FAANG Stock Update: Running Out of Gas in All the Wrong Places

If you're a student of the market and keep close tabs on it on a daily basis, you likely know the last couple of trading days have been less-than-great ones. And, you probably know the rally leading into this weakness was stopped and reversed at established technical resistance. The fact that this is where the bulls threw in the towel makes the new weakness all the more telling.

What you may not realize, however, is that not even the FAANG stocks are defying the overarching trend. That is to say, most of the FAANG names just bumped into clear technical resistance of their own. That's a major red flag in and of itself, as these stocks tend to lead the overall market both higher and lower.

The one saving grace? Most of the FAANG stocks are also still above important technical lines in the sand. As long as those hold up, the FAANG names and the broad market still have a fighting chance.

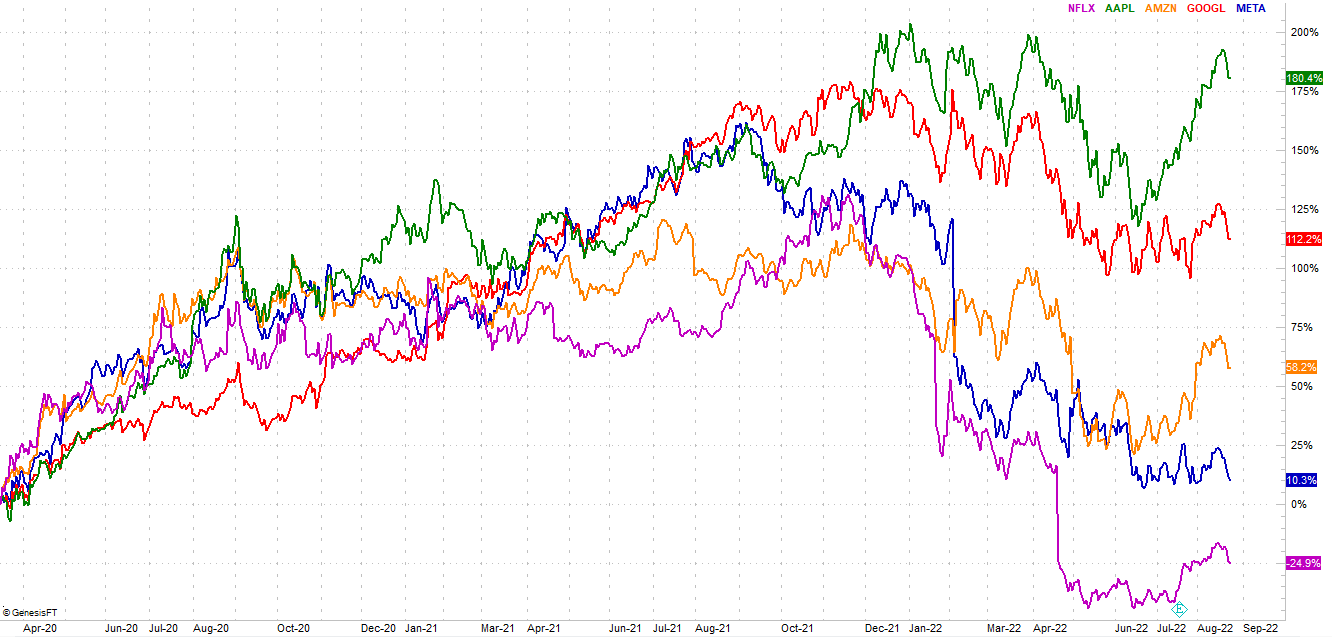

But, first things first. Here's a performance comparison of all the FAANG stocks going back to the rebound from March of 2020. Netflix (NFLX) is still dragging the bottom, and like every other name, rolled over in just the past few days. Apple (AAPL) as at the far other end of the performance spectrum, and even toyed with the idea of record highs last week. It too, though, rolled over. Meanwhile, Meta (META) remains a clear laggard, knocking on the door of new 52-week lows.

In nearly each case, however, a closer look at the daily charts of the FAANG stocks is merited.

