5 New Year's Resolutions for Traders

It's probably pretty safe to say that there is no such thing as the perfect trader. Whether you have been option trading for a month or a decade, there likely are areas of your trading that you feel don't measure up to the competition. But that doesn't mean you should just give up. "Strong traders often have as many shortcomings as weak traders, but they focus on their strengths and work around their shortcomings," says Jamie Oschefski, director U.S. sales at Cyborg Trading.

With the New Year around the corner, many people begin to think of ways they can improve themselves in the coming year. To that end, we talked with some industry experts to get their thoughts on possible New Year's resolutions for traders. Here are five of their top answers.

1. I will understand what I am trading

By far the most common suggestion given by analysts was to educate yourself and know exactly what it is you are trading before you even consider putting on a position. Even within the same asset class, products can have dramatically different specifications . For example, wheat futures may have different contract specifications depending upon which exchange's wheat product you are trading. As new products continue to be created, taking the time to understand the product becomes all the more important.

Not only do you need to understand the contract specifications of what you are trading, but also why you are taking the trade in the first place. J.J. Kinahan, chief derivatives strategist at TD Ameritrade, says retail customers particularly often struggle with this aspect. "It's good advice, but unfortunately not always taken. Retail customers will go into the stock world and trade a stock because someone at a cocktail party talked about it," he says.

Instead, traders should take the time to understand the product they want to trade and the strategy they wish to employ. Travis Rodock, senior futures analyst at efutures, says this is all part of doing your homework. "Education and preparation are two of the most important aspects in trading. [Because] markets always are evolving, it is important for traders to educate themselves constantly about the tools and strategies that are out there to help them take full advantage of trading opportunities," he says.

2. I will have a plan before entering a trade

Finding a promising trade is only half the battle. Before putting on any sort of position, it's important to develop a plan for entering and exiting the trade. Having a plan in place before taking a position can help reduce the bad decisions you might make when a trade doesn't go your way. Without a plan in place, Kinahan says it can be tempting to think, "This time is different," but he warns, "The only thing that will be different is how much money you will lose."

For Rodock, defined entry and exit points are a must for any trade. "Before entering a trade, market participants should develop a short plan that includes not just the entry point, but also a protective stop-loss exit and a profit goal exit," he says. "Without predetermined exit points, it can be difficult to evaluate whether or not a trading opportunity presents an acceptable risk-to-return ratio."

The most successful traders are the ones that know how to handle losses, Oschefski says. "The difficulty is not finding trading patterns, it's executing them properly 100% of the time. Let your winners run and cut your losers short," he says. "A trader is much like a professional baseball player - you can be very successful if you are right one out of three times."

3. I will have defined loss limits

Losses are a fact of trading. Unfortunately, those losses can come in a string for any number of reasons. Maybe the market just has been going against you, or maybe it is time to reevaluate your trading strategy. In any case, knowing when to step away from the trading desk sometimes can be the best thing for your trading account. Having defined daily, weekly and monthly loss limits can help to keep you trading for another day.

Rodock echoes this and says defined loss limits can keep you trading when others have been pushed out of the markets. "While it is imperative to determine the amount [you are] willing to risk on any given trade, many traders neglect to set daily, weekly and monthly drawdown levels. These longer-term risk levels can serve as excellent indicators that it is time to stop trading and reevaluate your trading system and plan," he says.

This largely goes back to having a plan in place. By deciding before a situation presents itself what you are going to do, it can make it easier to do the right thing, even if you may not want to do it at the time. Remember, "this time is different" usually isn't.

4. I will diversify my trading portfolio

Almost everyone knows they should trade a variety of products to diversify their portfolio, but defining "diversify" seems to be tricky for some people. At its simplest, diversification means trading two or more uncorrelated products so that if one does poorly, the others typically will excel.

Kinahan illustrates this saying, "If I trade Exxon, then trading BP is not diversifying; if I trade 10-year notes, then trading five-year notes is not diversifying. It's really trading something that's in a different sector."

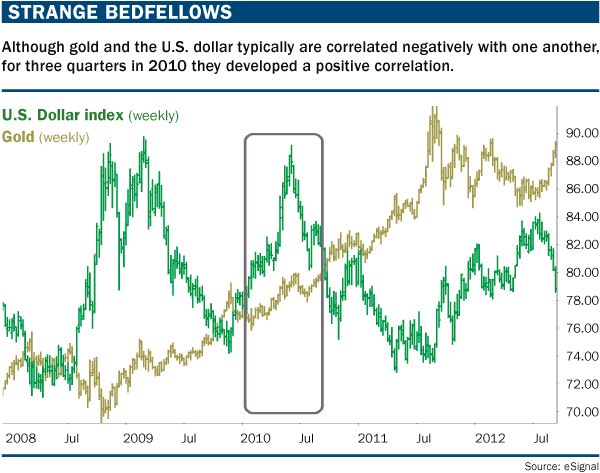

An important aspect of diversification to remember is that it is not something you can do one time for your portfolio and never worry about again. Events in the world affect markets differently, and there are times that correlations between markets can change. A number of examples of this can be found, and "Strange bedfellows" (below) shows one instance when Gold (GLD) and the U.S. Dollar (UUP), which normally are correlated negatively, developed a positive correlation in 2010.

Gold & Dollar Correlation Chart

5. I will start by paper-trading

No, it's not the same as trading real money, but paper-trading exists for a reason. Whether you are just beginning to trade or you are an industry veteran who wants to test a new strategy, paper-trading lets you work out any kinks in your system before laying any money on the line.

Additionally, if you just switched platforms, Kinahan suggests paper-trading first if for no other reason than to learn the mechanics of the new platform. He lists a number of questions you should resolve while paper-trading before making an actual trade: "How do I place the trade on this platform? What am I looking at when I place this trade?"

Of course, Kinahan is realistic about what paper-trading can teach you, as well. "If you have success in paper-trading it does not mean you will have success in real life - they're different because there's no emotional component in paper-trading," he says. Nonetheless, it serves a purpose.

Onward and Upward

Every trader has something he or she can work on to improve. We presented just five possible resolutions for you as we head into 2013, but if you feel you have a good grip on each of these, that doesn't mean there isn't another area in which you could use improvement. Whatever your option trading resolution, just don't be part of the 30% of people who make a New Year's resolution and break it within the first two weeks.

Courtesy of Michael J. McFarlin, http://www.futuresmag.com