The ‘Strongest 20’ stocks in the S&P 500

by Brett Golden

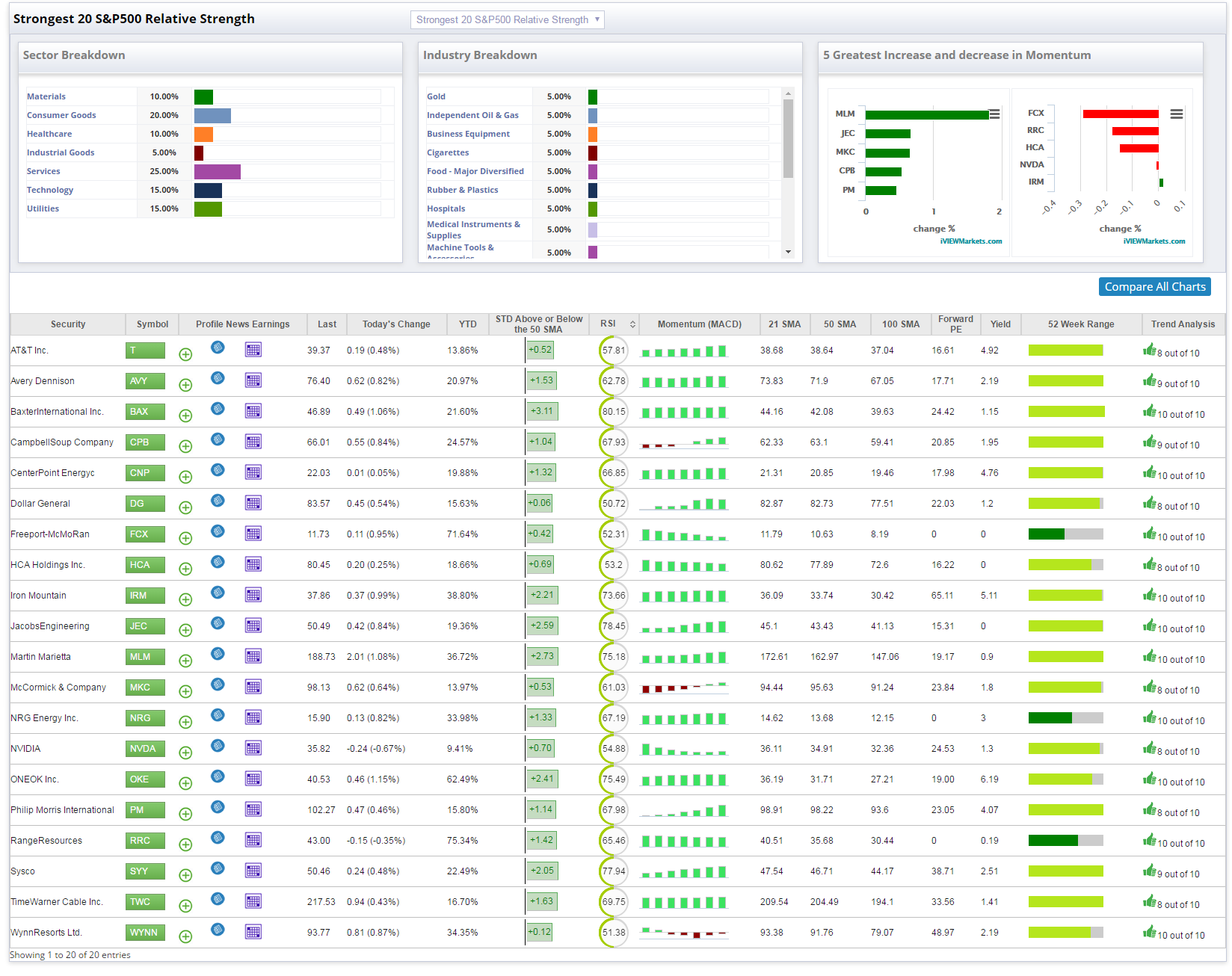

Today we want to look at the “Strongest 20” names within the S&P 500 (SPX) (SPY). We like to use S&P 500 stocks as an investment universe because of the liquidity, the fundamentals and market capitalization that it takes to be added to the index. In identifying strength inside the index, we are better able to find the sectors that are working, giving us clues to potential investment possibilities, as well as a better idea of the overall market picture.

When we talk about the “strongest” we are referring to technical strength measured by relative strength. For those who have read our previous columns, you will recall we used both technicals and fundamentals.

Today, we are looking strictly at relative strength measured by long-, medium- and short-term trends measured by moving averages and rate of change. Then we blend these to derive a score. The longer-term trends are weighted the most, as these are the most important data points. The total technical score is ranked from 0 to 10, with 10 being the best as seen in the image below.

As we can see from the table, that 55% of the Strongest 20 are represented by 10% in Materials (XLB), 20% in Consumer Goods and 25% in the Consumer Services sector. It's important to note, that since the relative strength is most heavily weighted to longer-term trends, in this case 200 days, not all of these stocks are seeing short-term bullish price action. Ideally, investors will want longer-term bullish trends coupled with short term increasing momentum.

Currently, we can see from the right side of the image that five of the 20 Strongest S&P 500 names are seeing a short-term increase in momentum.

Here are the names that are seeing the greatest increase in short-term momentum on the list:

- Martin Marietta (MLM)

- Jacobs Engineering (JEC)

- McCormick & Co. (MKC)

- Campbell Soup (CPB)

-

Phillip Morris (PM)

Additionally, you can reference the moving-average convergence/divergence (MACD) column to make sure the short-term momentum measured by the MACD is not declining.

The bottom-line is both the Consumer Discretionary (XLY) and Consumer Staples (XLP) sectors continue to work as investors who need to allocate capital are looking to play defense in perceived value with lower P/Es and beta. This type of sector rotation could also be viewed as late-cycle behavior.

(Click chart for larger version)

(Click chart for larger version)

Courtesy of marketwatch.com