Gold's relationship with stocks hits all-time low -- which could be a reason to buy

Gold and stocks don't always act like the best of friends, but as of late, they've become the worst of enemies.

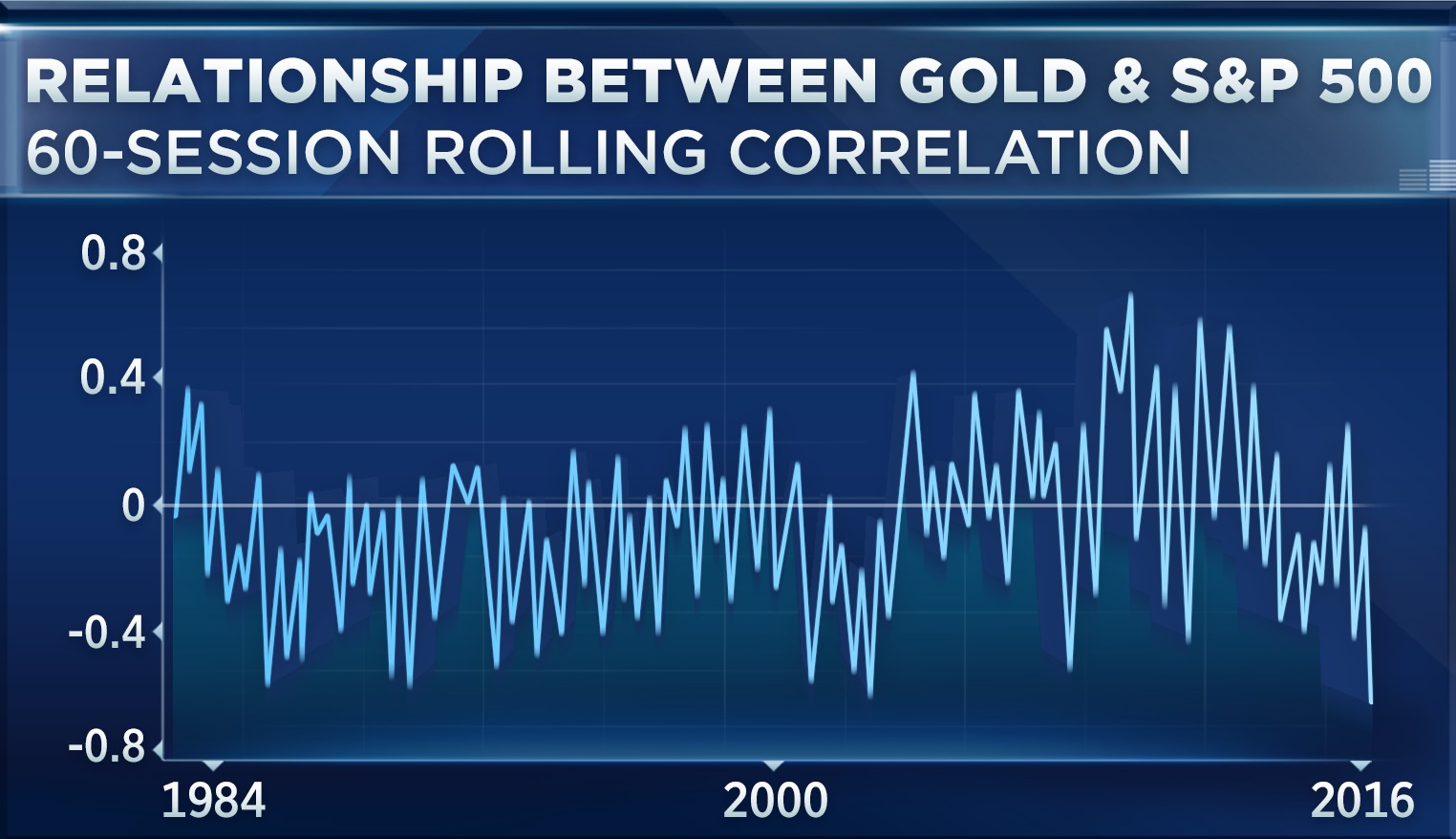

In the 60 sessions through Wednesday's close, the correlation between the daily moves of gold futures (GLD) and the S&P 500 (SPX) (SPY) has been negative 0.63. Since correlations run from 1 to -1, with 1 indicating perfect correlation, 0 indicating perfect indifference, and -1 indicating perfect opposition, this shows a very strong inverse relationship between the two assets. If all one knew about the market in a given session is that gold had risen, it would be a decent bet that the S&P fell.

As a matter of fact, -0.63 is the lowest ever correlation between gold and stocks, based on a CNBC analysis of FactSet data going back to 1984. Indeed, the average correlation over the entire 32-year period is just -0.06.

This turn lower in the bullion-S&P correlation, which was also pointed out in a recent blog post on ValueWalk, may be a consequence of ultra-low bond yields.

Gold, says Susquehanna head of derivative strategy Stacey Gilbert, is "your natural defense mechanism" against negative-yielding bonds. As ultra-low or negative yields fall, gold begins to look more attractive in comparison. Stocks, meanwhile, tend to rise along with yields, both because bonds and stocks are natural substitutes for one another, and because economic growth tends to increase both yields and stock prices.

This may all sound a touch obscure, but the ramifications for asset allocation are very real, since correlations among assets are a critical input to the portfolio construction process.

To understand why, let's imagine that two assets, asset A and asset B, each have expected returns of 10 percent and standard deviations of 20 percent. Consider first a portfolio composed entirely of asset A: It obviously has the same risk and reward expectations of asset A. Now consider an second portfolio composed of equal parts A and B. How profitable and how risky do we expect this portfolio to be? It all comes down to correlation.

If A and B have a correlation of 1, the second portfolio is equivalent to the first, and there's no reason to add the second asset. If A and B have a correlation of -1, the portfolio should neither risk nor gain anything and will be the functional equivalent to holding cash. It A and B have a correlation of 0, the expected return remains 10 percent, but the expected volatility falls.

One can do the math and find that the expected standard deviation in the last case is 14 percent rather than 20 percent in the first case, but that just proves what common sense already tells us: Two unrelated assets will together have a smaller amount of volatility than two identical assets, all else being equal.

Getting back to gold, the tumbling correlation between gold and stocks means that we should expect a portfolio containing both broad stock exposure and gold to enjoy a better risk-reward profile than one that just holds the stocks. We cannot, however, say that it should see less overall volatility — since gold has been about twice as volatile as the S&P of late.

To be sure, correlations are notoriously precarious, and while 60 sessions is a common time frame to examine, important portfolio decisions probably shouldn't be made on the basis of 120 data points. But for those who have been considering adding gold exposure to their portfolios, the all-time low correlation between gold and stocks can easily serve as one more excuse for doing so.

Courtesy of cnbc.com