Sector Spotlight: 2 Industries Close to Explosive Bullishness

-- A narrow group of stocks could soon be soaring thanks to their peers' bullishness. --

If you're looking for some budding bullishness in this overbought environment, look to the food retailing and healthcare equipment industries. Neither are flying yet. But, both are close. One more nudge could do the trick, given their technical shape made since early 2020.

That's what the charts are hinting at anyway. While they're not stock-specific hints, in light of the fact that most stocks in the same sector or industry move as a herd, if you find a breakout on the verge of taking shape then the battle is half-won already.

Let's start with the food and consumer staples retailing stocks. They've been getting squeezed into a pretty-well-defined converging wedge -- framed by blue lines -- since the middle of last year. That said, the lower boundary of this wedge also arguably extends back to the early-2020 low.

The big feature here is the convergence, where the highs are getting low and the lows are getting higher. The index is running out of room to navigate its range. In fact, there's no room left for it to navigate. Also notice how all of the key moving average lines are not only also converged, but all of them are just moving sideways now. That's another testament to just how flatlined (on a net basis) these stocks have been since the middle of last year.

The idea here is, the convergence "spring loads" these stocks. The market, stocks, and sectors tend to alternate between periods of no movement and periods of major movement. There's been no major net movement in months, which means we're due now. If the food and staples retailing index manages to break above the upper boundary of its converging wedge pattern, there's nothing left to hold it back.

Costco (COST), Kroger (KR), and maybe Walmart (NYSE:WMT) are the most familiar names from this group with charts that are reflecting the spirit of the groupwide chart and clues here.

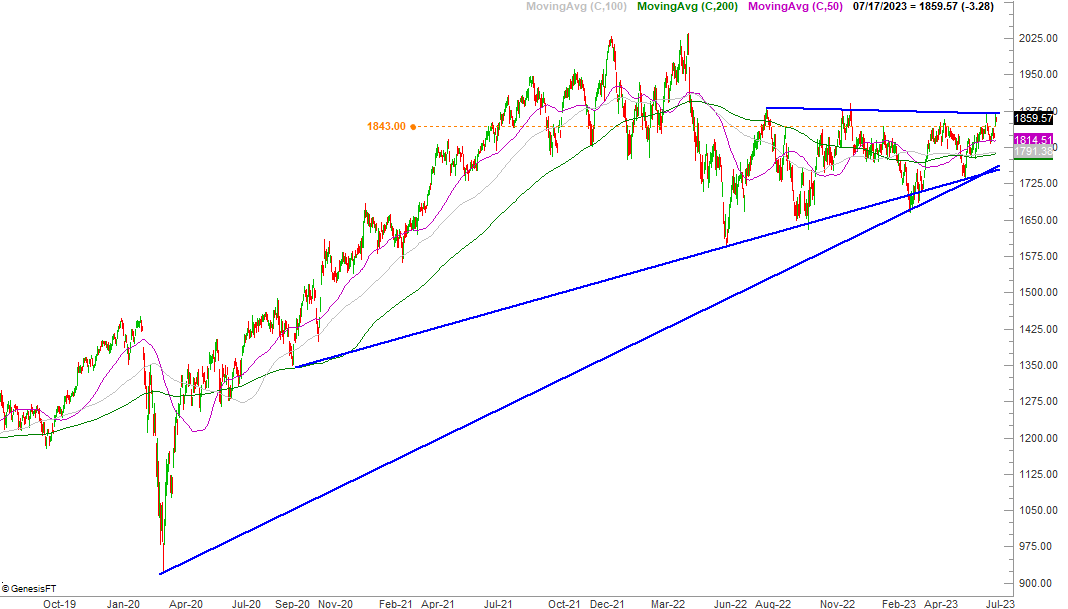

The other industry group to put on your radar here is the healthcare and equipment services index, for a similar (although not identical) reason. These tickers are being squeezed into the tip of a narrowing wedge as well. But, the group won't be forced out for several more weeks; see the blue lines on the chart below. Rather, these stocks are knocking on the door of a mostly-flat technical ceiling around 1843, and a shallow-falling ceiling that connects most of the major highs since August's peak. One or two more good days could get the group over the upper two of those humps. At that point there's no technical resistance left.

The fuel for the fire is the same here that it is for the food and staples retailing group. That is, the squeezing action is building up and explosive thrust outside of this confining trading range. It just needs the nudge. That being said, notice how the moving average lines are starting to arc upward. The index is even finding support at the 50-day moving average line (purple), pushing up and off of that floor last week. This kind of action bolsters the overall bullish case.

DexCom (DXCM) and Molina Healthcare (MOH) are a couple of tickers from this group that more or less look like they're following the group's lead. Even so, they're not identical. Just remember the stock's in an industry group tend to move with the group even if their charts don't quite line up with the groupwide index's chart shape.

Do you need help turning technical reads into actual option trades? Reading the chart is only half the battle. The other half is figuring out the optimal way of capitalizing on the opportunities you see. Deep in the money? Near-term expiries? Straight purchases of puts and calls, or maybe a spread makes more sense? Our Triple 3 Options Bootcamp and out Spread Trading Bootcamps can help you maximize your returns while minimizing your risk. Go here to learn more. Or, check out our Triple Crown Coaching sessions, which will help you develop and stick with an option trading plan that works.