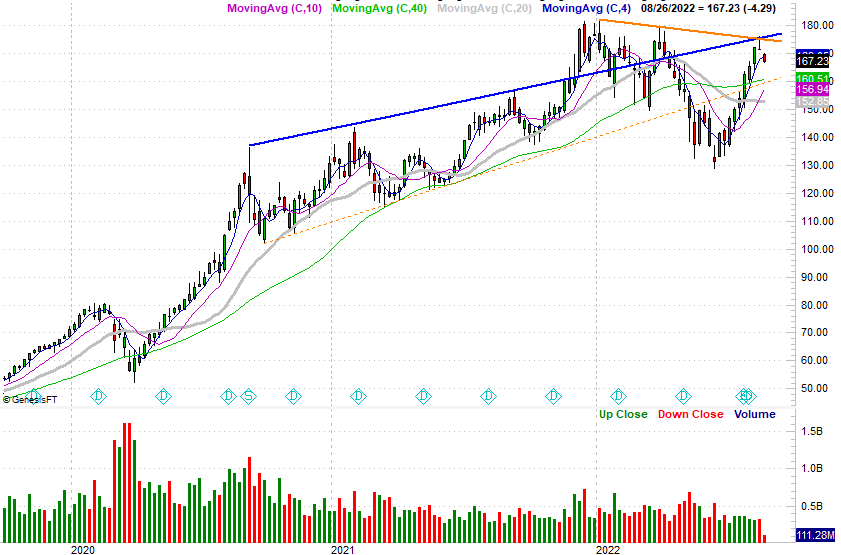

Here's Apple... a weekly chart of the stock, since this bigger-picture viewpoint gives us so much more detail. Last week's peak didn't bump into just one ceiling, but two. The high aligns with the streak of falling peaks since early this year (orange), but that high also lines up with the higher highs seen since late 2020 (blue). To see them converged here -- and to see AAPL unable to hurdle them -- underscores the scope of the impediment. The stock may need to get another running start to clear both of these hurdles in the future, but that running start may require a sizable pullback first.

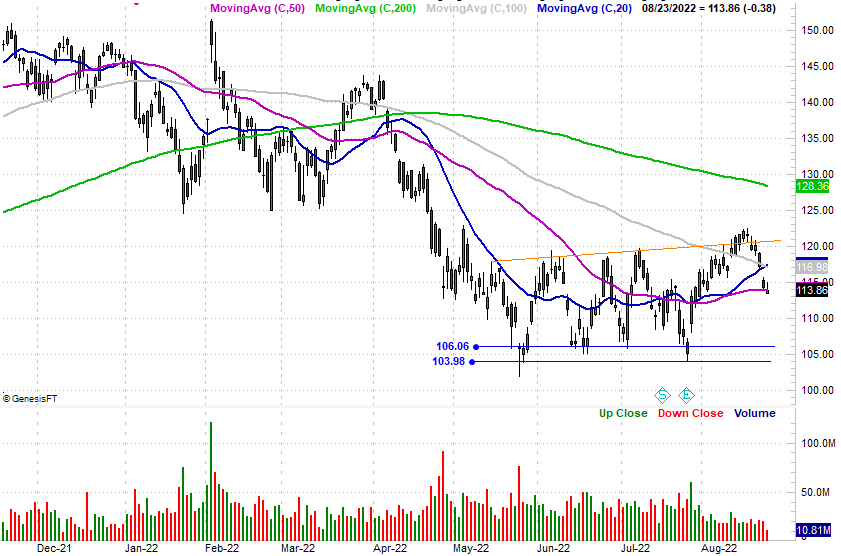

Check out the daily chart of Alphabet (GOOG, GOOGL). Thanks to the recent slide, Alphabet shares are now below all of their key moving average lines. That's not the noteworthy takeaway here, however. What's most memorable about this chart as the technical floor between $104 and $106, which ultimately gave rise to the now-failed rally effort. That tranche of support is likely still in platy.

The chart of Meta Platforms looks incredibly similar to Alphabet's, in the sense that a horizontal floor was well established before the rebound effort that got going (though ultimately failed) just a few weeks back. Keep your eye on the $154.30 mark, in case the current weakness continues to gain steam.

As for Amazon (AMZN), it's recent rise then fall looks a whole lot like the action dished out by most stocks, and indices. Mostly though, like so many other tickers, Amazon only had to kiss its 200-day moving average line (green) a few days back for the rally to turn over and become a new downtrend. If you're going to see a reversal anywhere, that's where you'd expect to see it.

Last but not least, take a look at Netflix. The stock's been hammered since the company began losing rather than growing subscribers a couple of quarters ago. It looked like it might finally pull out of that funk beginning in July, but as of this week shares are back under the 20-day moving average line (blue) and testing the 100-day moving average line (gray) as support. Mostly though, once again we're seeing a clear technical floor around $167.16 that could serve as support again if the current pullback continues.

These looks are just for perspective, of course. And, while they're a bit predictive, bear in mind that most of these stocks' futures will be driven by the broad market's direction. If stocks as a whole go higher, the FAANG stocks are likely to rally with them, and perhaps lead that charge. In the same sense, if the FAANG stocks maintain their current weakness, it's apt to coincide with marketwide selling.

One thing's for sure though. That is, the FAANG names remain the market's best trading prospects due to their above-average volatility. That's particularly true for options traders, who can make money whether the underlying stock is rising or falling. The key of course figuring out which of the FAANG stocks are setting up for the biggest and highest-odds moves.

If you'd like help getting the most out of these well-watched, highly-traded stocks, the BigTrends FANG Options Trader Advisory Service is the answer. Go here to learn more.