Credit Spreads

Credit spreads are a relatively simple option-trading strategy, made attractive by the fact that they generate income right at the trade's initiation, have a defined maximum loss, and can benefit from time decay rather than be adversely impacted by it. Conversely, credit spreads have a defined maximum gain - the initial credit.

Credit spreads use two options per trade... one is sold (or shorted), and the other is bought. In that the sold/shorted option is the higher-priced of the two options, the difference between the two options is the "credit" pocketed by the trader.

Credit spreads can be bullish or bearish on a stock or index, though all credit spreads also have a neutral element to them.

An example will best clarify how the strategy best works.

Assuming Johnson & Johnson (JNJ) is poised to move higher, or at least not move lower, from its current price of $100, we would buy a put option on JNJ, and we would sell the same number of put options with a higher strike price, which would inherently be priced higher than the put being bought. With the stock trading at $100, we could sell one-month puts with a strike price of 95 for $0.65 (or $65 per contract), and we would buy one-month puts with a strike price of 90 for $0.20 (or $20 per contract). Our "credit" - and our maximum profit - is the $45 difference per contract.

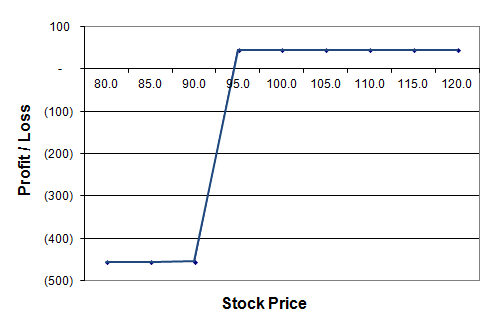

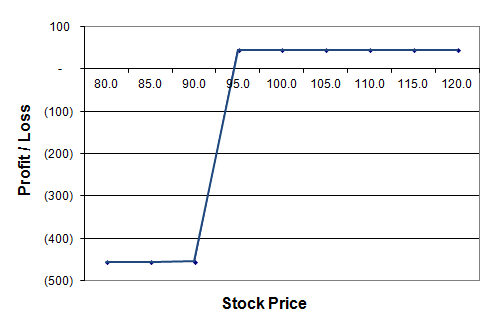

Bull Put Credit Spread Theoretical Proft/Loss Example

Ideally, Johnson & Johnson would never fall below $95 and therefore there would be no threat that the one-month 95 puts would be exercised against us. In that case, both options would expire worthless and we would simply retain that $45/contract credit while the liability of the trade simply disappeared at expiry.

The worst case scenario would be a move all the way below $90. At that point the one-month 95 puts would almost certainly be exercised against us, and though we would still own one-month 90 puts that we could exercise to offset the 95 puts being exercised against us, the $5 difference between the two strikes - $500 for one contract - would be subtracted from our initial $45 credit, leading to a loss of $455 per contract on the trade.

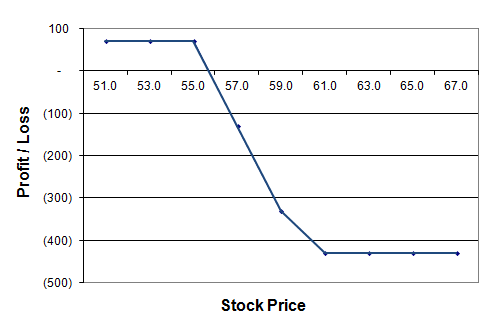

Bear Call Credit Spread Theoretical Profit/Loss Example

For that reason, it's generally wise to never let the worse-case scenario materialize, though in that regard the lower-priced long/owned put option could be considered something of an insurance policy of the trade, limiting its downside.

While the ideal credit spread is the expiration of both sides of the trade, should an adverse move develop, it's usually wise to close out the trade quickly before a small loss can turn into a big one. As the profit & loss chart illustrates below, the risk is technically greater than the reward.