Weak Q1 Earnings Put Pressure on Valuation Hopes

With 72% of the market's first quarter earnings results now in hand, we've got a pretty good feel for what corporate bottom lines were like during Q1. They could have been better. But, they could have been worse too.

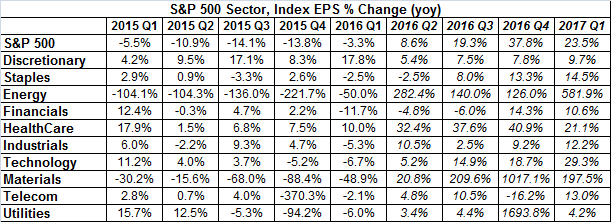

Overall, the S&P 500's (SPX) (SPY) per-share bottom line for the first quarter of 2016 so far is $24.97. That's down 3.3% from the $25.81 the index earned in the same quarter a year earlier. Don't sound the alarm bell just yet though.

As one could have expected, the energy sector's (XLE) ongoing losses (and widening losses) continue to take a toll on the overall bottom line. Energy stocks saw a 50% in the size of the loss they took in Q1 of 2015. That said, the energy sector was hardly the only group to drag the overall market's performance down earnings-wise. Financials (XLF), industrials (XLI), the technology sector (XLK), and to a lesser degree, telecom (XTL) and utilities (XLU) all posted year-over-year declines in their bottom lines. The materials sector (XLB) did as well, the largely for the same reason energy stocks struggled.

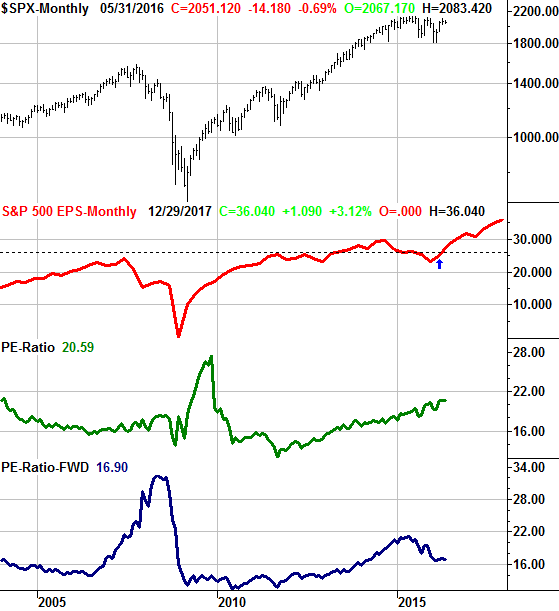

As for how the Q1 earnings numbers impact the market's valuation, the chart below tells the tale. The trailing P/E ratio now stands at 20.59, while the forward-looking P/E rolls and at 16.9. Both are above long-term norms, but at least the forward-looking P/E is palatable. The trailing P/E leaves little reason to expect a great deal more upside from stocks until earnings start to change for the better.

From a sequential point of view, the first quarter's suggest the broad earnings downtrend has finally reversed course after a miserable Q4. One quarter does not make or break a trend, however. [The arrow marks the first quarter's results.]

And again, all the energy sector gets a fair amount of the blame for the broad market's earnings weakness, it doesn't get all the blame itself.