Here Comes the U.S. Dollar's Rebound. Then What?

After eight months of misery the U.S. Dollar Index - and the U.S. dollar it represents - are bouncing back. The recovery has implications for several different areas of the market, including stocks, but commodities in particular. As such, trader should take note.

But, first things first.

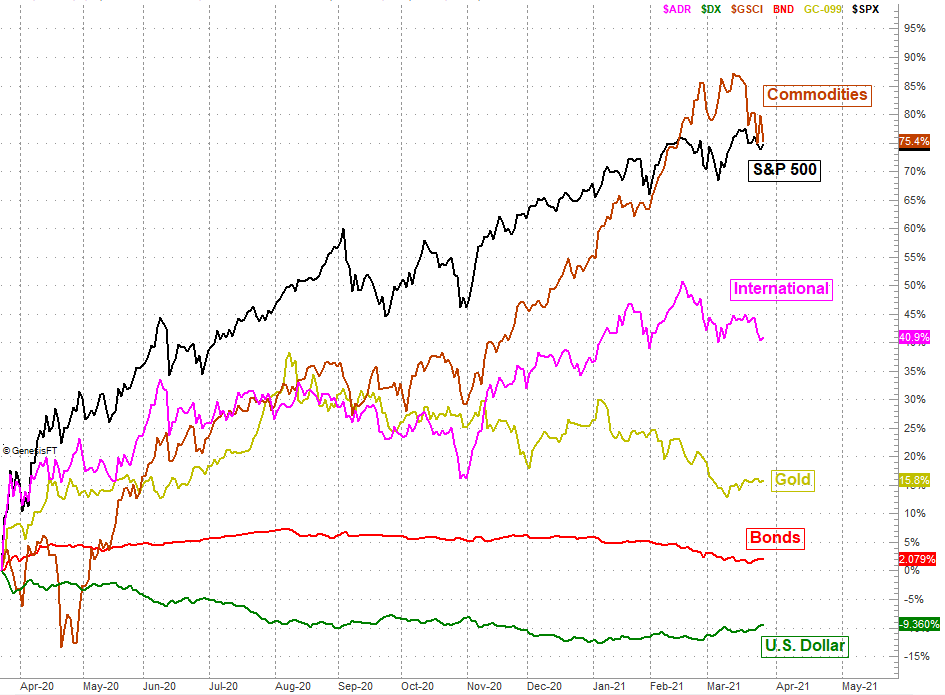

The chart below speaks volumes. It also requires something of an explanation. The wild volatility seen in February and March of last year is mostly the result of uncertainty linked to the coronavirus pandemic. The world was relatively certain central banks would do something to combat the ill effects of the contagion. People just weren't sure what those banks were going to do, or if it would be enough. There wasn't any possible clarity until April, when stimulus efforts started in earnest. The printing of cheap money devalued the dollar in a big way beginning in May of last year, and more and more of the same last year kept driving the U.S. Dollar Index downward.

Now things are changing. In fact, things changed in an enormous way as of Thursday with the U.S. Dollar Index, by virtue of its move above the 200-day moving average line (green) at 92.6. That's the first time this index has been above the long-term indicator line since May.

It's not just the move above the 200-day moving average line though. Also on Thursday the 50-day moving average line (red) crossed above the 100-day moving average line (gray) for the first time since June of last year; the 20-day moving average line (blue) moved above the 100-day moving average line for the first time since June of last year. These are all changes that point to a major shift in the direction of the greenback.

That's not to say the U.S. Dollar Index can only move higher from here. It's almost certain to feel at least a temporary pushback. Something is clearly different now than it was just a few weeks ago though.

As for how the dollar's newfound strength might impact different areas of the market, we're already seeing some of the expected ebb and flow.

We're definitely seeing the stronger dollar work against commodity prices, and though we're not seeing relatively new weakness in gold prices, it's arguable that gold prices already reflect a rebounding dollar given that they've fallen steadily since peaking in August; gold's surge before then was ultimately the result of some defensive speculation. While other commodities are still clearly vulnerable, gold may not have much more downside left to give.

The budding dollar rebound is also influencing other pieces of the market, albeit indirectly. Namely, international stocks are starting to fall out of their rally, and bonds are hinting at recovery as well. Just bear in mind that bond prices are mostly driven by bond yields, and right now there's upward pressure on interest rates that are necessarily correlated to the U.S. dollar's value.

U.S. stocks - as evidenced by the S&P 500 - are not facing the same headwind that international stocks are. This is most possibly because these stocks are priced in U.S. dollars anyway and don't necessarily reflect changes in foreign exchange rates. (That doesn't mean, however, that U.S. stocks aren't vulnerable here. They're just vulnerable to other things for a different reason. Namely, they're technically overbought.)

Nothing is ever etched in stone, of course, and right now is no exception to this reality. There's also always a chance the U.S. Dollar Index could reverse course for no unforeseen reason. We have to take things at face value until it's clear we can't though. And right now, all signs point to a recovering greenback. We have to adapt accordingly.