Forget trade - here's the real risk to the stock market

The 'morphine drip' preventing stock pain is ending, analyst says

By Ryan Vlastelica, MarketWatch

Over the past several weeks, policy uncertainty has been the biggest driver of moves in the U.S. stock market, with investors fretting that protectionist measures pushed by President Donald Trump could escalate into a trade war, or that recent issues surrounding internet companies could herald a more aggressive regulatory environment against some of the economy's biggest names.

Over the longer term, however, the real policy risk facing Wall Street may not come from the White House or Congress, but from the Federal Reserve.

The U.S. central bank has been gradually shifting its monetary policy in two significant ways: raising interest rates and reducing the size of its balance sheet. Low rates and the Fed's bond-buying program contributed to the equity market's massive rally over the past decade, and while changes to these policies have been widely telegraphed, analysts say Wall Street is still not appreciating the risk they represent.

"Years of accumulated policy distortion, a lack of Fed maneuvering room and shock waves from policy are the S&P 500 risks we see, but not corporate earnings or economic growth," said Barry Bannister, head of institutional equity strategy at Stifel. Bannister has been warning about Fed-related risks for a while, and he recently speculated that if the Fed mishandles the transition to a more normalized policy, that could spark an "unusually rapid" bear market, leading to a "lost decade for stocks," or 10 years with no positive returns.

Other analysts were not quite so bearish, but they roundly said that monetary policy was one of the primary factors that would drive trading over the coming years, comparable in importance to corporate earnings, economic growth, and inflation (although some of these factors are related and intertwined).

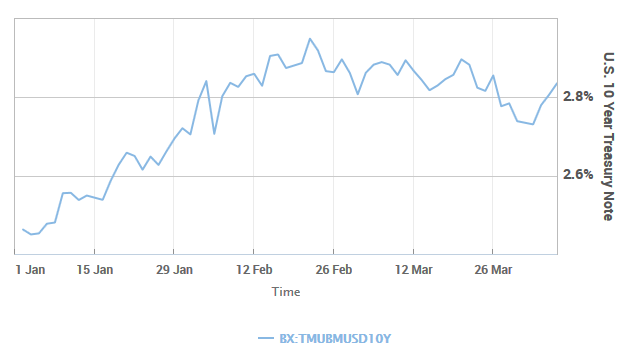

Changing Fed policies have likely already contributed to recent market action, including the yield in the U.S. 10-Year Treasury note moving up to 2.82% from 2.41% at the start of the year. It previously moved as high as 2.94% in late February, a four-year high. That rise in yields means Treasury prices have been falling, as the two move inversely to each other.

Rising yields and interest rates - along with the fear that inflation could be returning to markets, which would exacerbate both trends - also fueled the first correction in about two years for the Dow Jones Industrial Average and the S&P 500.

Compared with other asset classes, equities are seen as additionally risky now compared with past years, not only due to their valuations, but because for a long time, the 10-year had a lower yield than the S&P 500's average dividends, giving income-seeking investors a reason to favor stocks despite their higher volatility. Yields are only expected to continue rising from here: the Fed raised interest rates two weeks ago, and while it expects to only do so twice more in 2018 - some investors had expected four hikes this year - it pushed up its expected rate path for 2019 and 2020.

"If our thesis is correct - that Fed hawkishness is the primary variable recently dragging equities lower - there will be little reason to hold equities until the Fed pivots away from its current stance on rate policy," wrote analysts at Bretton Woods Research. "The Fed remains the primary risk variable, i.e., Public Enemy No.1 when it comes to the equity and growth outlook."

Another long-term tailwind for equities is also ending. The Fed's bond-buying program, which ballooned the central bank's balance sheet to nearly $4.5 trillion, helped push down interest rates and made stocks look further more attractive than fixed income. Now, with that balance sheet being unwound at a pace $10 billion a month (the pace will eventually accelerate to $50 billion a month), a steady drumbeat of equity support will fade.

"There's no page in any playbook that we can turn to for how this will turn out," said Leo Grohowski, chief investment officer at BNY Mellon Wealth Management. "I think the Fed has done a very credible job telegraphing the changes and I'm confident it can gradually remove the punch bowl without disruption, but it is clearly a risk, especially in the context of rising interest rates and inflation. If these factors result in the 10-Year getting up to 4% or 4.5%, there will be a contraction in multiples that our earnings growth can't overcome."

A normalized policy environment will likely mean a more normal equity environment, as opposed to the atypically low volatility of recent years. Of course, a market with sharp gyrations - as has been seen this year - will likely be more painful for investors.

"The morphine drip is ending," said Charlie Smith, chief investment officer at Pittsburgh-based Fort Pitt Capital Group. "Once quantitative easing is aggressively reduced, there's no way to avoid that volatility will go up."

From MarketWatch