Tough sailing: The case against buying low-volatility ETFs

Chasing so-called low-volatility stocks have become a popular investment strategy lately. But the such stocks, coveted for richer dividends and steady returns relative to some other investments, may be at risk of becoming victims of their own success.

Over the past few years, skittish investors have been piling into anything that rings of safety. Government bonds and investment-grade corporate debt have been among some of the haven assets in high demand as concerns about global growth have flustered Wall Street.

In stocks, investors have been piling into low-volatility ETFs, driving their valuations so high that some market participants are now questioning whether they are worth investing. Such investments tend to be skewed toward companies such as utilities and consumer staples, but over time can rotate into other sectors.

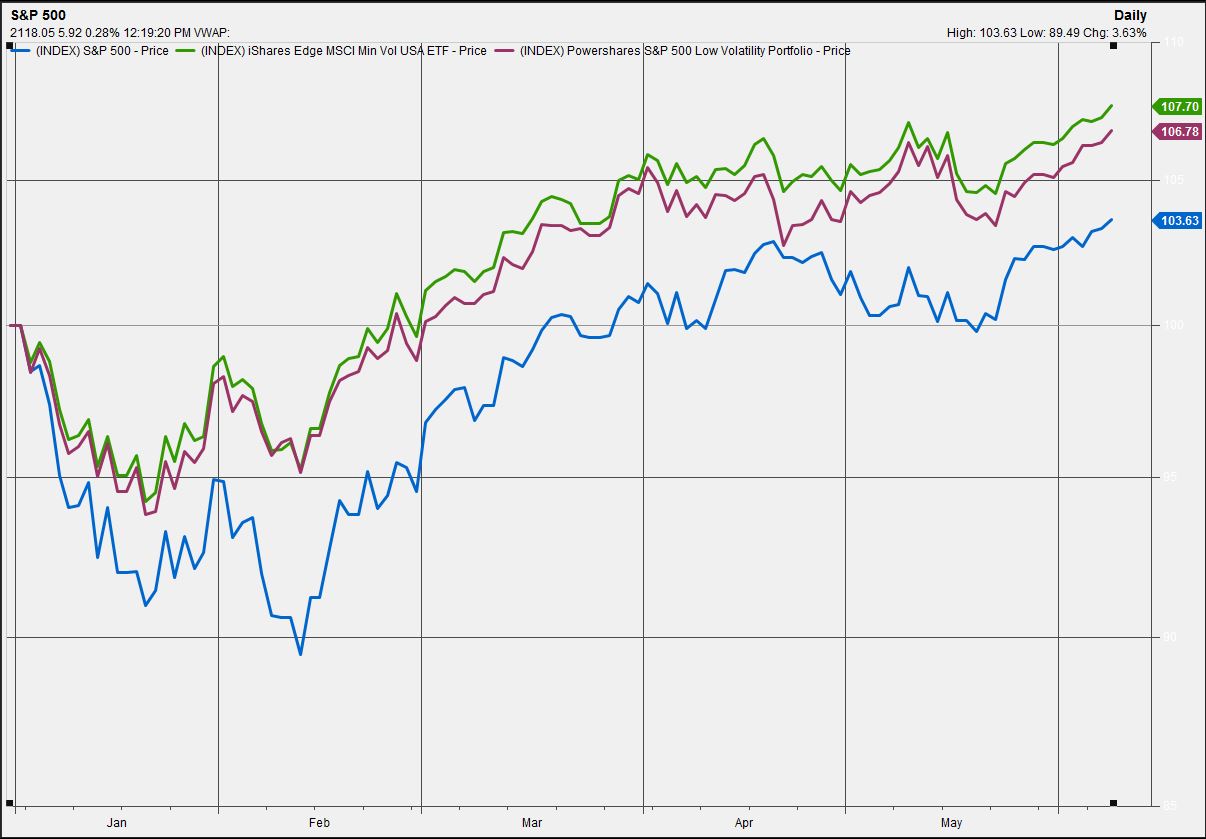

Low-volatility strategies tend to outperform over the long term and during volatile periods, such as severe declines in the value of benchmark indexes. But in years, such as 2013 when the S&P 500 advanced nearly 30%, low-volatility stocks underperformed the market.

“With each crisis beginning the financial crisis of 2007, investors have been seeking out low-volatility stocks, driving up their valuations to the point where now, the valuation premium is too high to invest,” said Chris Brightman, chief investment officer at Research Affiliates

Low-volatility stocks usually trade at a premium. That is investors are willing to pay more in exchange for smoother, steadier returns. That premium is too large now to generate excess returns, according to Brightman. Excess returns refers to gains that exceed a benchmark, like, say, the S&P 500.

Low-volatility stocks have become increasingly popular over the past year since the broader markets have been flat after suffering through a pair of steep drops, each greater than 10%.

The iShares Edge MSCI Min Vol USA ETF USMV USMV, -0.32% which is up 7.6% year-to-date has $13 billion under management, 40% of those funds flowed into the ETF in 2016 alone. The ETF’s price-to-earnings ratio on a 12-month trailing basis, a measure of valuations, is 24.8 compared with a 18.8 trailing 12 month P/E for the S&P 500 index SPX, -0.18%

The PowerShares S&P 500 Low Volatility Portfolio SPLV, -0.19% has seen investor inflows of $1 billion since January, raising the assets under management to $7 billion. The low-vol ETF is up 6.7% year to date, compared with a 3.5% gain for the S&P 500. It’s trailing P/E is 20.

Brightman notes that it’s not just flows into these particular ETFs that boosted the prices of low-volatility stocks, since they represent only a fraction of the low-volatility universe.

“There is evidence that as a group, low-volatility stocks unambiguously trade at a much higher premium and our research shows that at these valuations subsequent 5-year excess returns will be negative,” Brightman said.

In other words, defensive and often boring stocks, turned into more volatile momentum plays that tend to suffer the most when the next crisis hits.

However, if you identify low-volatility stocks that also have low valuations, you will still be able to outperform the market, according to Bill Jacques, president at Martingale Asset Management.

Jacques and his team use a quantitative approach to picking low-volatility and reasonably valued stocks. They also scour 13F filings to see how much ownership is in the hands of institutional investors. Large institutional investors as well as hedge funds are required to disclose their holdings in quarterly regulatory filings.

“Low-volatility stocks are still significantly under-owned by institutional investors to the tune of $400 billion. Recent flows into ETFs are still nothing compared to such underownership,” Jacques said.

“We pick quality stocks that have low volatility that often trade at a valuation premium, but if valuation gets out of hand, then we rebalance. In fact, we are constantly rebalancing our portfolios,” Jacques said.

Brightman’s advice to retail investors, who rely on ETFs for low-volatility strategy is to take profits and diversify.

“Investors often do the opposite of what they should be doing because they chase past performance. If you have low-volatility stocks, then it’s a good time to take profit,” Brightman said.

Brightman agrees with Jacque about rebalancing, espousing the merits of rotating into international value stocks, which have lower valuations.

“If you don’t have low-volatility stocks, then, it’s not a good time to buy them as their expected returns are going to be disappointing,” he said.

Courtesy of marketwatch.com