Cisco (CSCO) Sells Off Sharply Following Earnings

Cisco's (CSCO) Post-Earnings Tumble Can't Be a Complete Surprise

Networking giant Cisco (CSCO) may have topped last quarter's earnings and revenue projections, as well as reported top and bottom line growth compared to year-ago levels. But, the outlook for the current quarter wasn't good enough, sending CSCO shares lower in after-hours trading Thursday and on Friday.

In the third quarter of 2015, Cisco earned 59 cents per share on revenue of $12.68 billion. Both compared favorably to the Q3-2014 figures of 54 cents per share and sales of $12.24 billion, respectively. And, perhaps more important, both topped estimates -- analysts were only collectively calling for earnings of 56 cents per share of CSCO and a top line of $12.65 billion.

The outlook for the fourth quarter, though, weighed heavily on investors' minds as much as it weighed heavily on the stock. The company has projected a profit of between 53 and 55 cents per share for Q4, versus a consensus estimate 56 cents. Also of concern was the fact that the company's bread-and-butter business, enterprise routers, saw revenue fall by 8% on a year-over-year basis.

CEO Chuck Robbins explained, "Our guidance reflects lower than expected order growth in Q1, driven largely by the uncertainty of the macro environment and currency impacts."

As has been the case with so many companies during third quarter's now-winding-down earnings season, a strong U.S. dollar worked against the company, and is expected to do so again in the fourth quarter. Indeed, the U.S. dollar index is up 2% since the end of September (a significant move by currency standards), and could move higher still if interest rates continue to rise and/or we see an official rate hike.

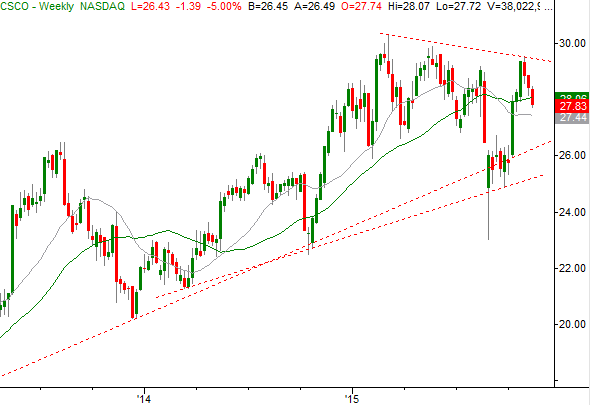

The pullback simply extended short-term weakness already seen from CSCO shares, which have been range-bound since early 2015. Conversely, there are not one but two established support levels in place that have the potential to rekindle the longer-term rally should the stock's weakness develop into more than just a temporary stumble.