Yes, stocks managed to eke out a small gain on Monday, and the S&P 500 even logged a new record high; the NASDAQ Composite came close. If the move's got you bullishly motivated though, take a step back and rethink things. Not all is as it seems on the surface. Monday's gains are not nearly as well-supported or as robust as they're being made out to be.

In simplest terms, a small number of the market's very biggest stocks did all of the broad market's heavy lifting. This group includes all of the FANG stocks and a handful of close cousins - technology, mostly. Their strength alone, however, is not enough.

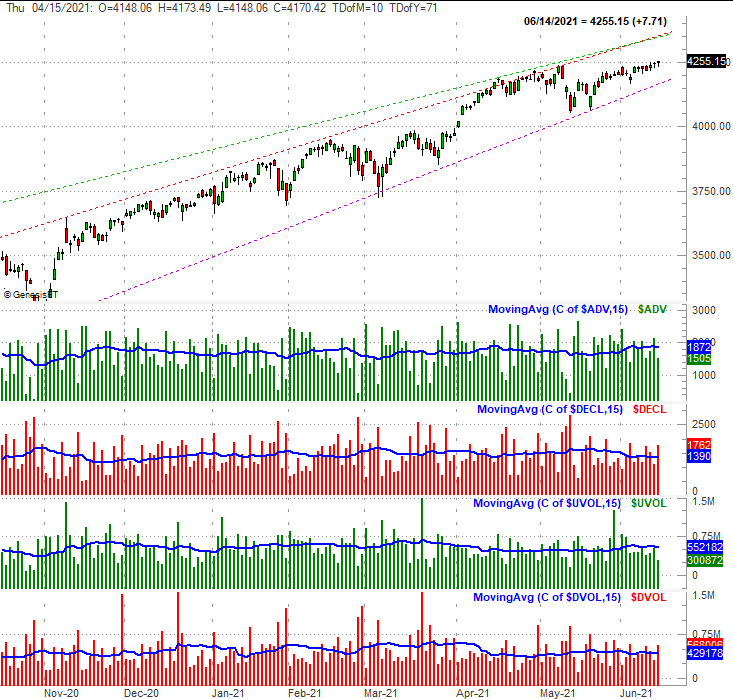

Here's a visual explanation of the crux of the problem... comparison of the S&P 500's daily chart to the NYSE's daily advancers and decliners ($ADV and $DECL), and a comparison to the NYSE's daily up and down volume ($UVOL and $DVOL); the blue lines are the moving average lines for each data set that help us spot new trends. Decliners and bearish volume greatly outweighed advancers and bullish volume on Monday despite the slight gain.

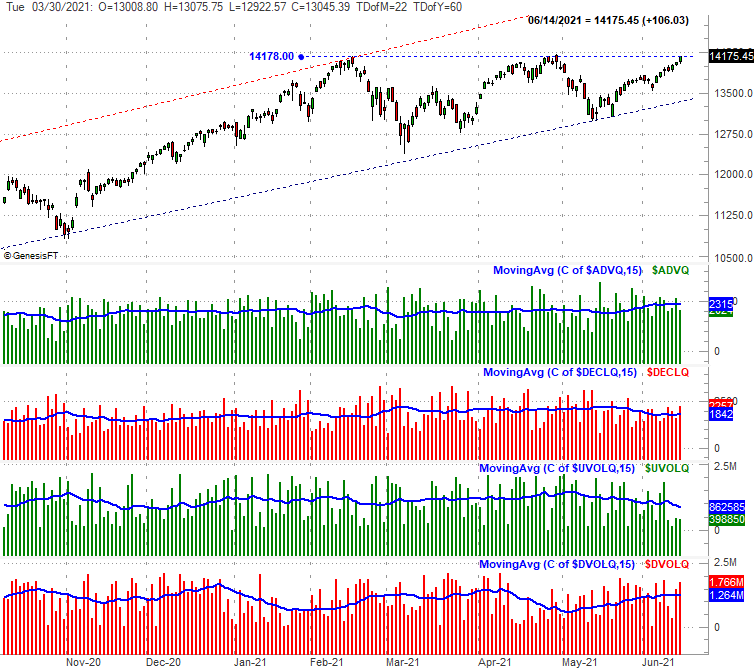

The same idea is evident with the NASDAQ Composite and NASDAQ-listed stocks, though the disparity is even greater here. The NASDAQ saw 2024 issues end Monday with a gain, while 2257 of its stocks lost ground. Its gainers only logged total volume of 398.8 million shares, while losers accounted for 1.76 million shares' worth of the NASDAQ's volume on Monday.

By the way, notice how the NASDAQ Composite tested its recent technical ceiling at 14,178, but didn't push past it. The buyers' hesitation is at least a minor red flag.

