After a Long Soft Patch, the U.S. Dollar is Rebounding

The effort's been underway for weeks now. But, it finally got some meaningful traction this week. The U.S. dollar - as measured by the U.S. Dollar Index - is rallying firmly now, with (almost) nothing left to stand in the way. If it continues to rise, there's a ripple effect that works directly against commodities, and somewhat indirectly against most stocks.

Take a look. Thanks to Tuesday's and Wednesday's surge, the greenback has cleared what appeared to be technical resistance around 93.4. It's pausing today around 94.5, near where it peaked a couple of times in October. But, that's the only plausible resistance left. Bolstering the dollar's bullish case is the fact that we're looking back at a string of higher lows and higher highs, and we're also seeing all the key moving average lines sloped upward now. That latter detail is a nuanced indication that the bigger trend is already bullish.

Here's the weekly version of the same chart, which shows us a couple of other interesting details. One of them is the possibility that we just saw something along the lines of a reverse head-and-shoulders pattern finalized. It's not an ideal head-and-shoulders pattern (they never are!), but the three-pronged movement is the important part of the pattern.

The other curiosity that becomes evident in the weekly timeframe is that this week's pause is a near-perfect 38.2% Fibonacci retracement of the rout from the dollar's early-2020 peak to its early-2021 low. Although Fibonacci lines may not necessarily align with technical support and resistance, they are key psychological inflection points. It's not surprising to see the U.S. Dollar Index's advance come to a halt right here. Although the advance could be readily rekindled, t his is exactly where one could expect the pushback to begin in earnest.

his is exactly where one could expect the pushback to begin in earnest.

Again, that's mostly a psychological matter, quantified using Fibonacci retracement lines.

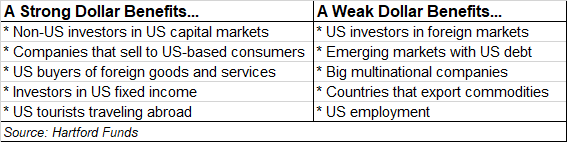

For the moment though, let's assume the greenback's current advance is going to renew itself. What's the impact? It's good news for consumers who've been paying a fortune for gasoline and food; it's also good news for companies that rely heavily on transportation and commodities to do business. These costs have been through the roof of late.

On the flipside, it works against energy companies. Think drillers and explorers. Their costs to extract gas and oil is somewhat fixed, so higher prices means their business is considerably more profitable when prices are high. The lower gas and oil prices get, the less profitable the energy business is. Ditto for gold mining.... another double-whammy in that gold prices themselves (regardless of mining profitability) fall when the dollar is increasing in value.

As for the impact a rising dollar has on stocks, that's a bit trickier. Broadly speaking a stronger dollar puts pressure on U.S. stock prices, though it's even more problematic -- theoretically -- for U.S. owners of foreign stocks. These correlations aren't particularly consistent though, and for good reasons. One of them is the fact that a strong dollar makes it more cost-effective for U.S. consumers and corporations to buy foreign goods. For this reason, don't read too much into the potential impact on any particular stock.

As for the impact a rising dollar has on stocks, that's a bit trickier. Broadly speaking a stronger dollar puts pressure on U.S. stock prices, though it's even more problematic -- theoretically -- for U.S. owners of foreign stocks. These correlations aren't particularly consistent though, and for good reasons. One of them is the fact that a strong dollar makes it more cost-effective for U.S. consumers and corporations to buy foreign goods. For this reason, don't read too much into the potential impact on any particular stock.

Indeed, it's entirely possible the U.S. Dollar Index's rally has already run out of gas. The only purpose in looking at the chart here, today, is to point out the possibility of what could happen from here. Things just changed, somewhat dramatically. Let's see where this goes.