Energy Sector Short Interest Highest In A Decade

Short Interest in the Energy Sector Hasn't Been This High in More Than a Decade

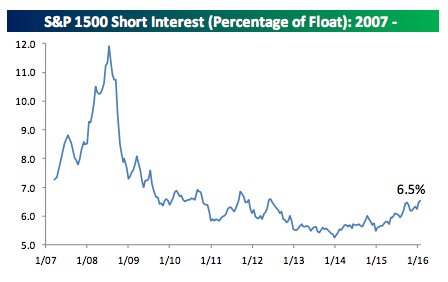

Just a couple of weeks ago, we pointed out that short interest in the S&P 1500 was at its highest level since June of 2012. Numbers are in for the second half of January, and the picture is only getting worse, with the Energy sector (XLE) playing a big role in the continued climb.

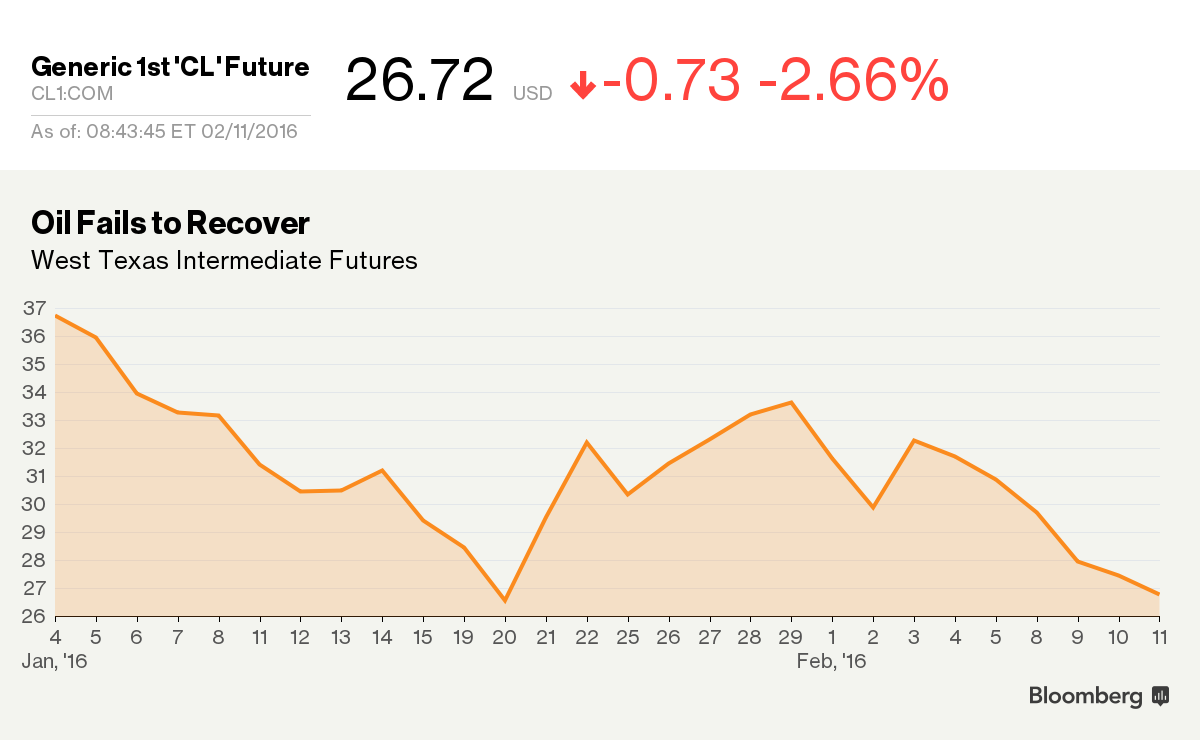

As a recovery in the price of oil remains elusive, the energy sector has been dealt a great deal of pain since the start of the year.

"Short interest levels for three sectors (Consumer Staples (XLP), Energy, and Health Care (XLV)) also increased to multi-year highs, and in the case of Energy, its short interest as a percentage of float [SIPF] level is now above 12 percent to its highest level in over a decade," Bespoke Investment Group points out. "Utilities (XLU) is a sector that has held up very well this year, but even here traders are starting to step up their negative bets as short interest in the sector increased from 2.9% up to 3.0%."

Short interest, or the quantity of stock shares that investors have sold short but not yet covered, can also be a measure of investor sentiment. The runup in short interest shows the decline in sentiment as investors weather the storm of stocks not only falling but also posting some big moves to the downside along the way. To be clear, the current level is still far from the highs we saw in the financial crisis. Here is a chart from a note Bespoke Investment Group recently sent out to clients. It shows the historical levels of short interest for the S&P 1500.

Source: Bespoke

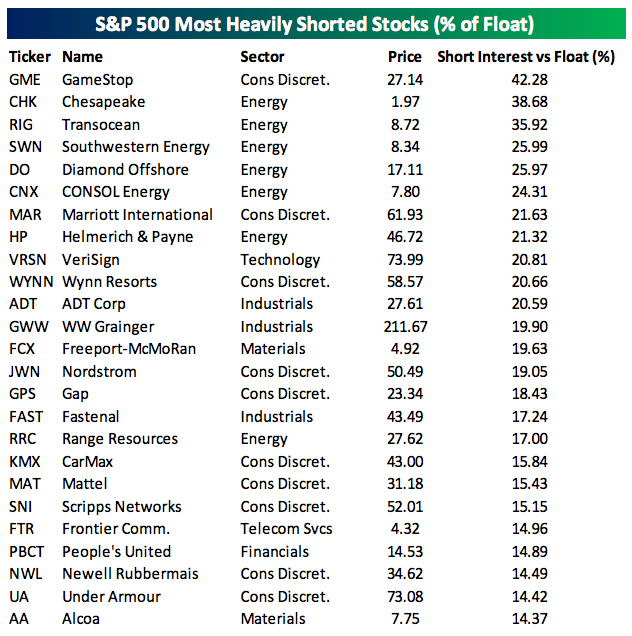

When looking at the most heavily shorted stocks, there are a large number of stocks from the energy sector that make the list. Big names include Chesapeake Energy Corporation (CHK), Southwestern Energy Company (SWN), CONSOL Energy Inc. (CNX), and Diamond Offshore Drilling Inc (DO).

Other areas that saw the a lot of pain include large-cap and midcap stocks. "In terms of market cap, both large and mid cap stocks also saw their SIPF levels surge to multi-year highs not seen since 2010 while short interest in small caps declined slightly," Bespoke writes.

Courtesy of bloomberg.com