5 Stocks That May Be Raising Dividends Soon

Look to buy these stocks before they raise their dividends

With earnings season currently in full swing, investors have turned most of their attention to quarterly reports, and crunching profit and revenue numbers. Earnings are certainly important to track, but as an avid dividend investor, I believe it is just as important to stay on top of dividend announcements, and in particular those stocks which will soon announce dividend increases.

There are two reasons why I like to search for companies that are close to announcing dividend increases. The first is that any time a company raises its dividend, it is a sign of management's faith in the underlying business. If a company's management was not confident that the company could afford the dividend, it would not vote to authorize the higher dividend payment.

A second reason I like to determine which companies are about to raise their dividends is because if you play the stock ahead of the announced dividend increase, you may get a little extra boost following the news. There is a lag between when a company announces a dividend and the date and when the stock trades ex-dividend, which is the date that determines those shareholders entitled to receive the dividend.

Many times, once investors learn of a dividend increase, they will add to their current positions, or set up new positions in order to take advantage of the higher dividend payment. If you can get into the stock ahead of the pack, you can sometimes get a little boost from the increased buying interest that follows a dividend increase.

The following five stocks are all likely to announce a dividend increase soon in my analysis:

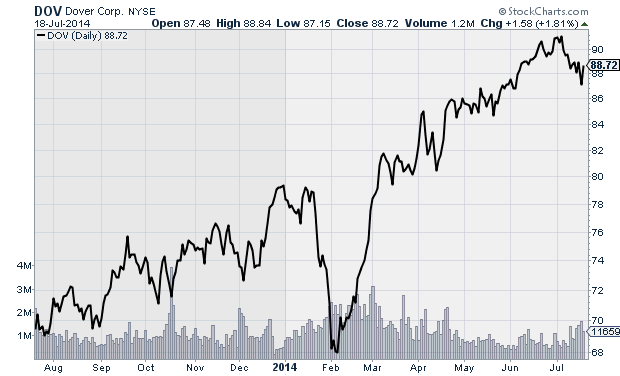

Dover Corp.

Diversified machinery maker Dover Corp. (DOV) currently has a 1.7% dividend yield, with a quarterly payment of $0.375. Considering that the company has increased its dividend 58 consecutive years, chances are very high that it will extend that streak this year. Historically the company has announced its dividend increases during the first week of August, so its next increase should be coming soon. The company currently has a 28.3% dividend payout ratio, so it can easily afford to increase its dividend. Last year it increased its dividend 7.1%, and in 2012 it boosted its quarterly payment by 11.1%. This year I expect to see Dover increase its dividend to $0.40 per share, which would translate to a 6.7% increase.

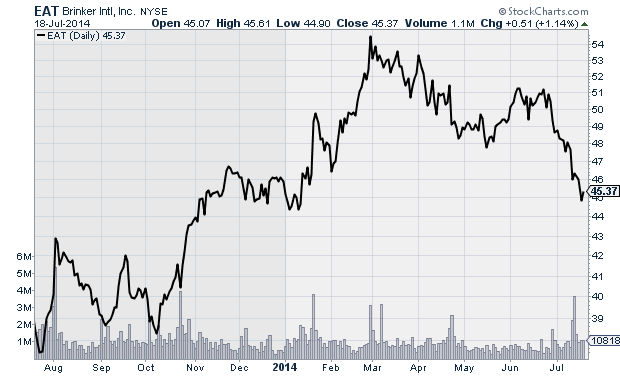

Brinker International

Restaurant operator Brinker International (EAT) does not have the most impressive streak of annual dividend increases, but I believe there is a good chance that the company is close to announcing another dividend increase, which would extend its streak to four years. The company's dividend payout ratio is just 34.8%, which means it can easily afford another increase. With the stock trending lower over the last four months, even a small dividend increase will have a notable effect on the stock's yield. The last couple of years the company has increased its dividend during the third week of August, so I expect news of a dividend increase to come in the next month. Recent increases have been impressive. Both of the last two years the company has increased its dividend by 20%, but this year I expect a slightly smaller increase. Look for the quarterly dividend to go from $0.24 to $0.28, which would mark a 16.7% increase.

