3 Things Wrong With This Rally (Not That it Matters)

Given the market is up nearly 15% since early November and is within easy reach of all-time highs, it would be easy to conclude all's right with the world; the media's bullish rhetoric is helping too. A closer look at ... well, everything though, suggests the only reason the market is going higher is because it's going higher. That is to say, no trader wants to be the first to get off the train, in fear that everybody else will keep on riding it higher. As such, most traders are simply ignoring clues that suggest a correction is due, a la 1999.

The sad/funny part? It works. The market can and does defy the odds and defy logic sometimes, entirely because nobody wants to admit the truth even though many participants are thinking it.

Thing is, the things that should matter but don't have a funny way of mattering all of a sudden. And in a case like this where the runup isn't a well-deserved one, once those things we're all ignoring start to matter, they matter in spades, in a hurry.

Here's a look at the three things that will prompt a huge number of "I told ya so" comments after the meltdown begins.... whenever that might be.

Stocks Are Overvalued

You can justify it with the "low interest rate" argument all you want [though that argument is weakening in the shadow of the Fed's plans to raise them this year], but eventually, valuations hit an absolute ceiling simply because interest rates hit an absolute floor. We're there. The S&P 500 is priced at 21.5 times its trailing earnings, and at 17.9 times its forward-looking earnings. Both are well above the norm, even for a low-rate environment.

Small Caps Are Lagging

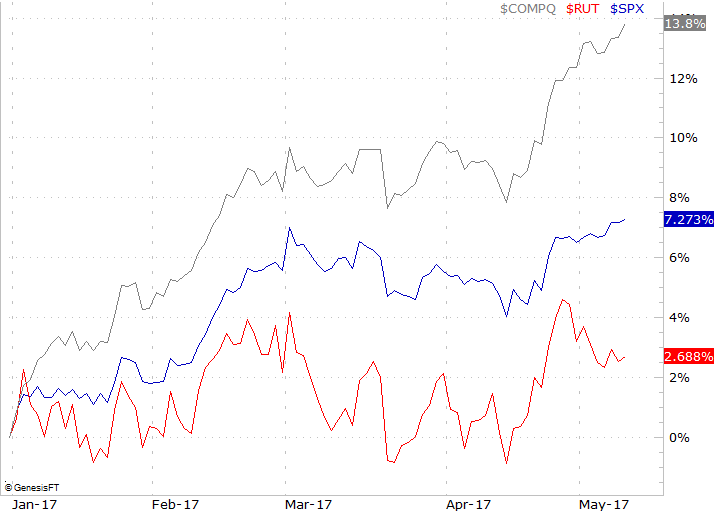

It's gone mostly unnoticed, but small cap stocks aren't participating in the marketwide bullishness we've seen since the beginning of 2017. The NASDAQ Composite, which is top-heavy with Alphabet, Amazon, and Apple, is up 13.8% year-to-date with the S&P 500 is up 7.3%. The Russell 2000 small cap index, however, is up a mere 2.7% for the year so far. It's a problem simply because if investors truly believe higher highs are ahead, they'll be thinking more speculatively with small companies that are better positioned for growth.

The Rally Itself Lack Participation

Not only are small caps strangely left out of the bullishness, the rally itself isn't drawing a lot of interest. It's just that the bears aren't bothering to put up a fight.

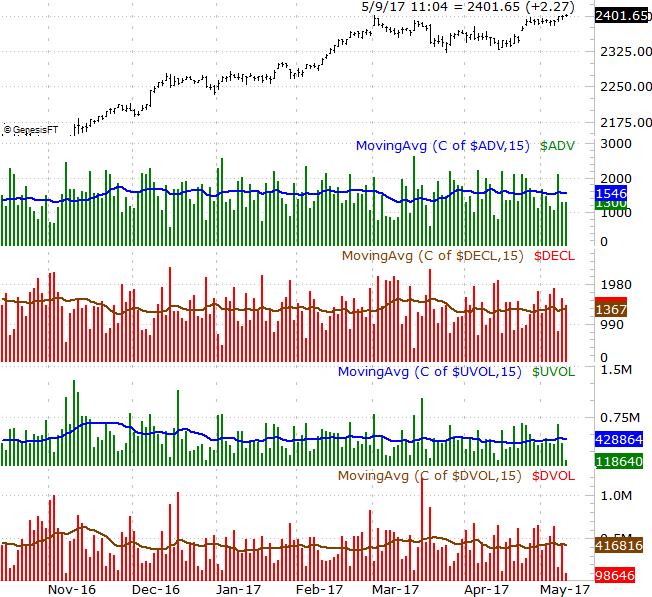

The chart below explains. The number of NYSE advancers as well as the NYSE's "up" volume has been lackluster for months now. Ditto for the NYSE's decliners and "down" volume. Generally speaking, the number of advancers and up volume tend to grow with the trend until its exhaustion. This time around though, most people really are staying on the sidelines despite missing out on the gains.

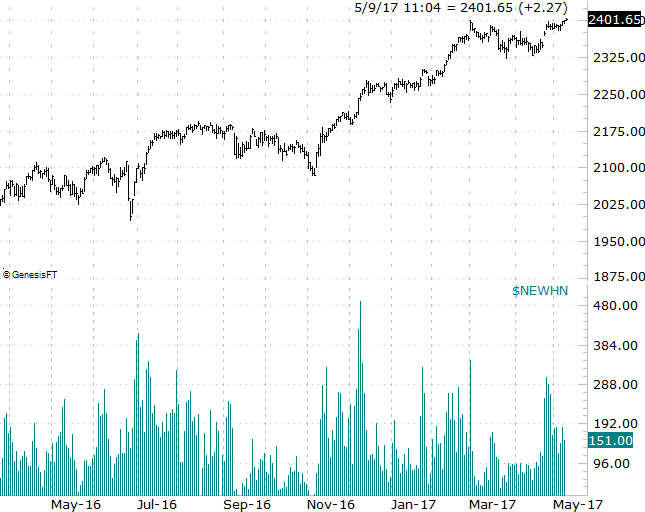

Along those same lines, though the S&P 500 hit record highs in early March, the number of stocks doing the same -- at least the NYSE's stocks -- didn't. The most recent peak in the NYSE's new highs actually came back on December 8th. The last two times the S&P 500 reached or almost reached (like this week) new all-time highs, the number of individual stocks doing the same failed to mirror the feat.

This is a sign that while a few of the market's biggest names may be doing well, most stocks aren't all the way aboard the train... something we could somewhat see in the comparison of the NASDAQ, the S&P 500 and the Russell 2000. It's a problem simply because the market's best-performing stocks can't carry all the weight forever.

But...

Trouble is, none of these things will matter until traders collectively decide they matter. Until that happens, the rally could continue on. As John Maynard Keynes so wisely said it, "The market can stay irrational longer than you can stay solvent." In other words, don't assume the market is ready to dish out a correction simply because it should. On the flipside, this certainly isn't a time to turn your back on the market. Once the tide turns, it could do so with little to no warning.