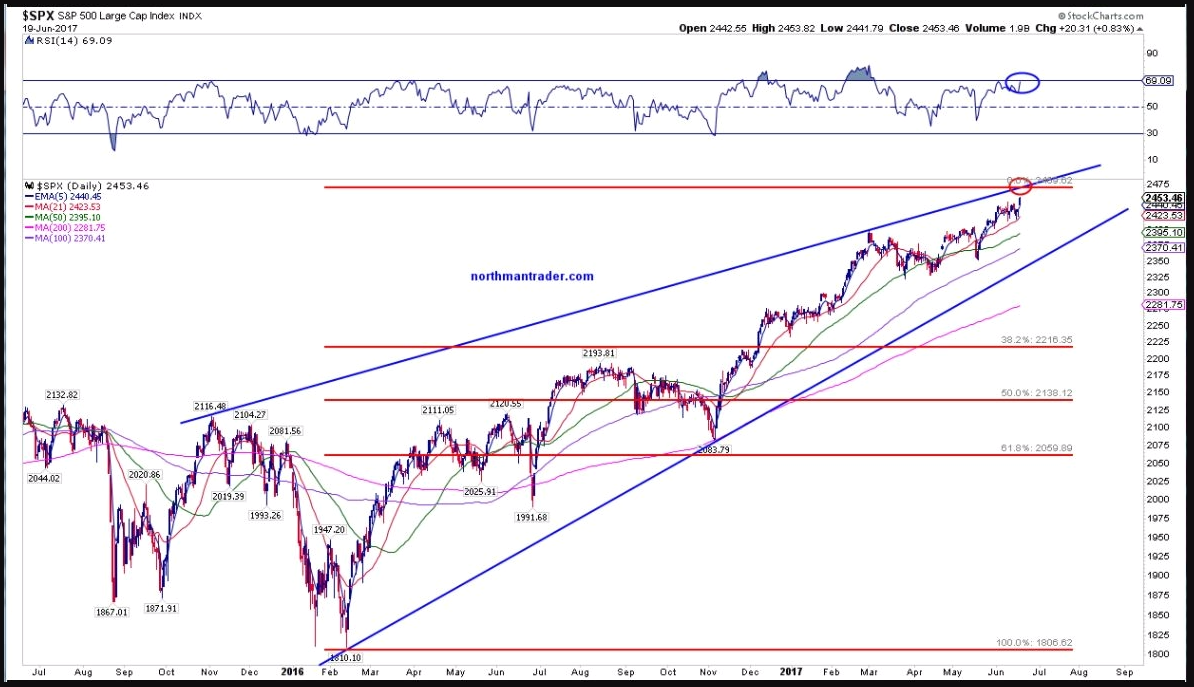

The blogger and market technician says a move for the S&P 500 above 2,450 — which it hit Monday, and briefly touched on Tuesday — may prove a top and provide a selling opportunity:

We consider any $SPX moves above 2450 (as yesterday) to be a selling opportunity setting up for a sizable technical correction and volatility spike. That initial spike may well be a fade for a trade, but we’ll cross that bridge when we come to it.

Check out the chart below:

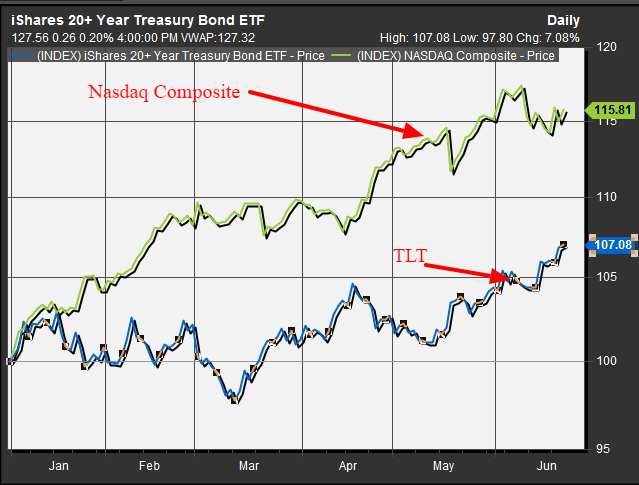

Beyond the technical call, Henrich touches on a point that continues to befuddle investors: The tendency of stocks to rally while other measures of economic health are sounding bearish alarms.

Indeed, bond prices and stock values have been moving mostly in the same direction — a relatively strange phenomenon. That’s because Treasury prices, which move inversely to yields, tend to climb when investors are at their most cautious, fretting about growth and mounting risk, while equities rally on economic optimism.

Government-bond yields have been stubbornly low despite a Federal Reserve that has stridently championed higher rates, and sluggish inflationary signals that have given some market-watchers pause.

On Wednesday, the 10-year Treasury note was at 2.156%, compared with 2.223% on Dec. 17, 2015, the day after the Federal Reserve hiked interest rates for the first time in nearly 10 years, and starting its first of four moves since to normalize ultralow yields. Still, rates remain lower despite the Fed’s decision last week to lift its key rates to a range between 1% and 1.25%.

Moreover, the premium between short-dated and long-dated bonds have narrowed, typically signaling a bearish outlook for the U.S. economy, despite the Fed’s more sanguine view. On Wednesday, the spread between the five-year Treasury note and the 30-year Treasury bond held at its narrowest since November 2007 at 95.6 basis points, according to WSJ Market Data Group.

The slow and then sudden collapse of crude-oil prices also has sent shivers down the spines of bears, who read the commodity’s descent into bear-market territory as a further signal that the global economy is on shaky footing. U.S. oil prices logged a 10-month low on Wednesday. Coincidentally, lower oil also is a factor in yields hanging lower, because lower inflation can encourage bond buying, since investors don’t have to fret about the corrosive effect rising prices can have a bond’s fixed payments. Perhaps that is one reason investors are scooping up stocks, as measured by the rise in the growth-oriented Nasdaq, while at the same time pushing the price of one popular bond exchange-traded fund, iShares 20+ Year Treasury Bond ETF TLT, +0.22% higher (see chart below):

Crude is the lifeblood of the world, and although cheaper oil is a boon for consumers, it is vexing to central bankers seeking to juice inflation; and lower oil is anathema to energy companies dependent on revenue. So, falling oil prices could help to tip markets lower, or so the theory goes.

Yet, all this angst and anguish hasn’t yielded a discernible correction for these toppy markets. Case in point, the recent bout of weakness in the technology sector XLK, +0.04% has seemingly dissipated, with investors taking the Nasdaq Composite to a positive finish on Wednesday and moving the tech-laden benchmark just about 1.4% from its recent closing high.

In other words, investors’ greed is overcoming fear. Here’s how Andrew Adams, a market strategist at Raymond James, put it in a Wednesday research note:

We have said it before, but I will say it again: a market that does not go down even when it feels like it probably should is clearly a strong market. Technology takes a breather for the first time in a while? That’s OK because other sectors are there to grab the bull by the horns. The S&P 500 hits what could be significant resistance? It just decides to consolidate for a bit instead of selling off. This kind of action is exactly what we want to see in a bull market and strengthens our belief that we are not approaching the end of it.