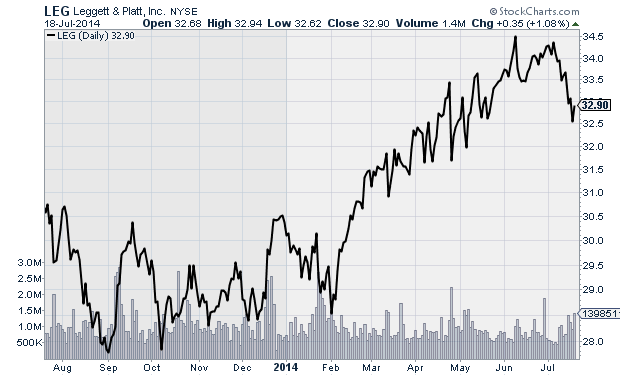

Leggett & Platt

Home furnishings and fixtures manufacturer Leggett & Platt (LEG) has increased its dividend for an impressive 42 consecutive years, a streak which I expect the company to extend when it announces its next dividend payment during the first part of August. While I believe the company will increase its dividend, I would not expect a huge increase since the company already has a dividend payout ratio of 69.0%. LEG currently pays a quarterly dividend of $0.30 per share, which is most likely going to rise to $0.31 for the next year. Over the last several years the company has increased the dividend by a penny, and that sounds about right this year as well considering how high the payout ratio is. Look for the announcement during the first half of August.

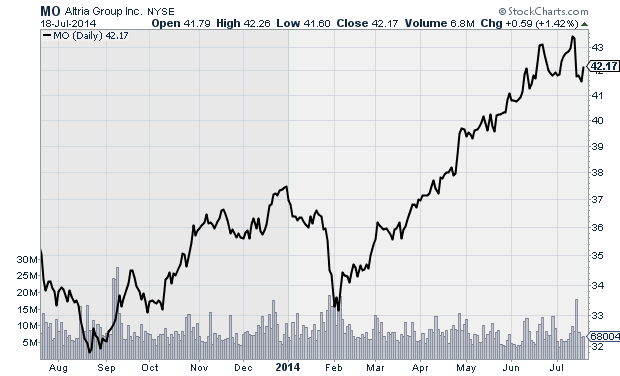

Altria Group

Tobacco heavyweight Altria Group (MO) has increased its dividend for 44 straight years, a streak which it will almost certainly extend when it announces its next dividend payment during the latter part of August. The tobacco industry is famous for its high dividend yields. Altria's dividend yield is currently an impressive 4.5%, with a quarterly dividend payment of $0.48 per share. One thing to be aware of is that the company's payout ratio is currently 74.7%, so Altria will not be able to make huge increases moving forward. Last year's increase was 9.1%, and in 2012 the company lifted its dividend 7.3%. This year I would look for something along those same lines, and expect Altria to increase the dividend to $0.52, equaling an 8.3% increase.

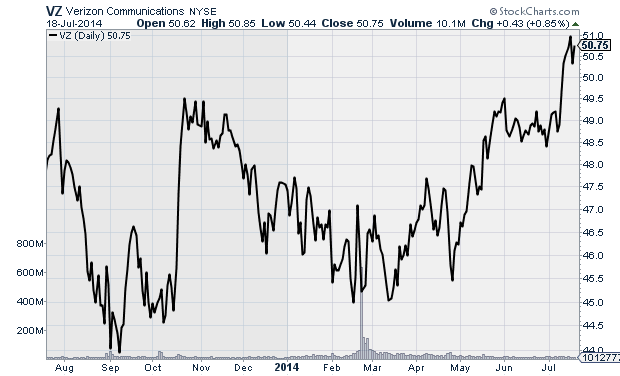

Verizon

Utility companies always tend to be high dividend payers, and Verizon (VZ) is no exception, with an annual yield of 4.2%. Verizon has a seven year streak of dividend increases, and with a payout ratio of 59.7%, it is highly likely that another increase will come this year. The increase is still a bit out in the future, but I would expect news of an increase to come during the first week of September. The last two years Verizon has increased its dividend by 2.9% and 3.0%, so investors should not expect a huge increase this year either. Currently the company pays a quarterly dividend of $0.53 per share, which I believe will rise to $0.545, for an increase of 2.8%. While the increase is likely to be small, considering the current dividend yield, Verizon is still one of the best paying dividend stocks for investors to consider.

Courtesy of MarketIntelligenceCenter