4 Reasons to Utilize 'Long-Term' Intra-Day Charts

How to Trade Oil and Gold Prices This Coming Week

Courtesy of Chris Vermeulen, www.GoldAndOilGuy.com

The past couple weeks have been tough for most investors. The recent light volume rallies which have taken place in gold, oil and stocks has been generating mixed signals for technical analysts like myself. In order avoid a large draw down on your trading capital you must focus on the long term intraday charts.

What is a long term intraday chart you ask? It is simply a 4 or 8 hour candlestick or bar chart. For example the charts below in this report are 4 hour charts. So each candlestick represents 4 hours (or 240 minutes).

Why should you use these long term intraday charts instead of say a daily chart?

There are four main reasons for this:

1. If you used a daily chart then this information would be condensed showing you the daily high, low, open and closing prices. While the 4 hour futures chart shows you large multi intraday chart patterns that most traders would never see... Patterns not seen by the average investor have a higher probability of working in your favor. Also these patterns are much larger than just normal intraday patterns which you see on the 5, 10, or 60 minute charts. Remember the larger the pattern the more potential profit there will be.

2. These longer time frames allow us to follow gold, silver, oil and stock indexes around the clock 24/7 using futures contracts. Think about it... regular trading hours from 9:30am - 4pm ET only allows you to see 1/3rd of the price action each day. That means you are only seeing parts of larger patterns while the 24/7 contracts show you ALL Price Action.

3. The next reason you must use futures charts is for the volume readings. Futures show real volume levels which can be used for trading. So the volume you see on ETFs will not have the proper volume levels for that specific commodity or index. More times than not it almost the opposite...

4. My last reason for trading long term intraday futures charts is because the price of the underlying commodity or index moves true, while the ETFs which try to shadow these commodities generate false breakouts and breakdowns on a regular basis.

Let's take a look at the charts...

Gold Futures

Gold (GLD) finally broke down from the bearish rising wedge which it had been forming through late September until mid October. I know the majority of traders, investors, and financial newsletters have already positioned themselves either long or short the metal as they anticipate the next major move.

I will agree that a large move either up or down is just around the corner but what sets me apart from others is the fact that I don't bet my hard earned money when the odds are 50/50. I don't pick tops or bottoms; rather I wait for a clean break out or low risk entry point. Only then will I take action. Until the blue box on the chart has been broken with some type of retest I will continue to observe and analyze the chart of gold.

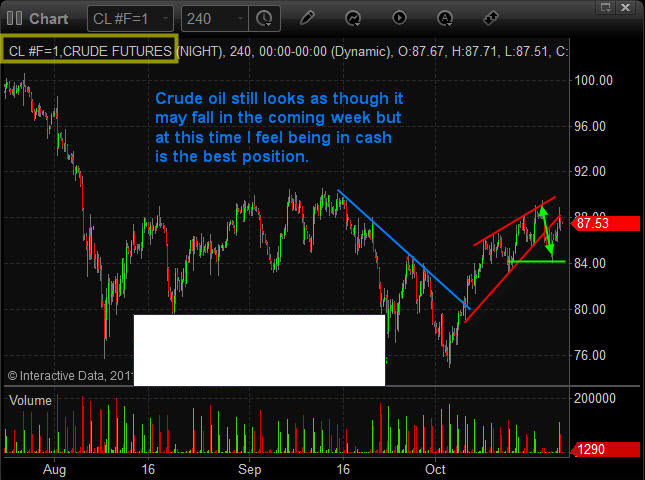

Crude Oil Futures

The past month crude oil trading has been very profitable for bearish Oil (USO) positions. Overall I am still bearish on oil but have moved to cash until I see another high probability setup unfolding. The recent price action in crude oil makes the odds about a 50/50 bet as to which way it will break next. This is why I have moved back to cash and closed down oil positions.

S&P 500 Index Exchange Traded Fund

This chart is not the S&P 500 (SPX) futures contract. This is just the SPY ETF but what I wanted to show was how the market was showing mixed signals. The past couple weeks price has been broadening and this can be taken two different ways...

More times than not it is seen as a bearish pattern and price generally falls afterwards. But in rare situations which I think we could be experiencing now this broadening price action can be very bullish, meaning much higher prices ahead. So I continue to observe and prepare for a possible trade setup.

Trend Conclusion:

In short, I feel the market is on the verge of a strong move. The problem is that price action, market sentiment and economic news are all giving mixed signals...

The best position right now is in cash and if something unfolds this week to our favor, then we will get involved but I am not going to take a 50/50 guess on what the next move is until the odds are in favor to one side or the other. From August until now the S&P 500 is down -3.7%, Gold is up 1.1%, Silver is down 20% and Oil is down -7.2.

Courtesy of Chris Vermeulen, www.GoldAndOilGuy.com