Department Stores Are The Weak Link Of The Retail Sector

The Rest of the Retail Spending Story: Department Stores are (Still) the Weak Link

This past week was an important one for the retail sector (XRT), as Nordstrom, Inc. (JWN), Macy's Inc. (M), Kohl's Corporation (KSS) and JC Penney Company Inc. (JCP) -- the four names that sent a terrifying message a quarter earlier when they posted miserable results -- posted their recently-completed quarter's numbers. The results this time around were much better.... sort of.

While all four stocks have bolted higher on earnings beats [and some revenue beats], it's worth noting that none of the numbers were impressively better than year-ago numbers. In fact, most of them continued to show deteriorations.

Worse, more weakness is predicted, as traditional brick and mortar retailers struggle to not just deal with online competition, but face a growing disinterest is apparel as an exciting use of discretionary income. Experiences and memories are quickly becoming bigger priorities than stuff, as many consumers have developed fashion fatigue.

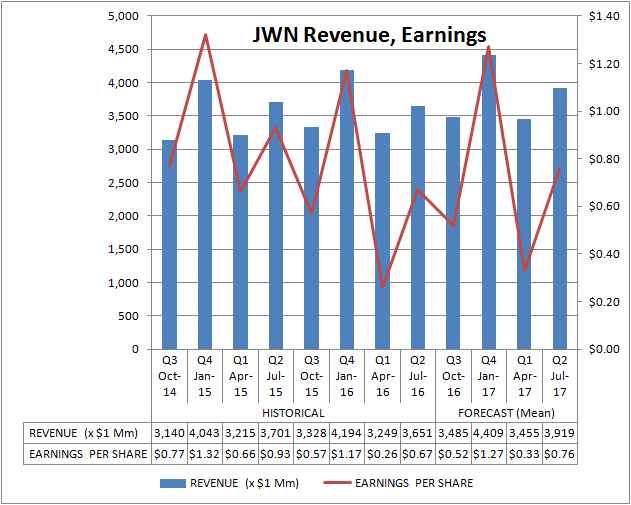

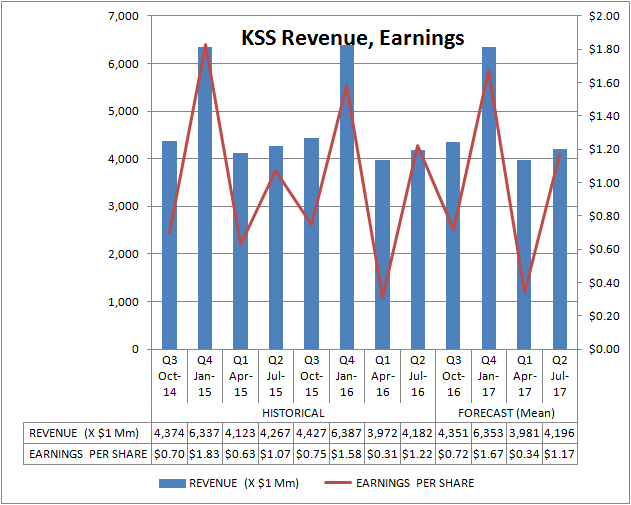

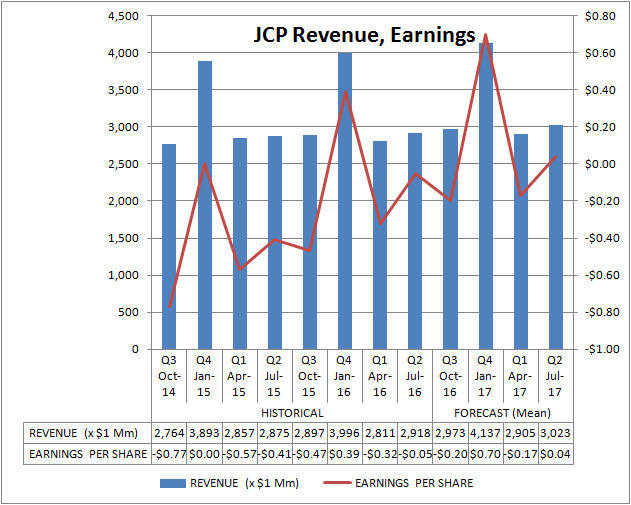

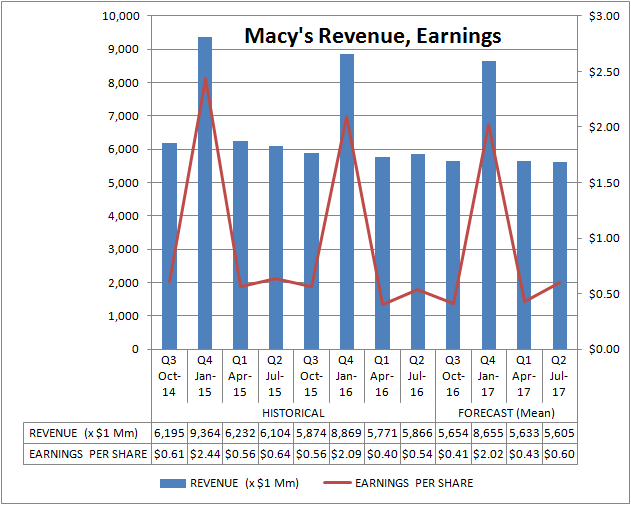

Rather than hashing out all the numbers, the four charts below serve up the details -- past and projected -- for the four aforementioned retailers.

The only one with a compelling trajectory is JC Penney, but that may because the bar has been set incredibly low; any success is going to look relatively better.

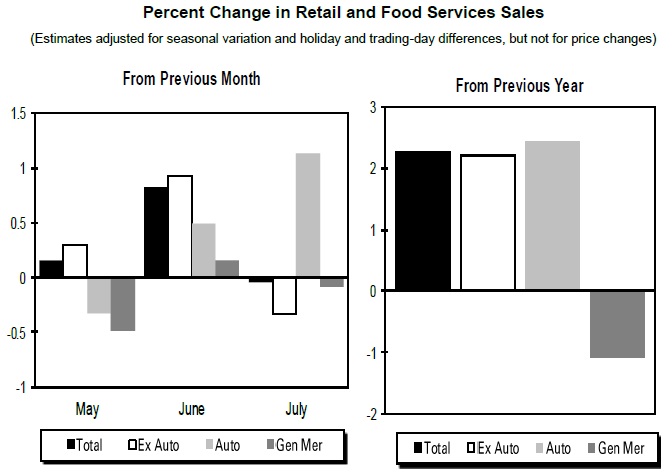

The quarterly reports came in front of Friday's concerning (though somewhat misleading) retail sales report from the Department of Commerce, which said overall retail sales were flat in July, and even down 0.3% when taking automobiles out of the equation.

