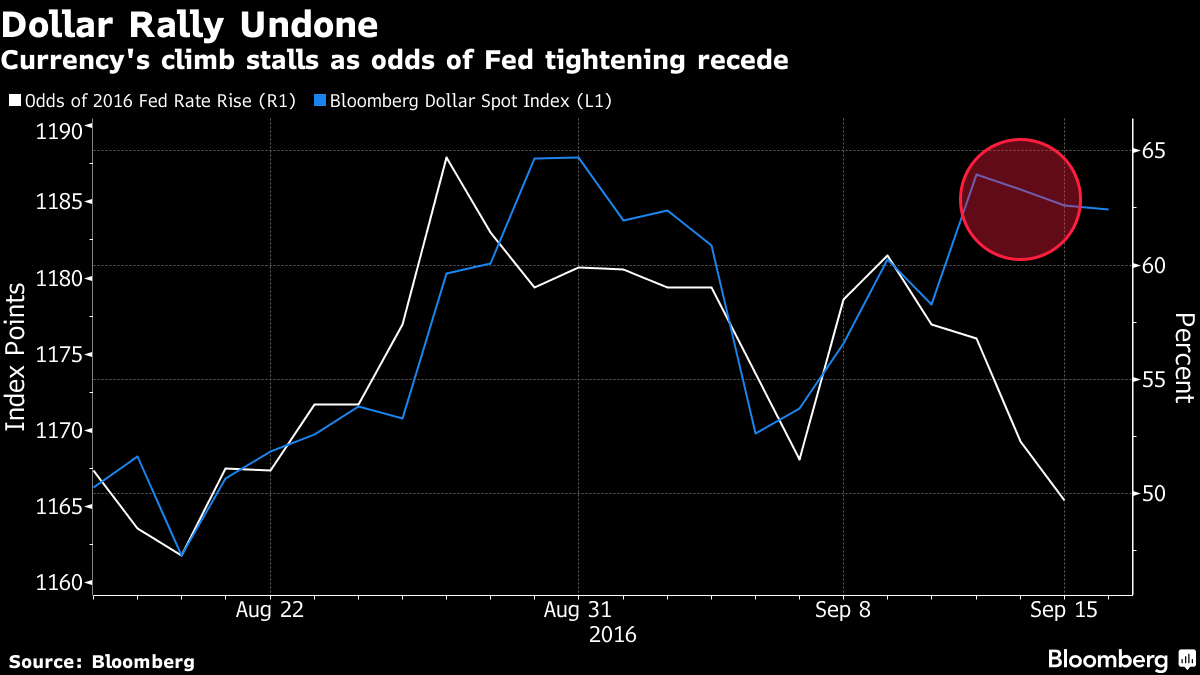

Odds Of Fed Rate Hike In 2016 Drop Below 50%

Dollar Rally Fades as Odds of Fed Move This Year Drop Below 50%

-

Fed’s Brainard urged ‘prudence,’ while U.S. data disappointed

-

Odds of Fed move this year has risen to 65% after Jackson Hole

by Kevin Buckland & Netty Idayu Ismail

The Dollar (UUP) rally is coming undone in a week that saw dovish Federal Reserve comments combine with disappointing economic data to cut the odds of higher interest rates (TLT) this year to below 50 percent.

A gauge of the greenback fell from the highest this month after Fed Governor Lael Brainard started the week by saying the case for tighter policy was “less compelling.” Her speech was followed by a retail-sales report that fell short of analysts’ forecasts, while a measure of data surprises slid to the lowest since June. The odds of Fed action by year-end are the lowest in a month, while those for next week’s meeting have fallen to 18 percent.

“There seems to be an adjustment lower on the Fed pricing, particularly in September, but the market doesn’t want to give up on the December idea,” said Gavin Friend, a strategist at National Australia Bank Ltd. in London. “The dollar is in a bit of a holding pattern. The market is desperate for some kind of direction, but it’s spinning its wheels and it’s unable so far to find that.”

The Bloomberg Dollar Spot Index, which tracks the U.S. currency against 10 of its major peers, was little changed as of 10:23 a.m. in London. It has fallen about 0.2 percent from its Tuesday close, which was the highest since Aug. 31. The dollar depreciated 0.6 percent this week to 102.03 yen, and was little changed at $1.1231 per euro.

Fed Odds

Futures show a 49.7 percent chance the Fed will raise rates this year, from a recent high of 64.7 percent on Aug. 26, after Chair Janet Yellen said the case for tightening had “strengthened.” The odds of an increase at the Fed’s Sept. 20-21 meeting peaked at 42 percent. The Bank of Japan is scheduled to hold its next policy gathering over the same two days.

“The market is hoping that we’ll come out with a greater sense of clarity” on the central banks’ policies, NAB’s Friend said.

Brainard on Monday urged “prudence” in removing policy accommodation. While Fed Vice-Chairman Stanley Fischer had also recently expressed bullishness on the economy, he stressed repeatedly that policy decisions would be data dependent.

Economic indicators released Thursday showed retail sales and industrial production both declined more in August that economists forecast.

“It’s unlikely that the Fed will go in September, and that’s reflected in the price action that you’ve seen in the U.S. dollar for the last couple of days,” said Thomas Averill, a managing director in Sydney at Rochford Capital, a currency and rates risk-management company. “There will probably be more weakness in the immediate future.”

Courtesy of bloomberg.com