The month of June generally isn't a great one for the market. The S&P 500, on average, loses about a tenth of a percent in the month ahead, and loses ground almost as often as it logs a gain. (meaning the average loss is just a bit bigger than the average gain when there is a gain in June). The market action heading into 2018's June doesn't bode particularly well either. We're more or less on the typical bearish path.

That's not to suggest every stock will finish the month underwater, however. As always, a handful of names will manage to log a gain. The trick is just finding them.

And how might one do that? The best means of finding that rare summertime winner is identifying the sector or industry best-positioned for a bullish move in the coming month... or months. It's estimated that 40% of an individual stock's movement is attributable to its sector group's movement alone. So, if you pick the right sector, the battle is almost half-won.

To that end, here's a look at the market's most promising - bullish - groups heading out of May and heading into June. These groupings are either looking bullish this month, are usually bullish in June, or both. In no particular order....

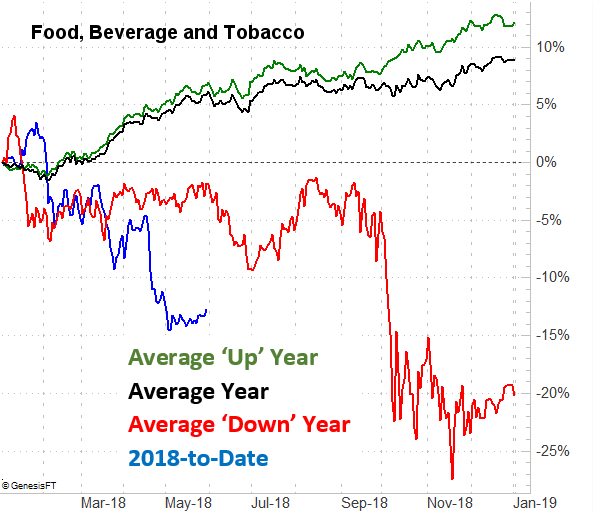

Food, Beverage and Tobacco

Most of the time, the consumer staples piece of the market - the things you'd buy in a grocery store or in a convenience store in particular - don't do terribly well in June. But this year, these stocks have been so overwhelmingly bad performers, the group is actually testing the waters of a rebound effort. There's certainly plenty of room to recover.

By the way, it's not like one segment of this industry is solely responsible for its weakness. Brewers, vintners, soft drinks and packaged food players have all been given some stunningly rough treatment.

Healthcare Equipment and Services

When things are bad for the healthcare equipment and services industry, then they're usually very, VERY bad. Fortunately, they're generally good during the summer. The average 1.0% gain these names usually log in June isn't earth-shattering, but it's part of a long and steady uptrend that should last into July (and then rekindle in September, and then again in October). This year's performance to date appears to be on the usual modestly-bullish path.

Healthcare technology stocks are your better bets this go-around within the group, and the companies that service healthcare deliverers (yet not the deliverers of car themselves).

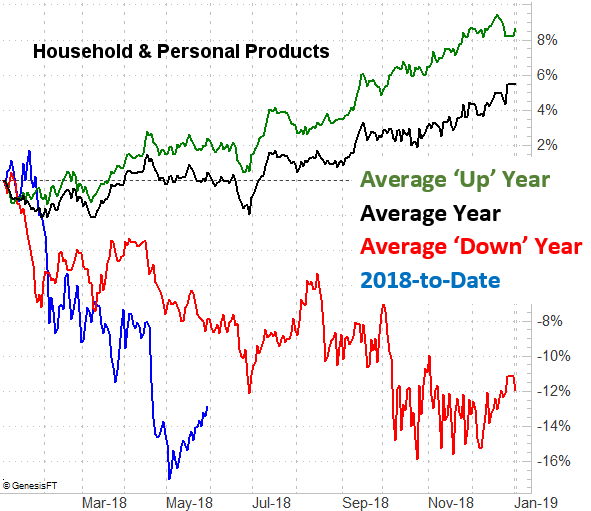

Household & Personal Products

It's slightly different than the 'Food, Beverage and Tobacco' group, which is also facing near-term bullishness here, though it's not surprising to see both groupings capable of bullishness headed into the slow time of year for stocks. That said - and as the chart below shows - the bullishness from the household and personal products segment doesn't actually kick in until early July. It's worth noting now, however, so (1) you can prepare for any entries on a strong dip, and (2) these names have been such bad performers so far this year, they may already be in rebound mode.

It's the 'household' side of this table that have been the pitiful performers. The 'personal' names have been market-average.

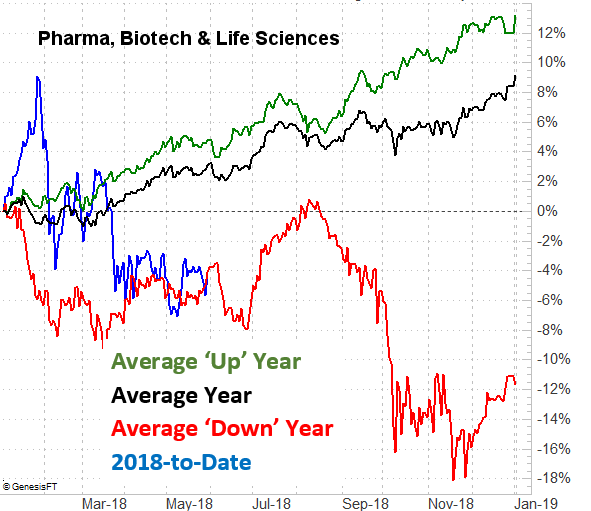

Pharma, Biotech & Life Sciences

The drugmakers have been disappointments this year, which us uncharacteristic of them for this point. But, we're heading into a two-month stretch that - even in a bearish year - tends to be amazingly bullish. In fact, the worse the start to the year, the more bullish the July/August move is.

Do note that in bearish years, the bullishness doesn't emerge until very late in the month. Given how the gains start to rack up early in June in the typical year though, it wouldn't necessarily be wrong to start wading in now... if you anticipate a rekindling of these names.

All of these names have been laggards year-to-date, by the way, so all of them have equal opportunities to dish out big recovery gains.