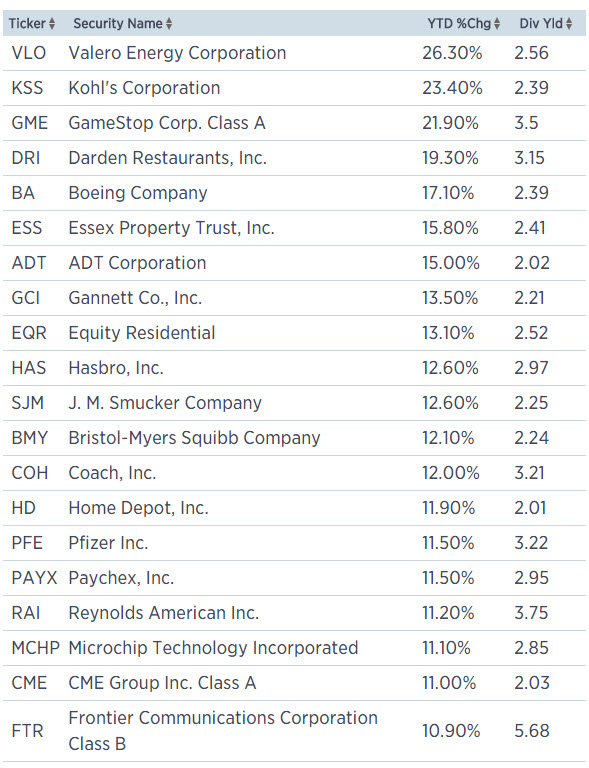

20 Hottest Dividend Stocks Of 2015 Thus Far

The hottest dividend stocks of 2015

by Dominic Chu

Investors often bail out of dividend stocks when interest rates rise, so it's worth noting that a number of dividend-paying stocks have weathered a sell off that hit some of the most popular plays.

The stock market has given investors a bit of a roller coaster ride so far in 2015, and after all the ups and downs, the major U.S. indices are just marginally positive. For those in some dividend names, the ride has been downhill. For instance, Utilities (XLU) are down 6 percent year-to-date and are the worst-performing major S&P sector.

Now that the Fed has opened the door for possible interest-rate increases later this year, these types of stocks could be poised for a longer period of lagging performance. High dividend-paying stocks, such as the utilities and real estate investment trusts (REITs), are often more sensitive to interest rate moves because the relative attractiveness of those yields diminishes as interest rates head higher.

CNBC screened the large-cap S&P 500 index to see where the hottest parts of the dividend stock market have been. First, only stocks that have the same dividend yield as the overall S&P 500 or greater were included. In this case, the threshold was 2 percent, the current overall dividend yield of the index.

The 500 stocks became 223 after this screen. Second, we took the remaining names and only screened for ones with flat or positive year-to-date price performance. The list of 223 then became only 111.

The purpose of the screen was to look for better-than-average dividend payers within the S&P 500, while attempting to screen out those stocks that may have their dividends cut in the future due to slumping share prices or capital positions.

Higher dividend yields can result from static dividend payments when a stock price is falling. The question in those situations is whether the company feels compelled to continue dividend payments at current levels, or cut them to help save needed cash. Looking for stocks that have at least generated some near-term positive price momentum could help mitigate some of that selection risk.

It was an Energy stock that made the top of the list, even though the sector (XLE) has been one of the worst performers over the last 12 months because of the collapse in oil prices. Shares of independent oil refiner Valero Energy (VLO) not only carry a respectable 2.6 percent dividend yield but have also managed to gain 26 percent since the end of 2014. Oil refiners have been outperforming the broader energy sector in recent trading.

Darden Restaurants (DRI) also made the list. The stock offers a 3.2 percent dividend yield and has managed to gain 19 percent year-to-date. The company, which owns brands such as Olive Garden and Longhorn Steakhouse restaurants, sold off its Red Lobster restaurant chain in May 2014. Since hitting a low of $43.56 on July 17, 2014, the stock has managed to rally around 60 percent.

Mega cap pharmaceutical stocks (XLV) (PPH) also made the list. Shares of Pfizer (PFE) currently yield 3.2 percent and have gained nearly 12 percent in that same time frame. Shares got a big boost in early February after it announced it would buy injectable drug maker Hospira for around $17 billion.

Those are just a few of the highlights. The top 20 stocks that emerged from the simple screen are listed below. As investors look toward dividend stock exposure, some are avoiding the route of picking the most beaten-down stocks with high yields, and instead are opting for a mix of those who still pay them to wait but have some positive price momentum behind them as well.

Courtesy of CNBC.com