April's Retail Sales Missed Estimates, But Were Still Up, Setting Stage for Rate Hike

Relative weakness in April isn't unusual, and last month's growth suggests the Q1 spending lull was temporary

-----------------

Last month, consumer spending was respectable, though not quite as hot as expected. On a month-to-month basis, retail spending grew 0.4%, falling short of the expected 0.6% increase. Perhaps more alarming than less, retail spending not factoring on auto sales was only up 0.3%, versus expectations for 0.6% growth.

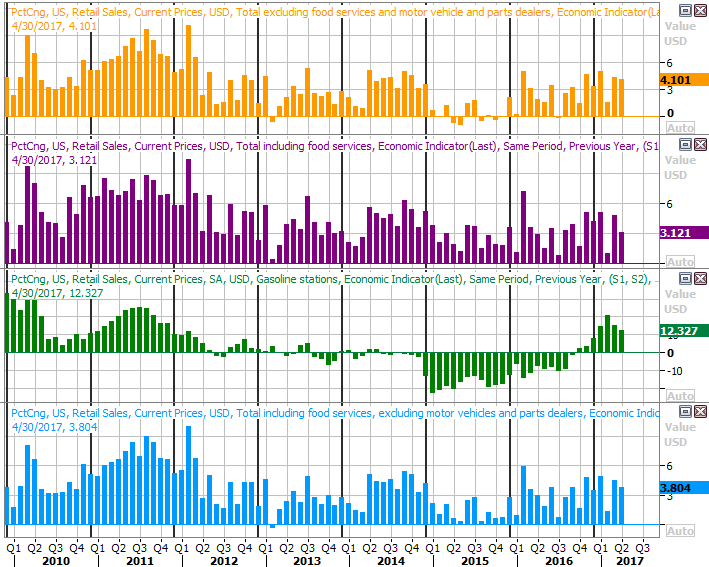

On a more important year-over-year basis, total retail consumption was up 3.1% overall, and up 3.8% when taking the automotive sector out of the equation. Those figures paint a slightly healthier picture, though as the image below illustrates, April's year-over-year growth wasn't as strong as March's.

Don't worry about it too much. April has been weaker than May in terms of retail spending growth for the past three years now. All things are relative, and it's worth noting that April-2017's year-over-year growth pace was stronger than April-2016's year-over-year growth pace. Nevertheless, we'd like to see the histogram bars on the chart above rising more than not.

The retail-growth malaise has taken a toll on retail stocks, with JC Penney (JCP), Macy's (M) and Nordstrom (JWN) shares all tanking on disappointing quarterly reports. Technically speaking though, April was a month of growth-progress, suggesting the first quarter's weakness that led to lousy Q1 results may have been a temporary phenomenon.

Or, perhaps Nordstrom, Macy's and JC Penney simply make a more defined point -- it's department stores rather than retailing at large that's the weak link. General merchandise stores saw a 0.5% decline in monthly sales, with department stores seeing a sales dip of 3.7% for the month. Other kinds of retailers saw modest sales growth in April.

Aside from the department store stock rout and April's retail sales growth shortfall, many observers still see last month's growth as a victory and cause to celebrate. Last month's consumer spending progress was also just enough keep the Federal Reserve on track for a rate-hike next month... the next scheduled chance Janet Yellen and her team will get to ratchet up rates. With annualized inflation rates rolling in at 2.2% (as of April) this week -- above the Fed's target of 2.0% -- the Fed has little reason to not go ahead and pull that trigger. Traders have priced in a 74% chance a 1/4 point rate increase on June 14th.