Three reasons this market isn't moving

by Rob Isbitts

There sure has been a lot of talk lately about elections and other things not being on the "up and up." But two things that have not been on the up and up, nor on the down and down, are the stock and bond markets. U.S. Treasury rates have bounced around in a range all year, but the long-awaited return to normalcy in the bond market has yet to occur. As for the stock market, the S&P 500 SPX, -0.02% has endured waves of short-term declines in different sectors, but has been trapped in about a 4% range from top to bottom since July.

Depending on who you are as an investor, this behavior is either boring, calming, causes anxiety or gnaws at your short-term attention span on a weekly basis. So what are the key factors weighing on the markets, suppressing performance and producing a general feeling that something bigger will happen ... at some unknown point in the future? I think it can be boiled down to three factors, which nicely fit as an anagram into that ever-popular three-letter word, RIG.

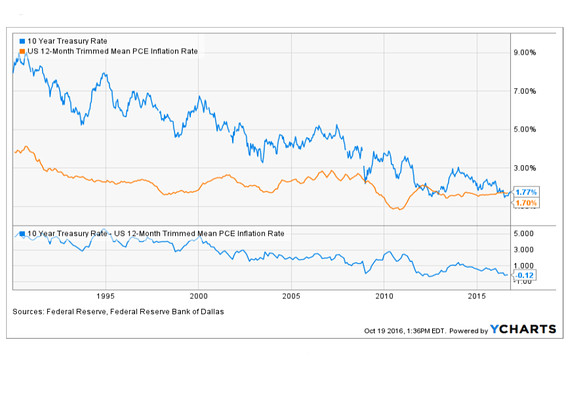

Rates (of interest on bonds)

We all know that interest rates paid by high-quality bonds have been falling for over two decades. But look at Figure 1 above and you will see that not only have they been dropping, their spread above the annualized rate of inflation has gone from 5% in 2000 to 3% in 2010 to under zero now. That means that while the cost of living is rising at a tepid rate, the amount that a retiree can earn on a conservative fixed-income investment has lost its premium. The "real" return of investing for 10 years in Treasurys (before taxes) is gone. Yet investors continue to pile into high-quality bond funds. That's not rigged, that's a strategy doomed to fail when rates finally do normalize (i.e., rise). There are alternatives to that type of thinking, and I have discussed this more specifically in many of my MarketWatch articles during 2016.

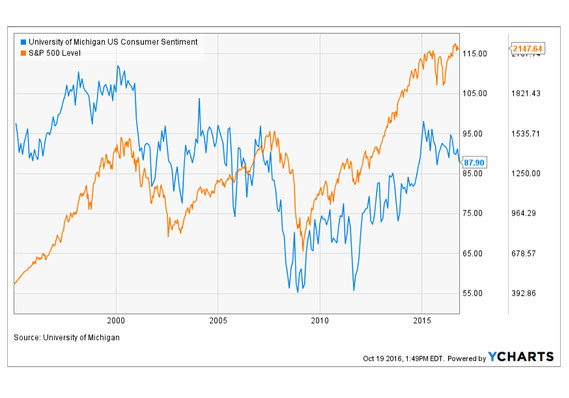

Investors (their sentiment toward the market)

In the year 2000 and again in 2007, the Michigan Consumer Sentiment indicator peaked just prior to the peak in the S&P 500 Index. From the looks of the right side of Figure 2 above, the Michigan indicator has peaked for this cycle. The stock market appeared to have peaked in April of 2015, but thanks to historic action by global central banks, the market came back like a zombie and made a new high this past July, by a marginal amount.

In addition, investor sentiment as expressed by the weekly American Association of Individual Investors (AAII) survey has shown a substantial number of investors as "neutral" rather than bullish or bearish. If consumers and investors are losing their enthusiasm and/or in a serious state of indecision, it calls for a different strategy than what worked during the long bull market I believe we are transitioning out of right now.

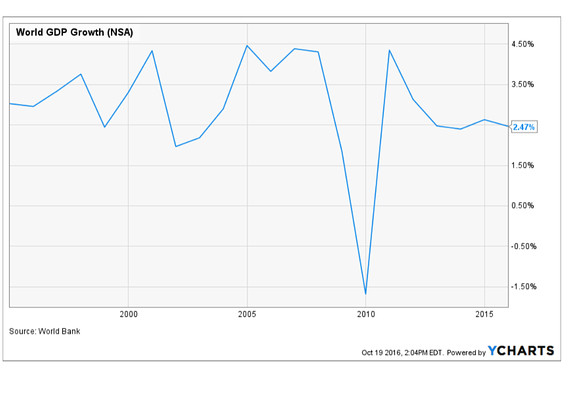

Growth (economic, stock market)

World GDP Growth (Figure 3 above) is toward the low end of the 2.5%-4.5% range it has been in for most of the last 20 years. While the globe has recovered from the depths of the financial crisis, its nothing to get too excited about. And investors are not getting excited, that's for sure.

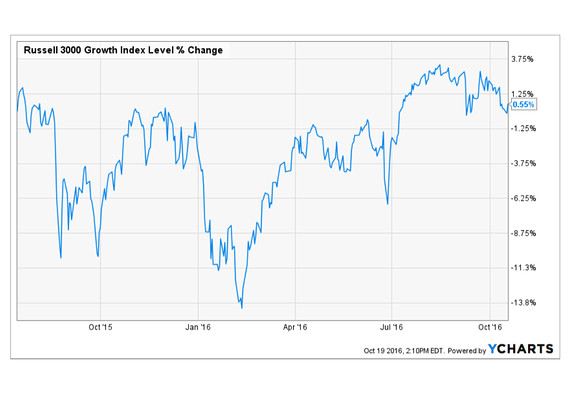

This last graph is perhaps the most important because it shows why it has been so tough for growth-minded investors to push their account balances forward since the summer of 2015. Around mid summer, the likely long, gradual transition to a stock bear market began. That's some hindsight, since bear markets don't typically jump in front of you and scream "I'm here!"

But look at the Russell 3000 Growth Index, a broad measure of "growth" stocks over the past 15 months ... no growth. Sure, high-yield stocks as a group have produced some returns, and S&P 500 Indexers are happy (for now) because that index has advanced somewhat over this time frame. But for investors who prioritize growth over income and capital preservation (presumably because they have longer investment time horizons for that money), it has been a muddy walk for well over a year.

What to do about the flattening of growth investing? Start by recognizing why that has been the case, and start plotting a path forward with the knowledge that traditional approaches to growth investing may need to be altered should the transition to a bear continue.

Bottom line? It's a “RIG” market, so to speak.

Courtesy of marketwatch.com