Here's why earnings won't matter much for the financials

The big banks are gearing up to report earnings — but the market moves may not come from the company reports.

"I know we're excited about this recent rally here, the recent outperformance of the financials, and part of that is because they are so hated," Stacey Gilbert, head of derivative strategy at Susquehanna, said Wednesday on CNBC's "Trading Nation."

The financials are the best performing S&P sector this month, up more than 1 percent. However, it's the second worst performing sector this year.

"If you look at it from the ETF perspective, you have almost $6 billion of outflows year to date; that's almost 28 percent of the AUM [assets under management] that has come out of financial-specific ETFs," Gilbert said, adding she sees an overall negative sentiment in the financial sector overall.

Gilbert is generally not seeing investors position around individual stocks, but rather around broader products, like ETFs including the regional bank KRE (KRE) and the XLF (XLF).

There's no doubt earnings matter, Gilbert said, but earnings reports are not what is driving investment into the bank stocks.

The Fed and the election are driving volatility in the financials, Gilbert said, and such turbulence could pick up before the end of the year.

Regional banks could be greatly affected should the Fed decides to raise interest rates this year, Gilbert said. And uncertainty over the election also looms, and if Democrats gain control of the House, financials could also suffer, she said.

In minutes released Wednesday from its last meeting, Fed officials said they anticipated raising interest rates "relatively soon," and delaying a hike any longer could cause a recession.

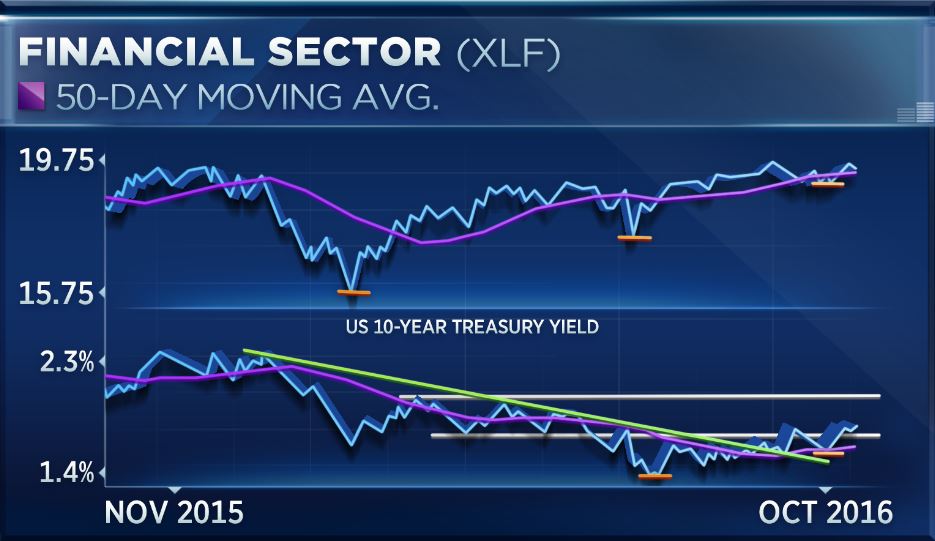

"If you take a look at the XLF, clearly there's a downtrend reversal that has occurred," Craig Johnson, senior technical research analyst at Piper Jaffray, said Wednesday on CNBC's "Trading Nation."

"When I break this down even further and look at large cap versus regionals, et cetera, it seems to me that it is more of the regional banks that are at interesting inflection points, and we are starting to see this playing out in the charts," Johnson said, noting the upward trend he sees in the chart.

Johnson said Piper Jaffray remains neutral on the financial sector with a positive bias, and he prefers sectors like energy and technology more.

JPMorgan, CitiBank and Wells Fargo report earnings on Friday. Wells Fargo shares surged after hours Wednesday following the resignation of Chairman and CEO John Stumpf in the midst of the bank's phony account scandal.

Bank of America, Goldman Sachs, Morgan Stanley and BNY Mellon report earnings next week.

Courtesy of cnbc.com