Strong Jobs Number Bolsters The Case For A Rate Hike

A Strong October Employment Report Bolsters the Case for a Rate Hike

The good news is, job-growth soared last month, and the unemployment rate fell to a multi-year low of 5%. The bad news is, job-growth soared last month, and the unemployment rate fell to a multi-year low of 5%.

The data is double-edged in the sense that it's arguably the strongest evidence all year long that employment, and therefore the economy, is on a solid growth track. Yet, that same economic strength also further opens the door to a Fed rate hike in December. While that in itself is ultimately an indication of growth, psychologically speaking, traders find rising interest rates to be at least a tad distasteful.

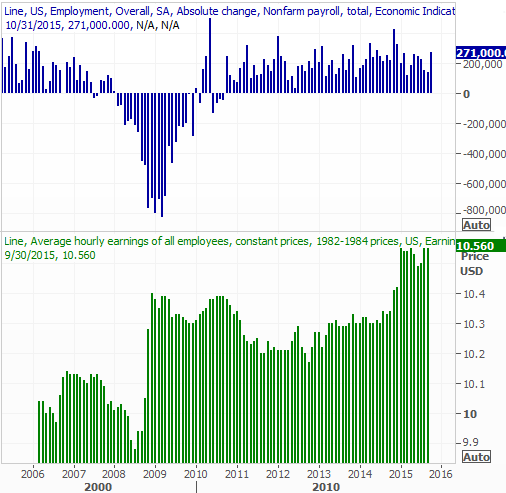

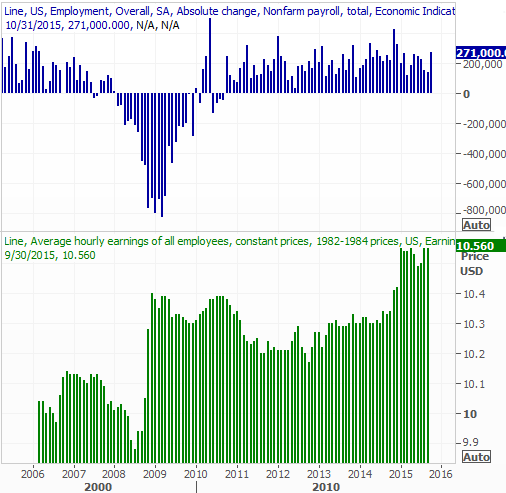

In October, payroll-growth reached a 2015 high of 271,000 jobs, at least partially quelling concerns about tepid job-growth numbers seen in many of the most recent months.

Underscoring the strong payroll-growth figure was yet-another solid improvement in hourly earnings -- they were up 0.4%, extending a recent spate of inordinately strong average wage reports... a spate that could only persist as long as it has if employers were increasingly desperate to find workers and/or workers were increasingly finding multiple job opportunities.

Non-Farm Payrolls & Average Hourly Earnings Chart

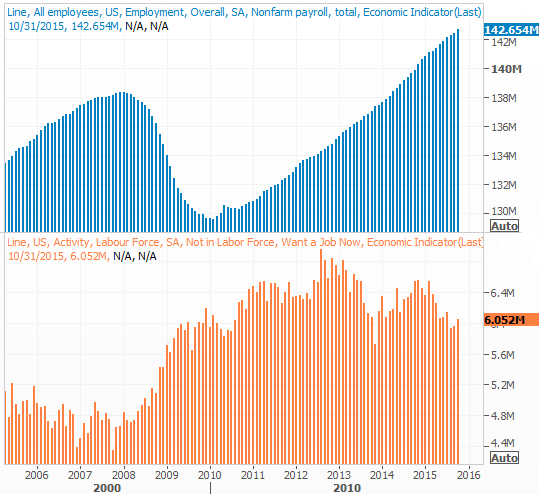

Lending itself to that premise is the total number of people in the United States who are not employed nor are technically not considered to be "in the labor force."

While this segment doesn't factor into unemployment rate, it's still a figure worth watching in that it paints a part of the picture that would otherwise be overlooked. And, that picture confirms the more overt job-growth and unemployment numbers -- things are getting broadly better. While the figure edged a tad higher to 6.052 million people last month, the longer-term trend is still pointed decidedly downward at the same time the total number of employed individuals in the U.S. rose to another record level of 142.654 million.

Employment & Not In Labor Force Long-Term Chart

Though one month does not make a trend, with the exception of the strong job-growth figure, the encouraging data from October is nothing new. And, while last month's employment news doesn't guarantee an increase in interest rates next month, it has to at least improve them a little. Another solid jobs report like this one in December (of November's data), however, may well force Janet Yellen to go ahead and pull that trigger. Investors should just bear in mind that's a sign of strength -- not weakness -- even if the market initially balks.