10 Stocks Recommended For Earnings Season, Via Morgan Stanley

10 stocks that Morgan Stanley says you should buy ahead of earnings season

by Sue Chang

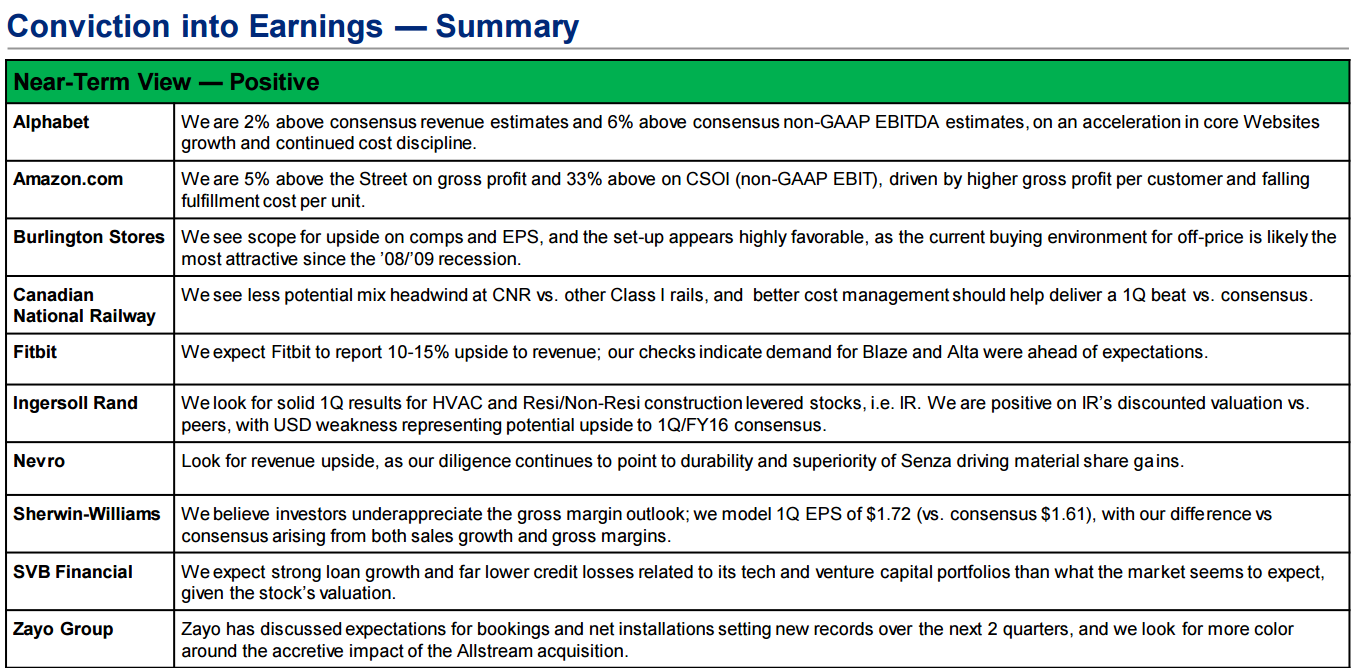

While companies have been preparing investors for a downbeat earnings season, there are still a handful of stocks that promise to deliver above and beyond Wall Street’s expectations. Leading that short list of potential overachievers are Google parent Alphabet Inc., Amazon.com Inc., and Fitbit Inc., according to Morgan Stanley.

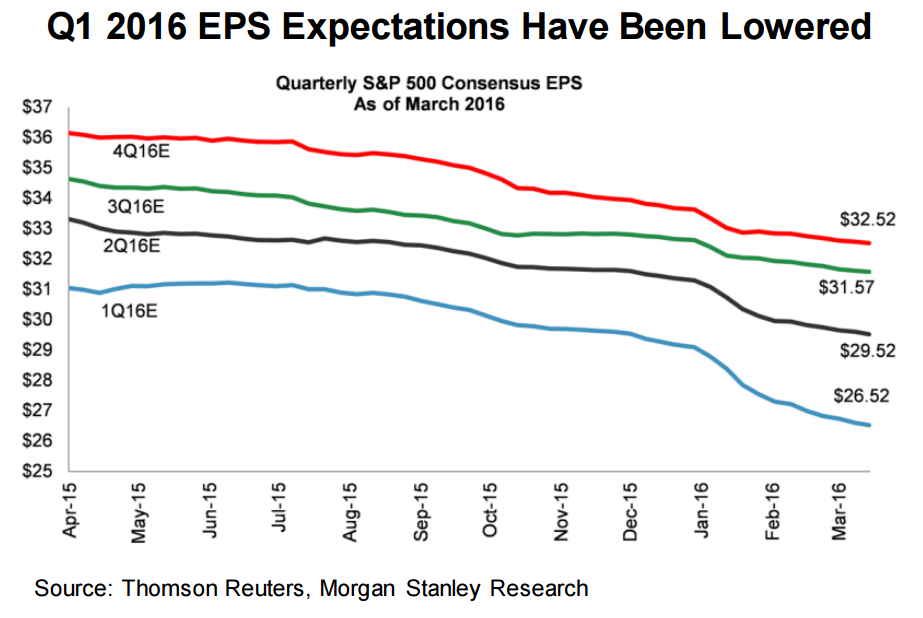

Over the past three months, nine of the S&P 500’s (SPX) (SPY), 10 sectors have witnessed a decline in average earnings estimates, led by energy companies, according to Morgan Stanley analysts in a report released earlier this week.

