Big drop in bullishness for U.S. stocks could actually be a good sign

Contrarians detect a robust ‘wall of worry’ that the market can climb

by Mark Hulbert

The U.S. stock market’s recent weakness represents little more than investors taking a breather before they mount another rally.

That, at least, is the conclusion of a contrarian analysis of current stock market sentiment. In contrast to the stubbornly held bullishness that typically accompanies significant market tops, the market timers I monitor have instead been quick to turn bearish.

They, therefore, are building a robust “wall of worry” for the market to climb.

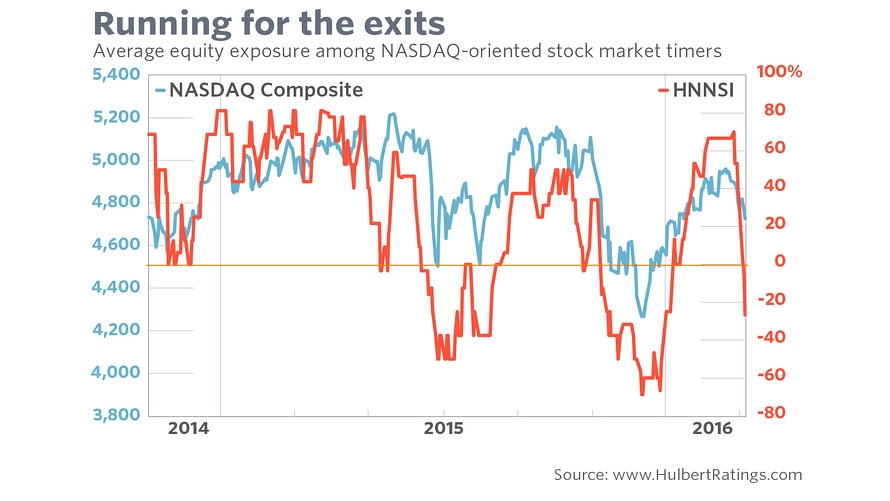

Consider the average recommended equity exposure among a subset of short-term Nasdaq-oriented stock market timers monitored by the Hulbert Financial Digest (as measured by the Hulbert Nasdaq Newsletter Sentiment Index, or HNNSI). Since the Nasdaq responds especially quickly to changes in investor mood, and because those timers are themselves quick to shift their recommended exposure levels, the HNNSI is my most sensitive barometer of investor sentiment.

The HNNSI currently stands at minus 26.7%, which means that the average Nasdaq market timer is allocating more than a quarter of his equity portfolio to an aggressive bet that the market will decline. As recently as the last week of April, in contrast, the HNNSI stood at plus 70%.

In other words, the average recommended equity exposure level among these short-term timers has plunged nearly 100 percentage points in just seven trading sessions. Over the three decades I have been monitoring stock market sentiment, I have rarely seen such a huge drop in bullishness in so short a period of time.

Furthermore, those prior occasions, when there was such a big and quick drop, were precipitated by something awful, like the 9/11 terrorist attacks. Yet nothing similar applies in the current instance: The Nasdaq Composite (COMP) is only 5% off its recent highs.

You have to go back to late February and early March to find another time when the Nasdaq-oriented stock market timers were as bearish as they are now. (See the chart at the top of this column.) Their bearishness then was more understandable, of course, since the stock market was coming off the worst start to a calendar year in U.S. stock market history.

Even so, contrarians at that time concluded that the prevailing bearishness was a bullish omen for the market, and they were right: The Nasdaq Composite rallied more than 6% over the next six weeks.

If anything, contrarians are even more bullish today than they were then.

Courtesy of marketwatch.com