Broad Market Expectations For July As We Reach Mid-Year

The Calendar Presents a Market Conundrum

With June winding down -- and ending another quarter as well as a half-year with it -- the market has the benefit of at least a partially cleaner slate. Clouding the outlook this time around is the fallout from Brexit, which was initially treated as a problem, but in the meantime the market has regained almost all the value it lost following the "leave" vote. Is it possible it's no longer relevant? Nothing can be ruled out.

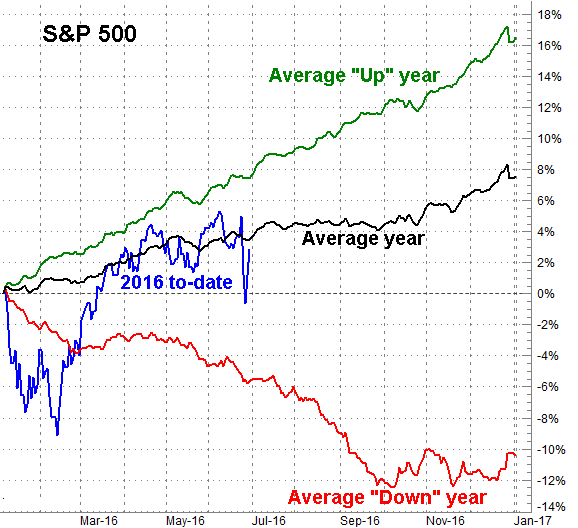

Be that as it may, this year to-date is actually a pretty typical one in terms of how quickly the S&P 500 (SPX) (SPY) is making forward progress. That is, the index is up 3.7% year-to-date, and normally it would be up 3.8% by the middle of the year.

Assuming this year's progress will continue to mirror the average, that presents something of a conundrum for stocks. While the S&P 500 index is overbought as well as arguably overvalued at this time, July is usually a bullish month for stocks. On average, the S&P 500 advances just under a full percentage point in July.

What does that mean for this year? Good question. The broad consensus is that a market that's already pushing its valuation limits at the same time most are terrified the Brexit impact will throw a cog in the globe's economic engine. And yet, the market has already wiped away the bulk of the initial pullback. At the very least, traders would be wise to acknowledge the possibility this July is going to be like most of them. That is, slightly bullish.

From that perspective, another look at the daily chart of the S&P 500 opens up this door to the possibility that there may indeed be room for the index to keep moving higher, even if against the odds. The June high of 2120 is 1.1% above the S&P 500's current value. The upper 20-day Bollinger band at 2140, or 2.1% better than the S& 500's current value, though that band line will start to move lower of the pace of the market's gain slows (which is likely). Both are apt to become ceilings, as they have before.

There are never any guarantees when it comes to stocks. On the other hand, never say never. July may well end up surprising more than a few traders by doing the seemingly less likely thing.