Economy: Service & Manufacturing Jobs Picture Differ Greatly

U.S. Service Industries Confidence, Job Growth Differs from U.S. Manufacturing Business

Call it a tale of two cities. Service-related business in the United States are doing well, and the nation's businesses know it. Conversely, factories are struggling, and the nation knows that too. Both sides of that coin will need to do well if the economy -- and the stock market -- are to reach escape velocity this year.

The finishing touches on the picture were painted on Wednesday, with the release of December's ISM Services Index and ADP's payroll growth numbers.

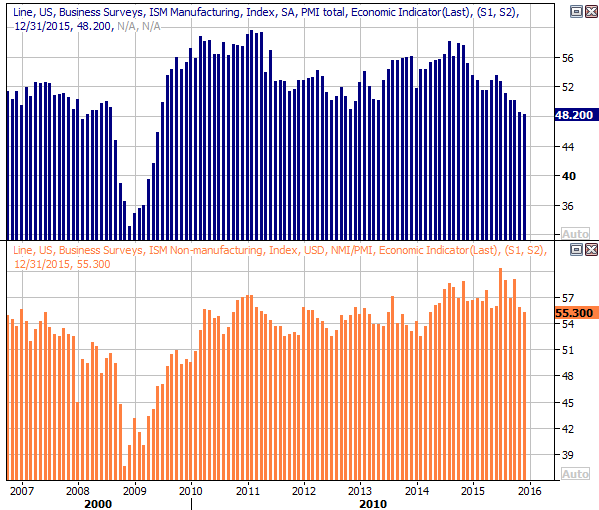

The ISM Manufacturing Index unveiled on Monday rolled in at 48.2, down from 48.6 in November. Any reading below 50 is considered a sign of recession, so the market wasn't particularly hopeful headed into today's barometer for service businesses. Investors were treated to another strong reading on that front. That is, the ISM Services Index stayed firm in December, moving from a score of 55.9 to a score of 55.3.

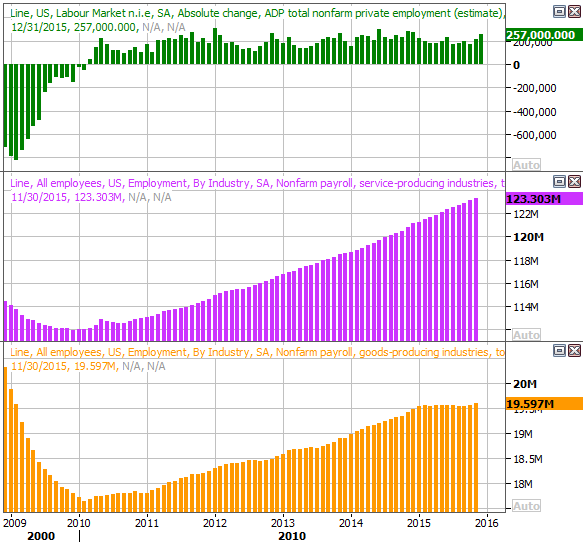

Interestingly, and in support of the notion, the ADP payroll growth data underscored just how well service-related businesses are doing at this time.

The total of 257,000 jobs that payroll processor says were created last month was the highest level of job growth for any month last year. Of them, though, 233,600 were service jobs, versus only 1900 (net) jobs created within the manufacturing industry. One could arguably say many of these service jobs were temporary, created only to satisfy holiday-shopping demand. A closer look at the data, however, makes it clear that strong service job growth is nothing new, nor is weak manufacturing job growth.

As for what it means to investors, job growth could be a sign of strength for particular kinds of companies. Even so, if service job growth continues to grow well enough, it's only a matter of time before manufacturing job growth kicks into high gear again as well. The question is, when will that happen? Broader economic growth - the kind that can really power the market higher - is depending on it.