Contrarian Watch - As Earnings Season Begins, Analyst Expectations Are Low

Contrarian Watch - As Earnings Season Begins, Analyst Expectations Are Low

[BigTrends.com note: These measures from 2 different sources indicate that analyst earnings expectations have been ratcheted down considerably as we begin this earnings season.]

Largest Cuts to S&P 500 Estimates since 2009 due to Energy Sector

by John Butters

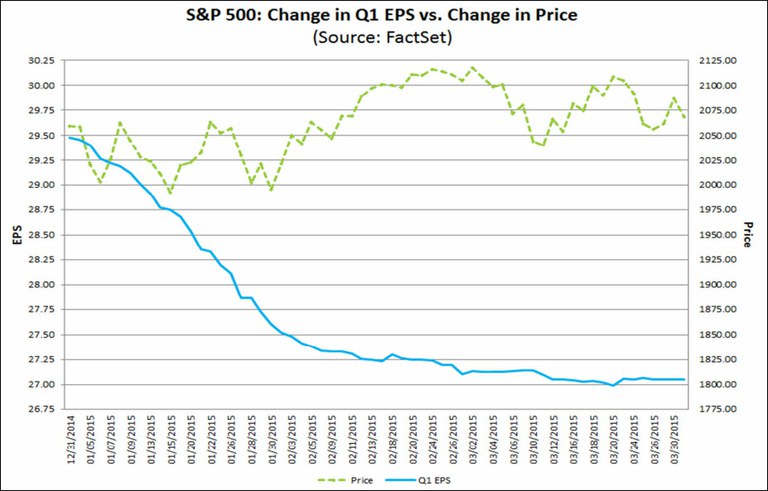

During the first quarter of 2015, analysts lowered earnings estimates for companies in the S&P 500 for the quarter. The Q1 bottom-up EPS estimate (which is an aggregation of the EPS estimates for all the companies in the index) dropped by 8.2% (to $27.05 from $29.48) during the quarter. How significant is an 8.2% decline in the bottom-up EPS estimate during a quarter? How does this decrease compare to recent quarters?

S&P 500 Change in Q1 EPS Estimates Chart

During the past year (four quarters), the average decline in the bottom-up EPS estimate during a quarter has been 4.3%. During the past five years (20 quarters), the average decline in the bottom-up EPS estimate during a quarter has been 3.0%. During the past 10 years, (40 quarters), the average decline in the bottom-up EPS estimate during a quarter has been 4.8%. Thus, the decline in the bottom-up EPS estimate recorded during the first quarter was higher than the one-year, five-year, and 10-year averages.

In fact, this marks the largest percentage decrease in the bottom-up EPS estimate for the S&P 500 for a quarter since Q1 2009 (-26.8%).

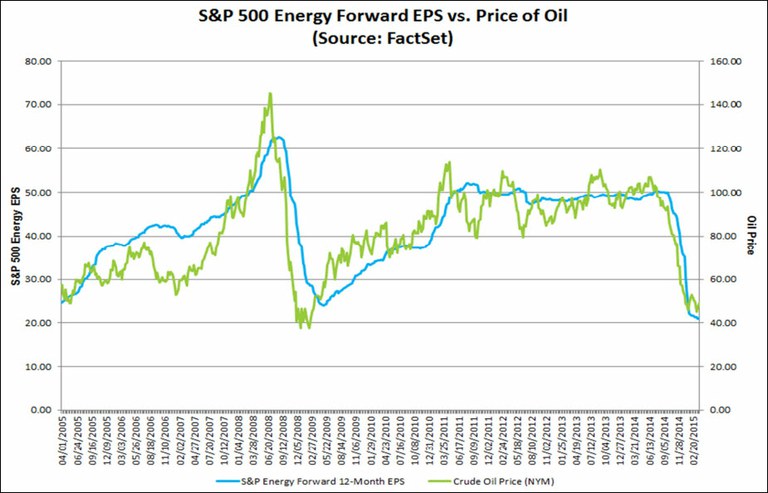

The Energy sector (XLE) alone accounts for nearly half (46%) of the decline in expected earnings for Q1 from December 31 through March 31. The Q1 bottom-up EPS estimate for this sector fell by 50.3% (to $4.16 from $8.38) during the first quarter, which was the largest percentage decline for all 10 sectors.

In fact, this quarter marks the largest percentage decrease in the bottom-up EPS estimate for the Energy sector to date for an entire quarter since FactSet began tracking the data in 2002. Prior to Q1 2015, the largest percentage decrease in the bottom-up EPS estimate for the Energy sector during a quarter was -42.0% (to $5.37 from $9.36) in Q2 2009.

Energy Forward EPS Estimates & Crude Oil Price Chart

Analyst Sentiment Heading into Earnings Season

Another earnings season has just kicked off with Alcoa (AA) releasing its Q1 earnings, and unless you have been living under a rock (or a snow bank) for the last several weeks, you have no doubt either heard of or experienced the slowdown in economic activity during the first quarter. Due to a variety of factors including weather, lower energy prices, the stronger dollar, West Coast port closures, etc., companies have been cautious in their outlooks and that has led analysts to continue cutting already reduced earnings forecasts. As of last Friday, analysts had lowered forecasts for 392 more companies in the S&P 1500 over the last month than they had raised forecasts for over that same period. On a net basis, this difference works out to 26.1% of the stocks in the entire index. The chart below shows how this reading has changed over the last year, and the current reading is not far from its lowest levels. The only other period in the last year where we saw even more negative sentiment was in early February.

S&P 1500 Earnings Estimate Revisions Chart

Courtesy of BespokeInvest and FactSet