Gold Hits 2 Year High, UBS Says Early Stages Of Next Bull Run

Gold Climbs to Two-Year High as UBS Sees Start Of New Bull Run

-

UBS raises short-term target to $1,400/oz from $1,250

-

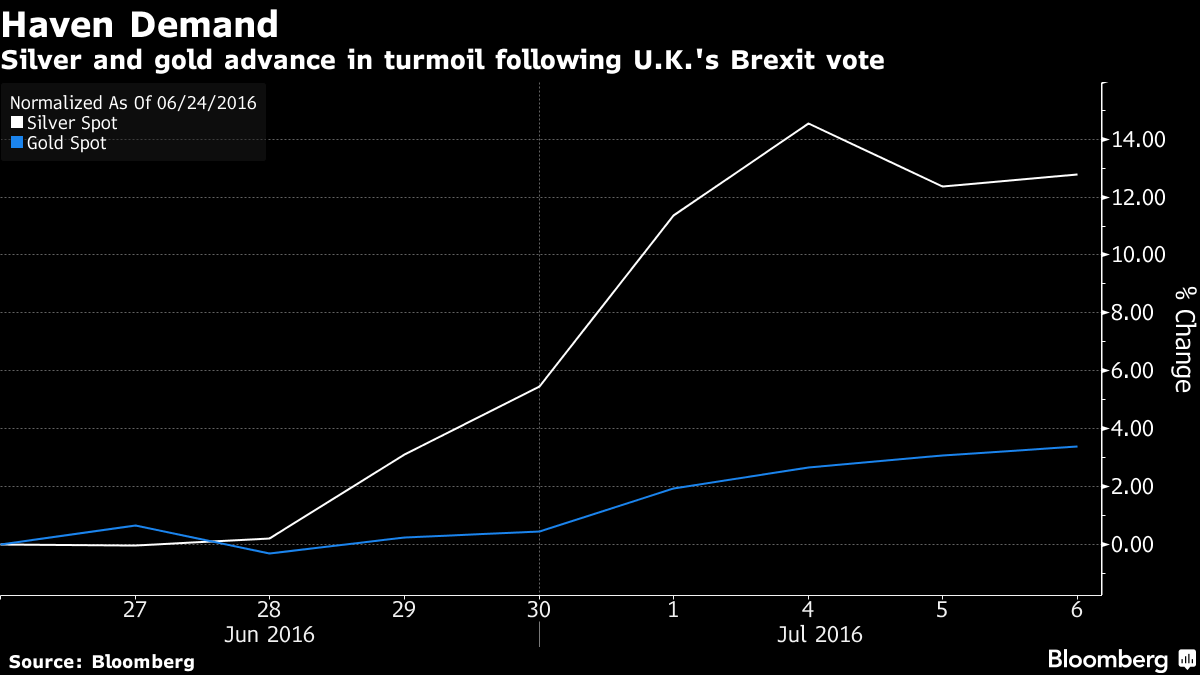

Investors seeking haven assets as Brexit vote hits markets

Gold (GLD) climbed to a two-year high as investors sought a haven from the tumult in financial markets, with UBS Group AG saying bullion is probably at the beginning of its next bull run.

The metal rose for a sixth day in London, reaching $1,371.39 an ounce, as stocks and the pound slid in the wake of the U.K.’s vote last month to leave the European Union. Gold may climb to $1,400 in the short term, according to UBS, which sees prices averaging $1,340 in the second half of this year.

Investors have been piling into precious metals, boosting holdings in gold-backed funds to the highest since 2013 while silver assets are near a record. Bank of England chief Mark Carney said Tuesday that risks from Brexit had started to crystallize. The vote has eroded prospects for a U.S. interest-rate increase this year and prompted speculation for more stimulus from central banks around the world.

“Gold has likely entered the early stages of the next bull run,” Joni Teves, an analyst at UBS in London, wrote in a report e-mailed Wednesday. “This trend should now deepen, attracting more participants and encouraging those who have been hesitating to get more involved.”

Gold for immediate delivery gained 1.1 percent to $1,370.75 by 10:30 a.m. in London, after earlier touching the highest since March 2014. Silver (SLV) advanced 2.1 percent to $20.3465 an ounce, taking its gain this year to 47 percent.

Silver trading has surged on the Shanghai Futures Exchange as open interest declined, a sign that day traders are behind much of the rally, according to Saxo Bank A/S. Volume was 1.6 million contracts on Wednesday after hitting 1.9 million on Tuesday, the highest since August.

Money managers are the most bullish on gold futures since at least 2006, U.S. government data show. Gold assets in exchange-traded funds rose to 1,997.3 metric tons as of Tuesday, data compiled by Bloomberg show. Investment climbed to a record Tuesday in the Huaan Yifu Gold ETF, the largest such fund in China. Holdings in silver-backed funds rose to an all-time high last month.

Gold mining stocks rallied on Wednesday, with the FTSE/JSE Africa Gold Mining Index gaining as much as 6.5 percent to the highest since March 2012. Harmony Gold Mining Co. Ltd. and Sibanye Gold Ltd. climbed at least 8 percent in Johannesburg.

Not everyone expects big increases in gold. Risks surrounding Britain’s exit of the EU is now priced in and physical demand is suffering amid higher prices, James Steel, an analyst at HSBC Holdings Plc said in a Bloomberg Radio interview with Tom Keene. He sees gold peaking near $1,400 this year.

Courtesy of bloomberg.com