Microsoft (MSFT) is Failing as a Growth Stock (for now)

The company can spin it any way they want to, but Microsoft (MSFT) can't get around the fact that growth has been tough to muster as it transitions from a software - an arena it dominated - to a cloud company, where the competition is much stiffer. Last quarter's results largely confirm a message that had already been delivered over the course of the past few quarters.

Microsoft reported a 6% decline in third-quarter revenue, to $20.5 billion. Operating earnings 62 cents per share came up short of the 64 cents per share earned in the same quarter a year earlier. Revenue was mostly in line with estimates, but that meant little relative to other disappointing comparisons.

The core of its future - cloud services - was lackluster. While its flagship product Azure saw 120% growth in its year over year revenue, the company is mostly just displacing sales of other products. Its cloud services division that includes Azure still only saw a 3% improvement in revenue. Similarly, its subscription-based Office 365 platform saw a 63% improvement in revenue, but the productivity and business division it operates within still saw a 2.5% drop in sales. And though its so-called "Intelligent cloud" unit posted a 3% increase in revenue, profits for hat unit fell 14%, as competition in that space mounts, forcing a price war.

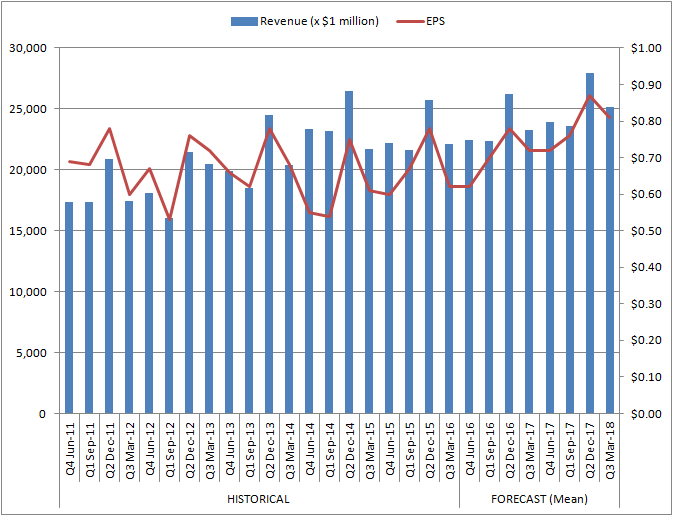

Of course, these tepid results can't come as a complete surprise, in light of the trends plotted on the revenue and per-share earnings graph below. Sales have been and continue to rise, though slowly. Income, on the other hand, isn't rising at all.

Per-share profits are projected to start rising from this point forward, but the tendency in the recent past has been to pull those projections lower as the time approaches. Given the increasing competitiveness of cloud services and the subsequent margin pressure that competition creates (we've already seen a glimpse of this from Microsoft), profits may also be stagnant moving forward.

It could be worse. Some companies are moving backwards and the revenue and earnings front. With MSFT still valued at a forward-looking P/E of 17.1 though, stagnation still isn't good enough. That's why MSFT shares fell more than 6% on Friday, breaking under all the key moving average lines except for the 200-day moving average line.

While some will view the stock's capacity to remain above the 200-day line at a victory as well as a bullish clue, traders should bear in mind Microsoft shares easily broke below the 200-day moving average line a couple of times last year... when it seemed the company had far more going for it then than it does now.