A couple of times in the past couple of weeks we've pointed out how large cap growth stocks -- mostly FANG stocks -- have been unusually strong. That's fine, but not necessarily sustainable. We've been looking for a pullback for a while now, particularly given how the NASDAQ's daily volume and daily breadth has been leaning in a bearish direction. We took a detailed look at the matter in this weekend's Weekly Market Outlook.

As it turns out though, there's more to this (developing) story.

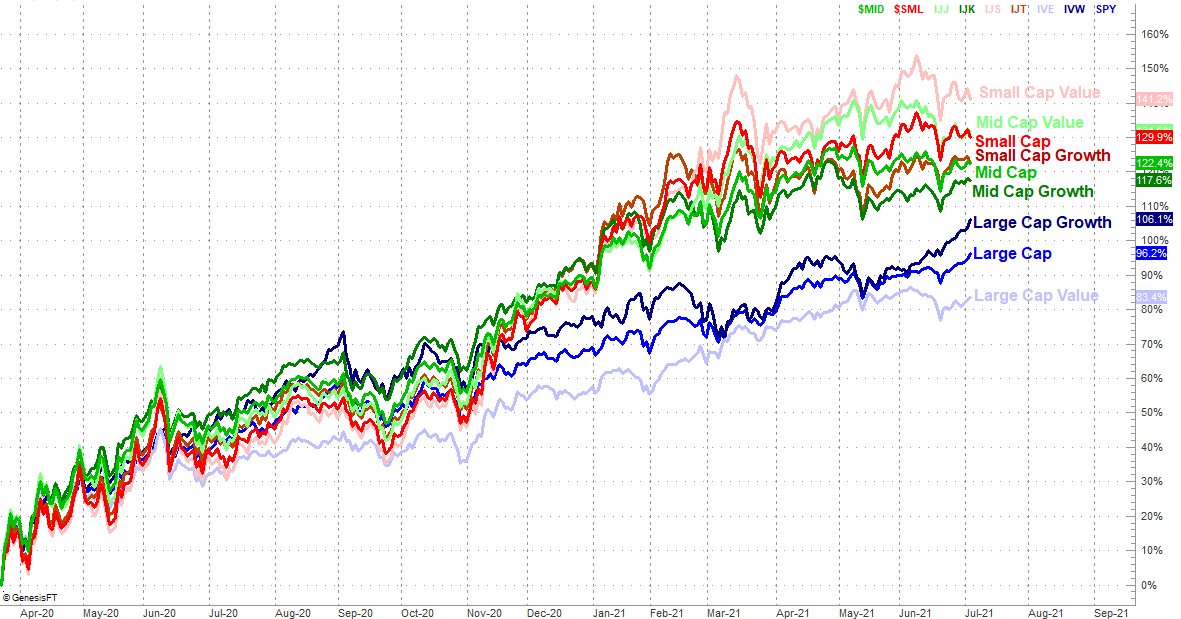

For the record, much of the recent leadership from large cap growth stocks has a lot to do with the fact that large caps in general lagged coming out of the pandemic meltdown. It's clear, however, that large cap growth stocks are still doing the heavy lifting for large cap segment. But, too much of anything is too much.

But, maybe that's not a problem just yet. Perhaps there's still room for large cap growth names to keep chugging... if that strength is at the expense of small cap and mid cap stocks, as it seems is developing as the case. Take a look. Large cap growth names are moving deeper into record high territory, but at the same time, small caps and mid caps are losing ground. Indeed, all large caps (growth and value) rallied last week while all small and mid caps lost ground. Even Friday's rock-solid rally to end the week was limited to large caps, sending all smaller companies lower.

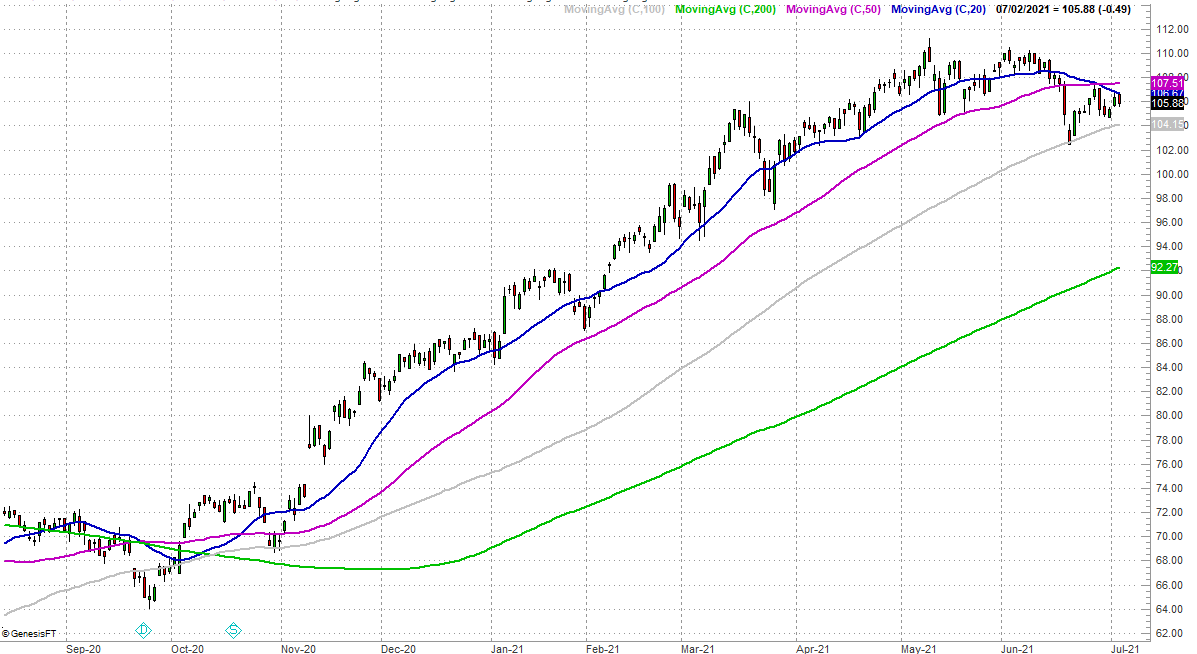

To this end, the mid-cap value stocks -- as proxied by the iShares S&P Mid-Cap 400 Value ETF (IJJ) -- has already suffered a key technical breakdown. Not only is it now below its 20-day (blue) and 50-day (purple) moving average lines, it's tested both as technical resistance within the past couple of weeks. It failed to move back above either with either attempt. The 20-day moving average line is also below the 50-day line... one of the only major market indices to dish out this technical red flag.

The 100-day moving average line (gray) is still support; it sparked the rebound from the mid-June low. Just keep an eye on that line going forward. If it fails to hold up as support if it should be tested again, that's a big problem.

It's all still admittedly incredible. Large caps look and feel overextended. Small and mid caps were even more overextended a couple of months ago. They continued to rally anyway... at least for a while. And as they say, never fight the type.

Just something to think about.