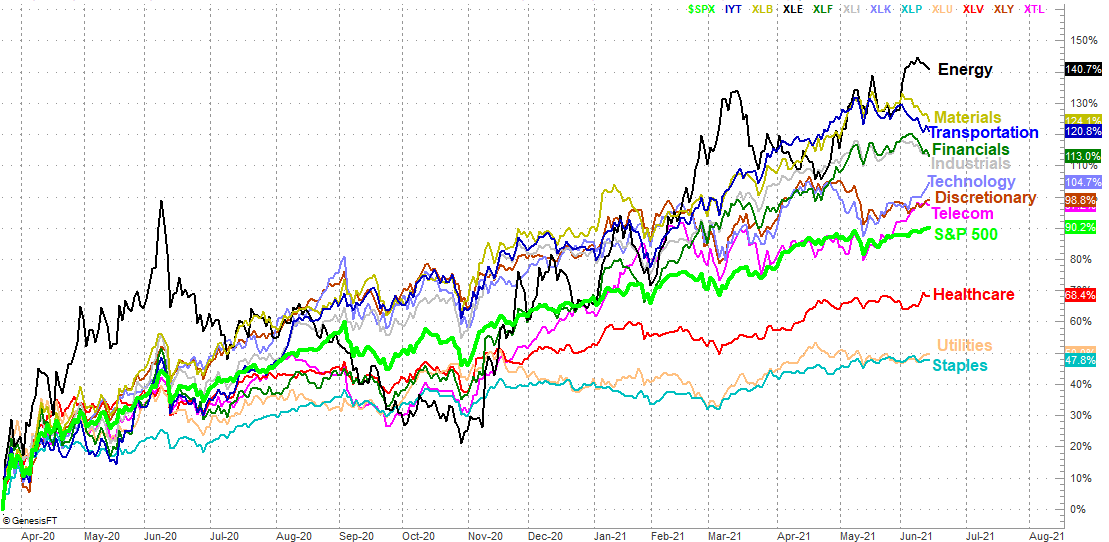

And these aren't the only red flags waving with this latest step in the rally. As was noted, Monday's advance was almost entirely limited to technology stocks. In fact, this has been a quiet, budding disparity among sector performances for a few days now (with the one winner aside from tech being telecom).

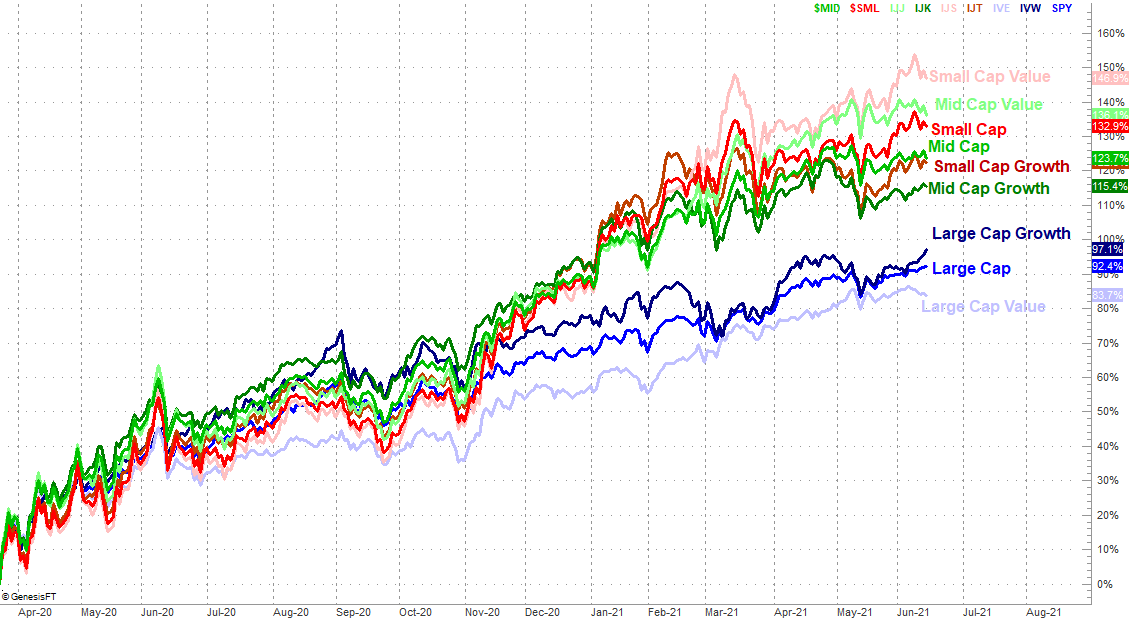

It's also exclusively a large cap thing... and large cap growth in particular. Large cap growth stocks are of course the category most of the FANG names and similar names... most of which are NASDAQ-listed stocks.

None of this is to suggest the rally's inner workings can't ease their way into a healthier balance that sets the stage for a more prolonged advance. From an odds-making perspective though, this isn't the sort of action you want to see. Well-grounded rallies are better balanced, and induce more and broader participation.

It's just something to think about from Tuesday on this week.