Earnings/Price & Interest Rate Ratio Indicates Market Not Overvalued

Earnings/Price & Interest Rate Ratio Indicates Market Not Overvalued

A 45-year chart shows stocks not overvalued: Economist

With stocks near record highs, many are starting to worry that valuations have gotten too rich for the market's own good. But one influential economist is saying investors need not worry, and he has a 45-year chart to prove his point.

The S&P 500 (SPX) (SPY) is now trading at the highest price-to-earnings (P/E) multiple that stocks have seen in a decade, roughly 22 times its last 12 month's earnings, according to data compiled by S&P Capital IQ.

However, according to economist Alan Reynolds, senior fellow at the Cato Institute, the market shouldn't be looking at P/E in a vacuum. Instead, he maintains the key indicator is Earnings Yield - the inverse of the P/E ratio - and how it moves with interest rates.

"It makes no sense to say that stock prices are too high unless you also say that bond prices are too high," said Reynolds, who was part of President Reagan's OMB transition team in 1981. "I think bond prices are too high but so does the stock market."

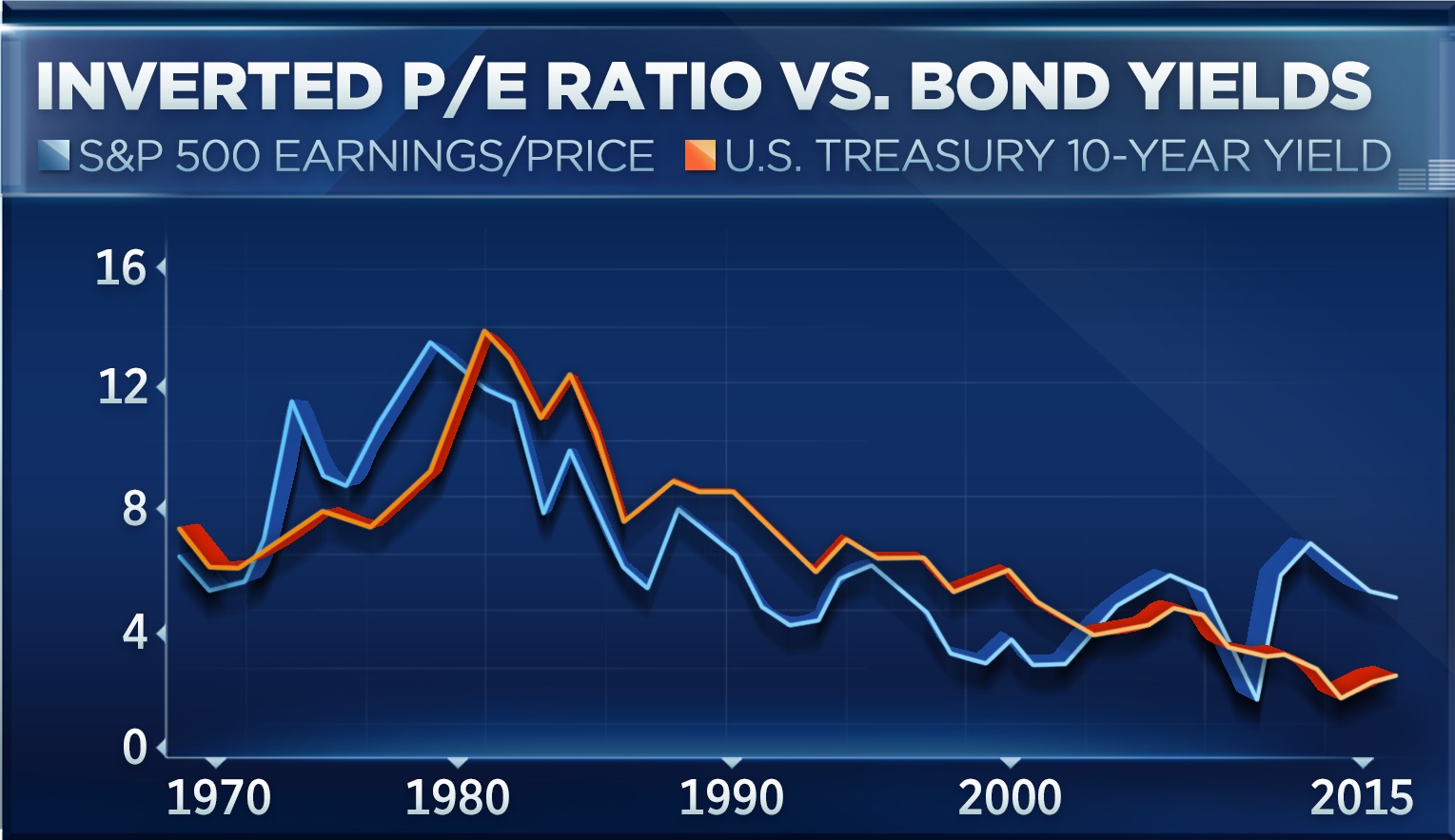

Reynolds has graphed the S&P 500's earnings yield against the benchmark U.S. 10-year Treasury note going all the way back to 1970. He found that earnings yields track quite closely with bond yields. And since yields move in the opposite direction of price, the prices of both stocks and bonds have risen steadily over the past few years.

"If anything, the E/P tells you something about bonds rather than the other way around," said Reynolds. "It tends to lead."

He says that S&P 500's earnings yield and the U.S. 10-year bond yield have both averaged about 6.7 percent in the past 45 years. With U.S. 10-year yields at a relatively low 2.15 percent, Reynolds holds that the market's P/E ratio to be higher than average.

"To say that the P/E ratio today is unusually high - meaning the E/P ratio is unusually low - is simply to say bond yields aren't 6.7" percent, said Reynolds. "At 2.1, we would expect the P/E ratio to be much higher than it is."

Since there's still a gap of a couple of percentage points between the 10-year bond yield and the S&P 500's earnings yield of 4.5 percent, Reynolds said that stocks are indicating bond yields are too low. Therefore, he isn't concerned about an expected Fed hike coming so much as he is about earnings.

"I think it's overdue," he said of a rate increase. "I don't think that's what we worry about so much as 'E' in the P/E ratio. If something bad happens to earnings, all bets are off."

Courtesy of cnbc.com