Operating Profit Margin Peak Is Concern For Broad Market

Operating Profit Margin Peak Is Concern For Broad Market

Profit-Margin Peak Points to U.S. Stock Shift

by David Wilson

Profitability at U.S. companies may have reached its peak for the current economic expansion, according to Sean Darby, Jefferies Group Inc.'s chief global equity strategist.

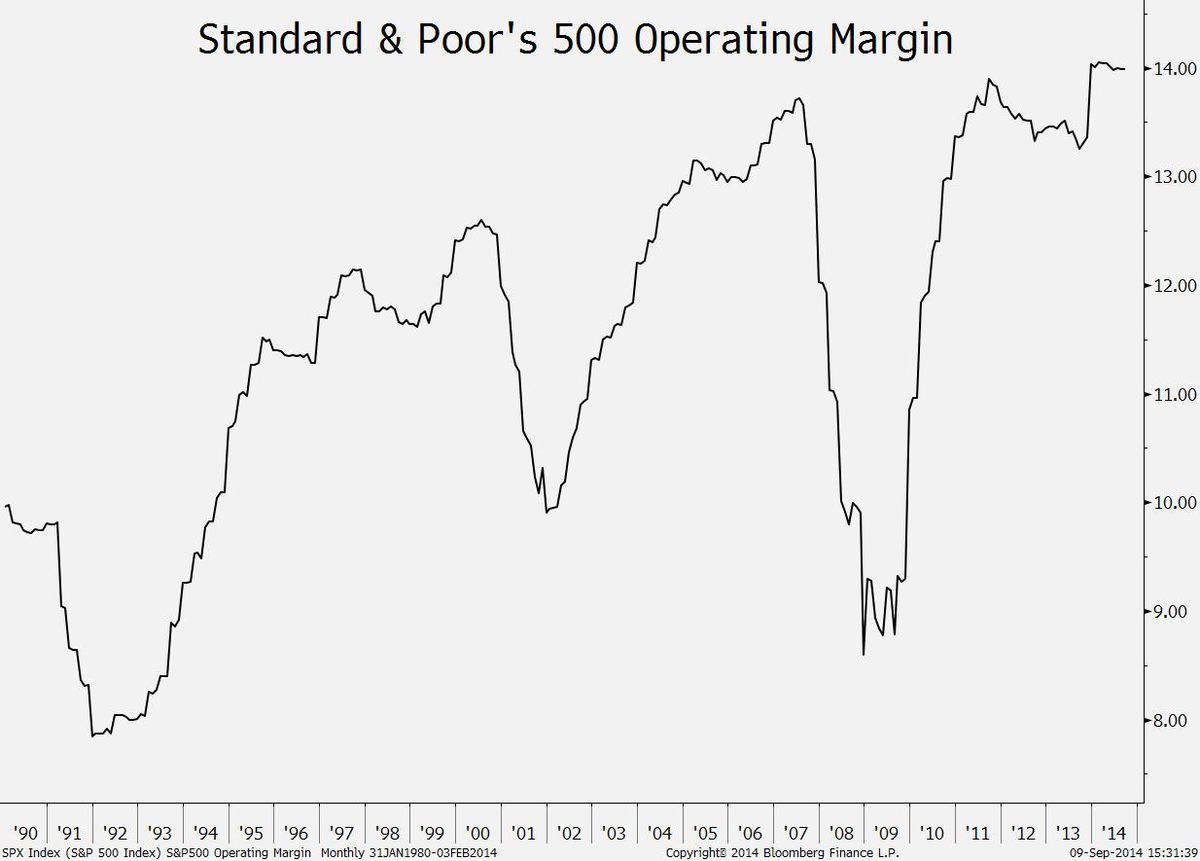

As the CHART OF THE DAY shows, operating profit for companies in the Standard & Poor's 500 Index (SPX) (SPY) held steady this year at about 14 percent of revenue, according to data compiled by Bloomberg.

At the same time, margins fell for U.S. companies more broadly, according to data compiled by the Commerce Department. In the first quarter, profit dropped below 12 percent of gross domestic product for the first time in 2 1/2 years. The margin last quarter was 12.1 percent.

"Stock valuations that have relied on margin expansion" will become harder to justify, especially as companies spend more for wages and salaries, Darby wrote in a Sept. 2 report. Civilian wage growth accelerated to 1.8 percent in the second quarter from 1.6 percent in the first, according to data from the Labor Department.

The S&P 500's operating margin fell as low as 8.6 percent in the most recent recession, which ended in June 2009. Since then, the earnings gauge expanded in every year except 2012, when it slipped 0.3 percentage point to 13.4 percent.

Corporate cash flow is poised to fall along with margins, Darby wrote. The Hong Kong-based strategist recommended that investors favor the shares of larger companies in the best position to expand, especially through takeovers.

Courtesy of bloomberg.com