Oil Deserved to Fall This Week (and may well deserve to keep falling)

This week, the three-week rally effort from Crude Oil (USO) finally came to an official close. Between Wednesday's 2% pullback and Thursday's 3% tumble from the commodity, and near-term trend was broken, with crude prices falling just a tad under their 20-day moving average line. The rollover effort is a familiar one in that it's got the same look and feel as so many others we've seen from oil since the middle of 2014.

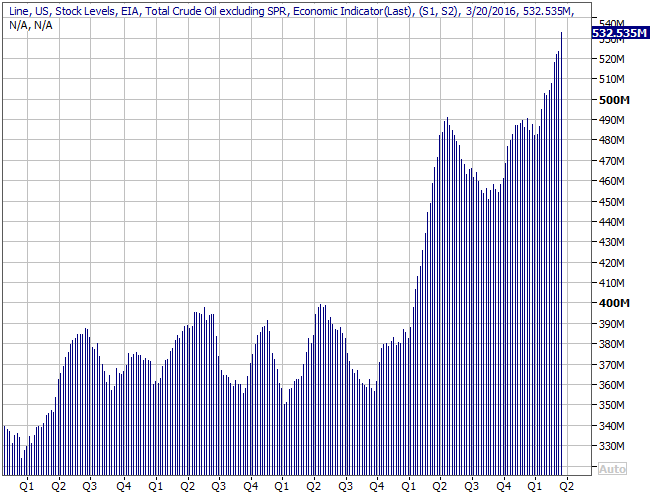

The real story here isn't the technical breakdown of crude oil, however. Rather, it's the underlying reason for the retreat... Thursday's report on the amount of crude oil the United States has stockpiled. Not only was it up to yet-another record, it was up even more than expected.

As of late last week, the United States is sitting on 532.535 million barrels of crude oil. That's the most, ever.

The number, though, doesn't do justice for the reality of the situation. Neither does saying the words "We've got 43% more crude oil currently in storage then we did at the end of the first quarter of 2014... before oil began a long implosion due to excessive supply." The only way to put some real perspective on this week's crude oil pullback is by showing you a chart of the nation's oil stockpile, and how it's changed over time. As they say, read 'em and weep.

We're (literally) running out of feasible places to put it.

More important than the logistics of extracting and storing crude oil is the supply/demand dynamic. The supply is ridiculously big, while demand has remained consistent with the mild growth seen before 2014. Until we've cut this supply down by a significant amount, oil prices are going to struggle.

Yes, the value of the U.S. Dollar (UUP) has something to do with commodity prices. Recent short-term weakness in the greenback has even helped boost the price of crude since the latter part of last month. The U.S. dollar seems to be holding its ground again, however, so we can't look for great deal of help there. Thing is, even if we could, the sheer oversupply of oil is creating a much bigger headwind for crude than any benefit a falling dollar could offer oil prices.

That being said, one can't help but wonder if the recent near-encounter with the 200-day moving average line (green) had at least something to do with this rollover. As you can see on the chart's history, brushes with an even just near that long-term moving average line have rekindled the bigger downtrend.

A move back to the $35.00 area seems likely, though a move back to $29.00 isn't much less plausible. If the lows near $29.00 early in the year don't hold up as a floor in the event of a pullback, there's no telling where well could end up below that level. Such a move would probably create the final capitulatory bottom, however, flush out the last of the weak drillers and refiners out of business altogether, finally putting a real crimp on the supply.