Iron Condors: Sometimes, the Best Trade is the One Not Taken

Most of the time a successful option trade means making the right call about a particular stock or index's future, and then determining which option (or options) would find the optimal balance between risk and reward. Sometimes though, circumstances simply make it impossible to make a decent buck even if you make the right call. This was one of those times.

This week, our BigTrends Earnings Extravaganza service was mulling a trade on Adobe (ADBE), which reported its prior quarter's earnings on Thursday.

The BigTrends Earnings Extravaganza advisory primarily utilizes iron condor trades to capitalize on the typical pre-report and post-report volatility that tends to be seen when key companies release their results. Iron condors, which is essentially a trade consisting two credit spreads (one on each side of the stock's price), are counter-intuitively suited as a way to benefit from earnings news.

We say counter-intuitively because it seems/feels as if any earnings related volatility that option traders want to "get in on" would take shape following news, suggesting buying or owning options before the news hits and then selling those options after news is released -- when volatility is greater -- would bear fruit. That's not how things pan out though; traders are collectively too smart for that approach to work.

See, the market knows volatility is coming after earnings, so traders price in that impending volatility before the news hits the wires. Ironically, on a net basis, the news itself marks the wind-down of the volatility that inflates premiums. Ergo, iron condors, are an ideal way to "sell volatility" before the volatility-premium starts to evaporate following news.... provided the stock doesn't move too much after the report. As was noted with Oracle though, quirky circumstances meant we couldn't find an optimal trade with more reward than risk. Walking through the thought process of the non-trade would be a fruitful exercise.

The basic premise of an iron condor is to determine a "zone" or price range on a chart a stock isn't likely to move out of, even following an earnings report. To make money on such a trade, one would sell an out-of-the-money put, and buy another out-of-the-money put with a lower strike, and at the same time, one would sell an out-of-the-money-call, and buy another out-of-the-money call with a higher strike. This is essentially the combination of two credit spreads (a bull put spread and a bear call spread, to be specific). The idea is to reverse all four positions at a much lower net price after a post-earnings move from the stock, or better yet, let all four options expire worthless and keep 100% of the initial credit reaped at the entry of the trade.

Sometimes though, the math simply can't make sense.

The quirk is the way the options' strike prices are arranged. For Adobe, unlike most other major stocks, its options are only available in $5 increments (calls with a strike price of $70, $75, $80, etc.). Though we can still pocket a credit by selling an out-of-the-money put and at the same time buying an out-of-the-money put with a lower strike [which is effectively an insurance policy], there's not a lot of money to be made between the two considering the risk. Ditto for the credit spread using calls -- that $5.00 gap makes it difficult to pocket enough premium at the onset of the trade relative to the risk incurred.

At the same time, where ADBE shares were trading arguably made it even more difficult to make enough money given our risk.

The stock was trading at $105 for the better part of the week, which put it right on a key strike level and then considerably far away from any of the neighboring strikes. That's good from the viewpoint that we don't want Adobe shares to move outside of the range established by our option trades - the wide range would allow for plenty of volatility. But, from an option-selling or credit-producing perspective, this can make it even tougher to collect a decent premium.

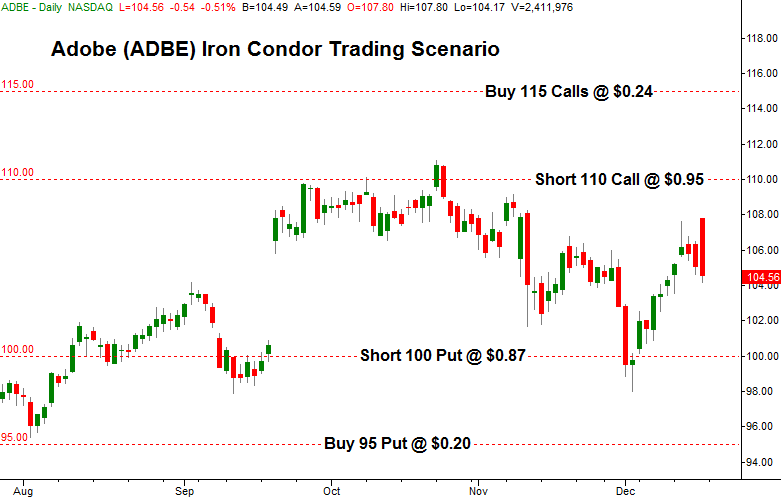

The scenario: With Adobe shares trading at $105, our only choices that were even remotely viable for an iron condor would be the sale of a $100 put - expiring on Friday, by the way - the purchase of a $95 put, the sale of a $110 call, and the purchase of a $115 call. Those prices were, respectively, $0.87, $0.20, $0.95, and $0.24. For every contract involved, we would have put $138 in our pocket ($0.87 - $0.20, and $0.95 - $0.24, times 100), which isn't bad. But, it's not feasibly enough. We'd need Adobe shares to remain between $100 and $110 after earnings. Any move above $111 (and change) or below $109 (again, and change) would have sapped all of our profits, but in the case of Adobe, that was readily possible. ADBE shares hit a low of $98.00 just two weeks ago, and the stock hit a high of $111.09 less than two months ago. The right earnings news could have easily pushed the stock back to either of those levels again, wiping away all of our credit pocketed when the trade is entered.

In this case, a net credit of closer to $2.00 for every contract involved would have been more desirable.

Sure, we could have pushed each side of the iron condor out, meaning buy the 120 calls and sell the 115 calls, and sell the 95 puts and buy the 90 puts, but would have meant considerably less premium... not even enough to bother with.

Moral of the story? It's not very often a matter of logistics and circumstances makes a trade "not worth it" from a risk/reward perspective, but it can happen.

To be clear, the Adobe trade could have been a profitable one. This one just wasn't going to be profitable enough relative to the risk we would have been forced to take. And it wasn't just the $5 gap between strikes making things tough either. It was the way the market was pricing in premiums for the calls and puts further away from the stock's current price, but wasn't quite doing the same for the options with strikes closer to where ADBE was trading.... the un-quantifiable X-factor in trading. We like to see a 3.75% profit cushion, at least, relative to the amount of capital we're putting on the line with iron condors, but that just wasn't happening here. Were the strike prices only in $1.00 increments or $2.50 increments, it may have been a different story. That wasn't a choice though, so in this case the best trade was no trade at all.

If you'd like to use iron condors as well as capitalize on earnings news, the BigTrends Earnings Extravaganza newsletter is the way to go. Though we didn't take the Adobe trade, we've got more than enough trading opportunities to keep even the most active of traders busy.