The misleading aspect of the monthly report is that it compares one month's numbers to the previous month's numbers, ignoring the fact that the calendar and time of year may impact consumer spending. A more meaningful comparison is the year-over-year look, and in that light, July's retail spending was up 2.2%.

The twist: Spending on general merchandise was down 1.0% on a year-over-year basis. Auto sales and non-general merchandise proved to be a drag, not just compared to June, but compared to July of 2015.

It underscores the problem the likes of Macy's, Nordstrom, Kohl's, and JC Penney have been facing, and aren't expected to shrug off anytime soon.

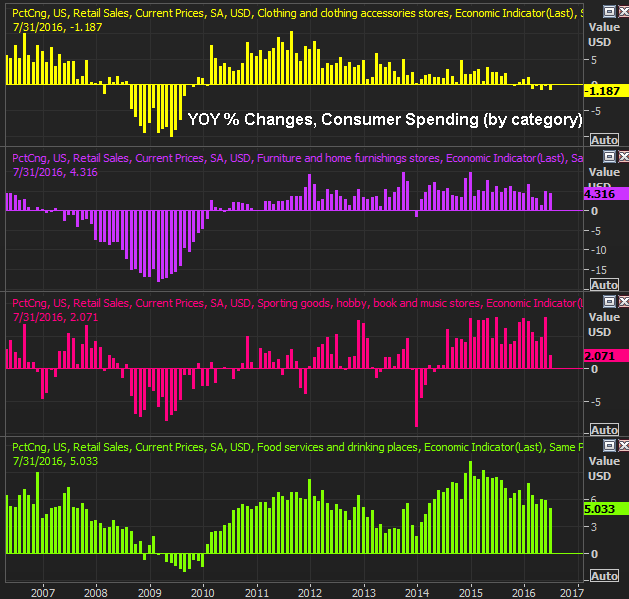

The distinctions are worth making -- now perhaps more than usual -- as they make it clear that not every segment of consumer-oriented markets are struggling. Apparel is, and by extension, department stores and general merchandise stores are. When drilling deeper into the Department of Commerce's monthly report though, restaurants and specialty stores are showing strong growth. Sporting goods, hobby stores, and book stores have grown sales 5.9% year-to-date. Department store sales, on the other hand, are down 3.9% year-to-date while general merchandise store sales are flat for the year so far (perhaps nodding back to the notion that consumers are starting to care less about what they wear and more about what they do). The trends are rather well-developed too, for better or worse.

Bottom line: Don't jump to conclusions, good or bad, about consumer spending solely based on the outcomes Nordstrom, Macy's Kohl's and J C Penney. They're in a very unique situation right now.