Chartist Sees Biotech ETF (IBB) Rally Continuing

Trader: It's time to bet on a big biotech rally

The real biotech rally is just getting started, according to options trader Andrew Keene of AlphaShark.

The popular IBB ETF, which tracks Nasdaq biotech stocks (IBB), has seen a bit of a roller-coaster ride this year. The product lost more than a third of its value in the first several weeks of the year, only to bounce and retreat several times hence. Over the past month, it has risen nearly 7 percent, even after shedding 2 percent on Wednesday.

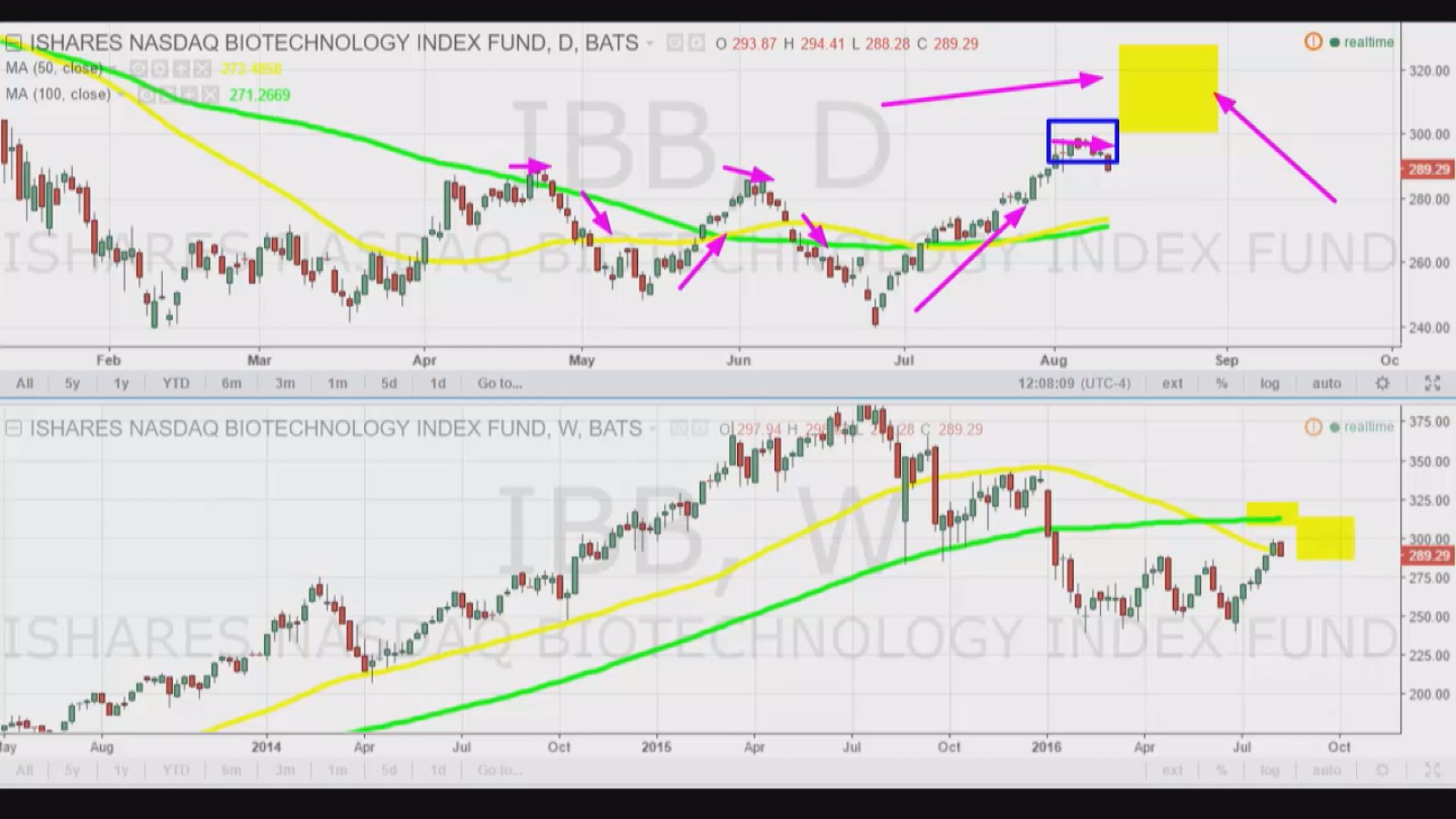

Yet Keene says the chart suggests that biotech stocks could do very well over the next few months.

"I think that the IBB has seen a short-term top, but I think that it can move even higher by the end of the year," he said.

On a daily chart of the IBB, Keene points out that the ups and downs in biotech show that $300 is an important level for the ETF. That price has served as a level of resistance, the trader said, but could soon change into a level of support.

So how high can biotech go? Keene points to the IBB's weekly chart for an answer. With the 100-week moving average crossing the 50-week moving average at $320, he believes that $320 is where IBB can sit by year's end. That would represent an 11 percent rally from Wednesday's closing price.

To capitalize on this view, Keene is buying the December 300-strike calls and selling the December 320-strike calls for a total of $6.50 per share, or $650 per options spread (given that each options contract controls 100 shares of stock).

If the IBB closes at or above $320 come mid-December expiration, each spread will be worth $2,000, for a healthy profit. On the other hand, if IBB fails to close above $300, the trade will expire worthless.

Courtesy of cnbc.com