Goldman: Here Are the Stocks to Buy and Sell If You Want to Beat the S&P 500 - Still opportunities in a flat market.

With Wall Street expecting the S&P 500 (SPX) (SPY) to end the year not far from its present level, stock-picking has become attractive for investors seeking anything better than meager returns.

It's fortunate then that the upside to that strategy is growing, according to a new note from Goldman Sachs Group Inc. analysts led by David Kostin and Ben Snider. They say it's become more important in recent months to differentiate between companies on the index, as the correlation between different industries' stocks becomes weaker — and that two sectors in particular deserve a closer look.

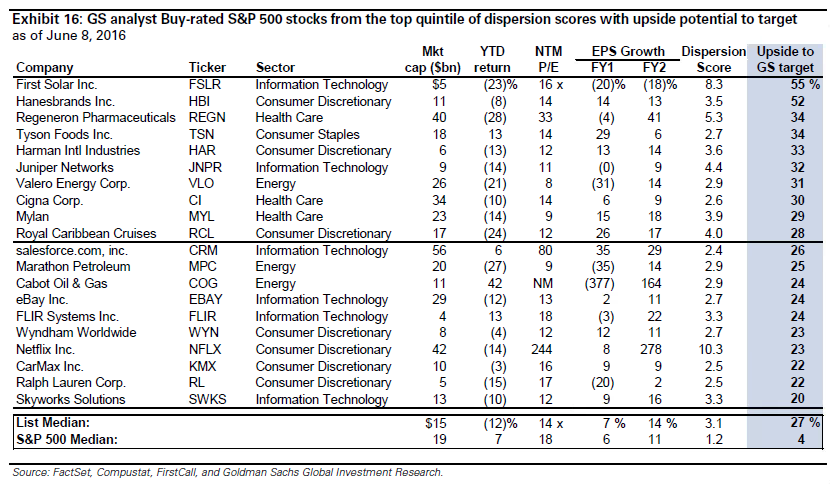

Consumer discretionary and information technology sectors contain stocks with "the best combination of micro-driven returns and high expected firm-specific risk,” the team writes, referring to superior odds that the shares react to company news, rather than moving on trends in the broader market. “These sectors therefore present the most fruitful stock-picking opportunities."

By contrast, energy companies also have a high firm-specific risk, "but stock returns in the sector will be driven by macro, rather than company-specific micro factors." According to the analysts stock-picking opportunities are smallest within utilities.

Here’s the full list:

Courtesy of Goldman Sachs

Increased differentiation can mean more potential downside, too. Goldman also identified firms that are likely to react to micro events, but which have 'sell' or 'neutral' ratings from Goldman analysts. Names on this list include Transocean Ltd., Coach Inc., Kohl’s Corp., and United Rentals Inc. All of them have 12-month price targets that are between 17 percent and 33 percent lower than they trade for today.

Courtesy of bloomberg.com