March Asset Class Performance & February's Leaders Are Lagging

March Asset Class Performance & February's Leaders Are Lagging

Key Asset Class Performance So Far This March

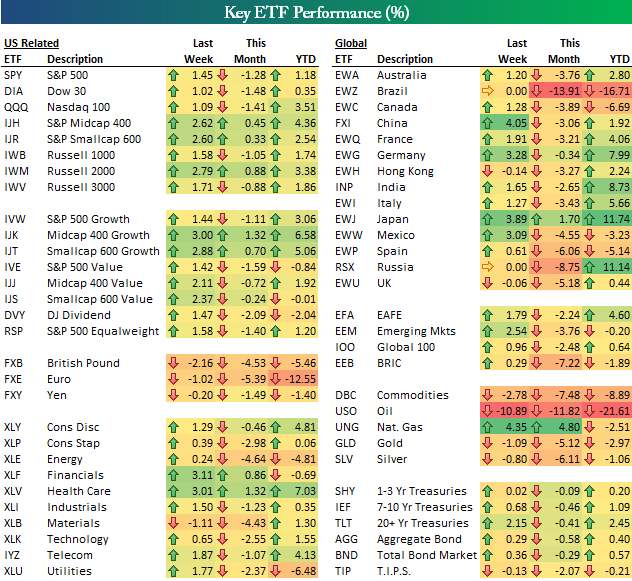

Below is a matrix highlighting the recent performance of various asset classes using ETFs traded on US exchanges. While stocks are up over the last week, they're mostly down on the month here in the US. The S&P 500 (SPX) (SPY), DJIA (INDU) (DIA) and Nasdaq 100 (NDX) (QQQ) ETFs are all down more than 1% this month, but notably, Smallcap and Midcap ETFs are slightly in the green. And while "Value" ETFs are down on the month, "Growth" ETFs are positive.

On a sector basis, 8 are down in March and 2 are up. Financials (XLF) and Health Care (XLV) are the two sectors in the green, while Energy (XLE) and Materials (XLB) have gotten hit the hardest.

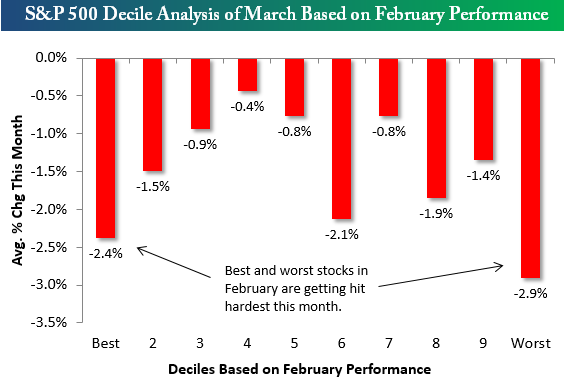

Below is an interesting trend we've seen in terms of performance within the S&P 500 this month. We broke the S&P 500 into deciles (10 groups of 50 stocks each) based on stock performance in February (when the market rallied sharply), and then we calculated the average performance of the stocks in each decile so far in March. As shown, the decile of the best performing stocks in February and the decile of the worst performing stocks in February have been the two worst performers in March. So the stocks that did the best in February and the worst in February are getting sold off the most this month, while the stocks in the middle of the pack have held up better. It's tough to ride a trend when you see this type of action in the market.

Courtesy of bespokeinvest.com