HD & LOW Results Show Not All Retailers Are Suffering

Strong Q3 Numbers From Home Depot (HD), Lowe's (LOW) Say Consumerism is Alive and Well

Were it just one OR the other to top its third-quarter earnings estimates, it might be easy to dismiss those strong results and agree that U.S. consumers are losing their will and ability to spend. To see both Lowe's (LOW) AND Home Depot (HD) beat their prior quarter's fiscal expectations -- and their year-ago figures -- though, we can say U.S. consumers aren't in dire straits after all.

It's in contrast to the conclusions largely made since last week, when both Macy's (M) and Nordstrom (JWN) failed to fully meet their earnings estimates and/or failed to post compelling outlooks. Many interpreted the failure of the two apparel department store chains to produce growth as a sign that consumers may have already started a recession even if the economy technically hadn't done to the same yet. Home Depot and Lowe's, however, have proven consumers are indeed willing to spend (increasingly). It's just a question of what they're willing to spend on, and where... and that's largely a function of how they're being marketed to and what they're being sold.

That's a nod to the likes of e-commerce names such as Amazon.com (AMZN) and other smaller online venues, which are increasingly able to compete with the likes of Nordstrom and Macy's, but have thus far been unable to supplant home improvement stores.

Home Depot delivered its good news on Tuesday. The company earned $1.35 per share on $21.8 billion worth of revenue. Analysts were only expecting a bottom line of $1.32 per share and sales of just a tad less than the $21.8 billion the company generated. Even more impressive was the improvement versus Q3-2014's numbers of a profit of $1.15 per share and sales of $20.52 billion. Same store sales grew 5.1%, versus estimates of only 4.6%.

Lowe's announced its third-quarter results on Wednesday morning, earning 80 cents per share on $14.36 billion in revenue. Analysts were only calling for a bottom line of 78 cents per share and sales of $14.34 billion. This year's Q3 top line was 5% better than the year-ago figure of $13.68 billion, while the bottom line for Q3-2015 left the year ago earnings figure of 59 cents per share in the dust. Same store sales for Lowe's grew 4.6%, beating the expected 4.1% growth rate.

Some relevant ETFs to the stocks mentioned in this article: Retailers (XRT), Consumer Discretionary (XLY), Consumer Staples (XLP), Homebuilders (XHB), Internet (FDN).

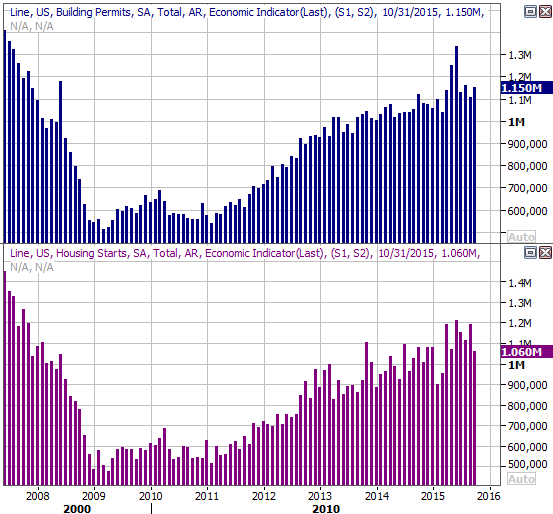

While impressive, the results can't be terribly surprising. Last month, homebuilder optimism reached its second-highest level in the past seven years, while September's housing starts also reached their second-best reading in the past seven year's... an annualized pace of 1.2 million units. Though October's housing starts fell 11% to 1.06 million homes, that was to be expected heading into the winter months. Year-to-date, home construction has grown 10%, and the broad uptrend is still intact even with October's lull.

Bullding Permits & Home Starts Chart