.“We have seen more than three instances of negative guidance for every one instance of positive guidance,” they said.

Against this gloomy backdrop, the analysts identified 10 stocks that they believe will outperform their peers, helping to propel shares higher.

Analyst Brian Nowak said Alphabet’s (GOOGL), stock price could rise to $900 on the back of strong results from accelerated traffic growth. Shares closed Thursday at $775.39.

Nowak was also upbeat on Amazon (AMZN), arguing that its shares do not accurately reflect the company’s e-commerce business, which is expected to drive profits in the near term. The analyst has a price target of $800 on Amazon. Shares of Amazon ended Thursday at $620.75.

Fitbit (FIT), also got the nod due to expectations that the company will deliver stronger-than-expected first-quarter results.

“Fitbit is well-positioned with its dominant share in fitness trackers, strong brand, and over time the network effect especially as it builds out its software and services,” said analyst Katy Huberty.

In the retail sector, Burlington Stores Inc. (BURL) got singled out for a favorable write up amid signs of steady improvement.

“Burlington Stores is a turnaround story,” said analyst Kimberly Greenberger. “We view Burlington Stores as a way to gain exposure to the secular growth in off-price, which continues to take share from department stores and specialty retailers.”

In the transportation sector, Canadian National Railway Co. (CNI) got Morgan Stanley’s vote of confidence as the type of defensive play preferred by conservative investors.

“We see Canadian National Railway as a best-in-class, defensive rail, that should be able to deploy its operating superiority and relatively defensive end-market footprint to deliver returns superior to peers in a challenging environment for rails,” said analyst Ravi Shanker.

The U.S. dollar’s soft patch is one reason why Morgan Stanley picked Ingersoll Rand PLC (IR), for its buy list.

“We are positive on Ingersoll Rand’s discounted valuation versus peers, with U.S. dollar’s weakness representing potential upside,” said Nigel Coe.

The greenback pulled back from its 2016 highs after the Federal Reserve in March indicated that it will refrain from an imminent interest rate increase due to ongoing global uncertainties. Corporations had blamed the dollar’s strong rally since mid-2014 for hurting their bottom lines. The ICE dollar index (DXY), a measure of the U.S. currency against a basket of six major rivals, is down nearly 4% year-to-date.

In health care, Morgan Stanley recommends Nevro Corp. (NVRO), a small-cap medical devices company that went public in late 2014.

“We view Nevro’s Senza high frequency device as a potentially disruptive entrant into the $1.5 billion market for spinal cord stimulation,” said analyst David Lewis. “Our diligence continues to point to durability and superiority of Senza driving material share gains.”

Sherwin-Williams Co. (SHW), is a company best known for paints that Morgan Stanley expects to benefit from steady U.S housing demand.

“We are also bullish on Sherwin-Williams’ same-store sales, which should continue to benefit from soft comparisons, remaining cyclical upside, share gains, and beneficial weather,” said analyst Vincent Andrews.

Among financials, SVB Financial Group (SIVB), beat out some of Wall Street’s biggest names to make the cut.

“SVB Financial Group shares have come under significant pressure on concerns over weaker venture capital activity, which potentially sets up a positive trade if the company posts the solid loan growth and low credit losses that we expect,” said analyst Ken Zerbe.

Rounding out the list is Zayo Group Holdings Inc. (ZAYO), a bandwidth infrastructure services company which went public in late 2014. Zayo’s core business is leasing unused fiber-optic cables to companies that want to expand their networks.

“Demand for dark fiber and fiber to the tower allows Zayo to maintain strong revenue growth,” said analyst Simon Flannery.

Courtesy of Morgan Stanley

Meanwhile, Morgan Stanley specifically named three stocks that investors should avoid due to negative catalysts—Union Pacific Corp. (UNP), Sprint Corp.(S) and US Cellular Corp. (USM).

Union Pacific is likely to miss its first-quarter earnings as its traffic continue to fall, according to Shanker.

Both Sprint and US Cellular are facing steep challenges to grow subscribers due to a saturated wireless market, according to Flannery.

For the broader S&P 500, Morgan Stanley projects earnings to grow 1.4% and earnings per share of $120 in 2016.

“Our main message last quarter was ‘things are mixed, not bad’. Now it’s ‘things are mixed, not great,’” said the analysts.

Courtesy of marketwatch.com